Question: 1. The primary difference between a secured and unsecured loan is a. b. whether the lender charges interest on the debt. whether the lender has

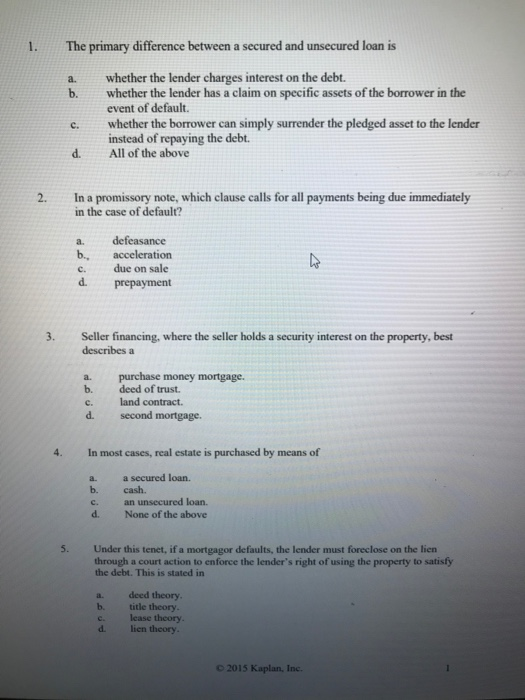

1. The primary difference between a secured and unsecured loan is a. b. whether the lender charges interest on the debt. whether the lender has a claim on specific assets of the borrower in the event of default. whether the borrower can simply surrender the pledged asset to the lender instead of repaying the debt. All of the above In a promissory note, which clause calls for all payments being due immediately in the case of default? b., defeasance acceleration due on sale prepayment d. 3. Seller financing, where the seller holds a security interest on the property, best describes a b. c. purchase money mortgage. deed of trust. land contract. second mortgage. In most cases, real estate is purchased by means of c. a secured loan. cash. an unsecured loan. None of the above Under this tenet, if a mortgagor defaults, the lender must foreclose on the lien through a court action to enforce the lender's right of using the property to satisfy the debt. This is stated in a. deed theory, title theory lease theory lich they. | 2015 Kaplan, Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts