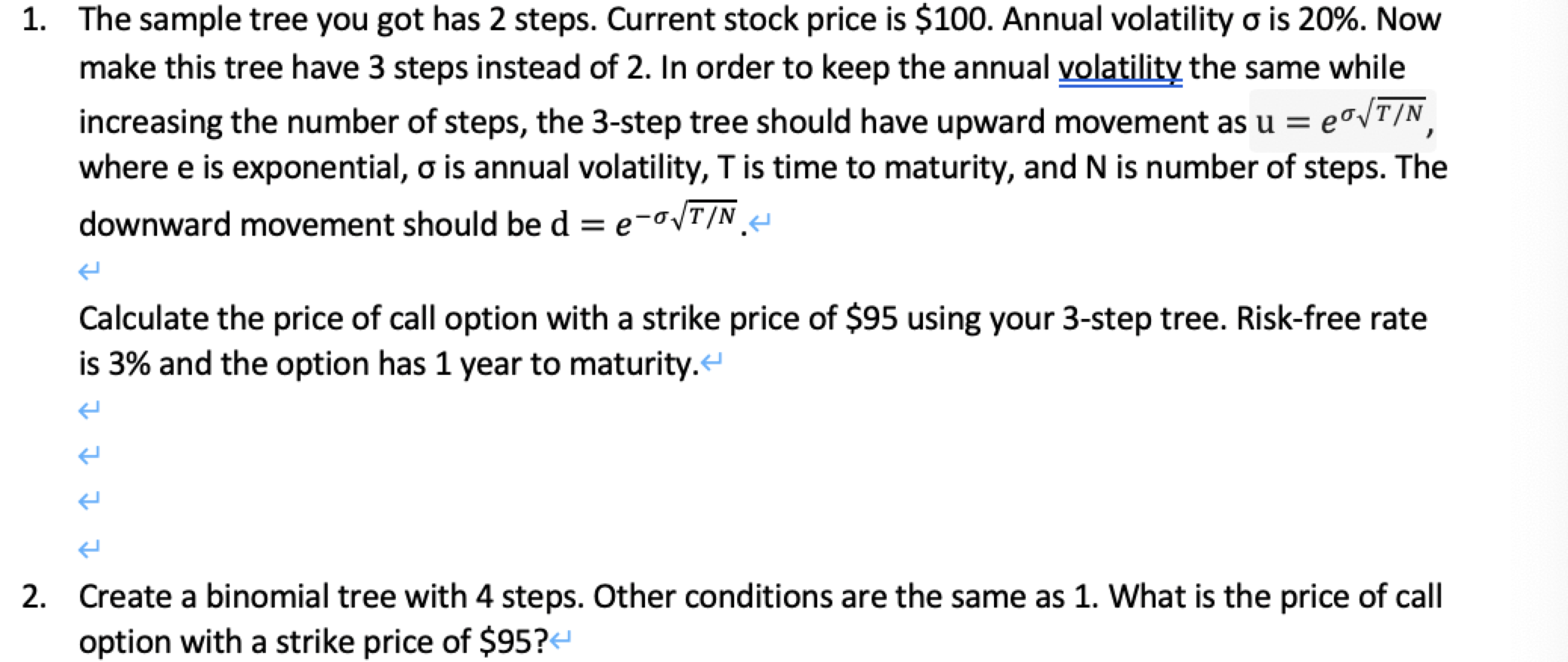

Question: 1. The sample tree you got has 2 steps. Current stock price is $100. Annual volatility o is 20%. Now make this tree have 3

1. The sample tree you got has 2 steps. Current stock price is $100. Annual volatility o is 20%. Now make this tree have 3 steps instead of 2. In order to keep the annual volatility the same while increasing the number of steps, the 3-step tree should have upward movement as u =eO/T/N where e is exponential, o is annual volatility, T is time to maturity, and N is number of steps. The downward movement should be d = e-T/N. Calculate the price of call option with a strike price of $95 using your 3-step tree. Risk-free rate is 3% and the option has 1 year to maturity. 2. Create a binomial tree with 4 steps. Other conditions are the same as 1. What is the price of call option with a strike price of $95? 1. The sample tree you got has 2 steps. Current stock price is $100. Annual volatility o is 20%. Now make this tree have 3 steps instead of 2. In order to keep the annual volatility the same while increasing the number of steps, the 3-step tree should have upward movement as u =eO/T/N where e is exponential, o is annual volatility, T is time to maturity, and N is number of steps. The downward movement should be d = e-T/N. Calculate the price of call option with a strike price of $95 using your 3-step tree. Risk-free rate is 3% and the option has 1 year to maturity. 2. Create a binomial tree with 4 steps. Other conditions are the same as 1. What is the price of call option with a strike price of $95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts