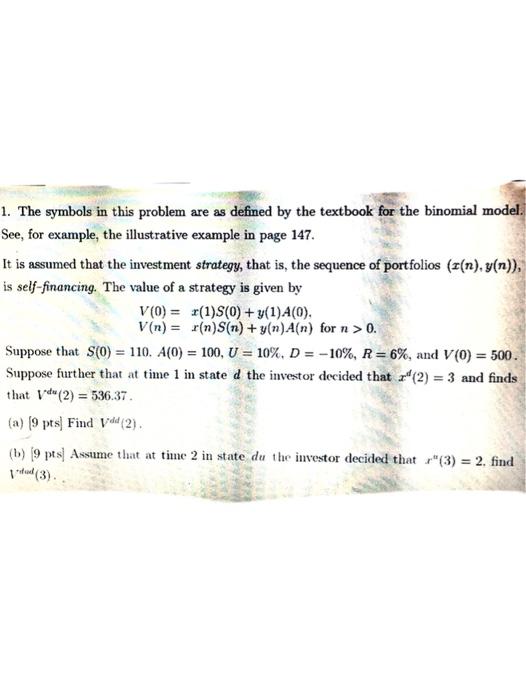

Question: 1. The symbols in this problem are as defined by the textbook for the binomial model. See, for example, the illustrative example in page 147

1. The symbols in this problem are as defined by the textbook for the binomial model. See, for example, the illustrative example in page 147 It is assumed that the investment strategy, that is, the sequence of portfolios ((n), y(n)), is self-financing. The value of a strategy is given by V(0) = x(1)S(0) + y(1)A(0), V(n) = r(n)S(n) + y(n)A(n) for n > 0. Suppose that S(O) = 110. A(0) = 100, U = 10%. D = -10%, R=6%, and V(0) = 500. Suppose further that at time 1 in stated the investor decided that 2" (2) = 3 and finds that 14 (2) = 536.37 (a) (9 pts) Find Vdd(2) (1) 9 pts) Assume that at tine 2 in state du the investor decided that "(3) = 2. find el (3) 1. The symbols in this problem are as defined by the textbook for the binomial model. See, for example, the illustrative example in page 147 It is assumed that the investment strategy, that is, the sequence of portfolios ((n), y(n)), is self-financing. The value of a strategy is given by V(0) = x(1)S(0) + y(1)A(0), V(n) = r(n)S(n) + y(n)A(n) for n > 0. Suppose that S(O) = 110. A(0) = 100, U = 10%. D = -10%, R=6%, and V(0) = 500. Suppose further that at time 1 in stated the investor decided that 2" (2) = 3 and finds that 14 (2) = 536.37 (a) (9 pts) Find Vdd(2) (1) 9 pts) Assume that at tine 2 in state du the investor decided that "(3) = 2. find el (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts