Question: both pls The primary difference between a secured and unsecured loan is 1. whether the lender charges interest on the debt. b. whether the lender

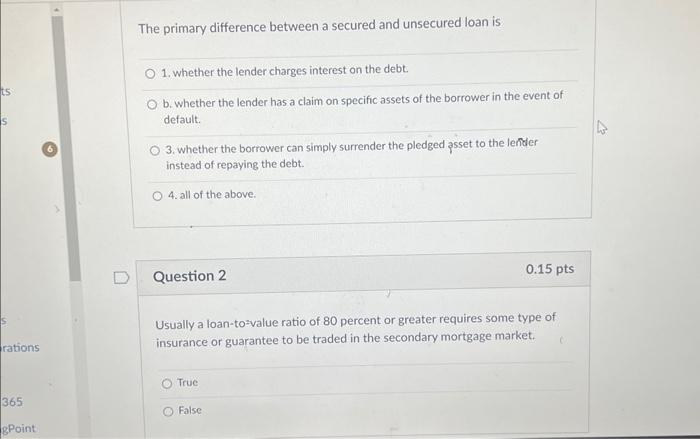

The primary difference between a secured and unsecured loan is 1. whether the lender charges interest on the debt. b. whether the lender has a claim on specific assets of the borrower in the event of default. 3. whether the borrower can simply surrender the pledged asset to the leder instead of repaying the debt. 4. all of the above. Question 2 0.15pts Usually a loan-to=value ratio of 80 percent or greater requires some type of insurance or guarantee to be traded in the secondary mortgage market. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts