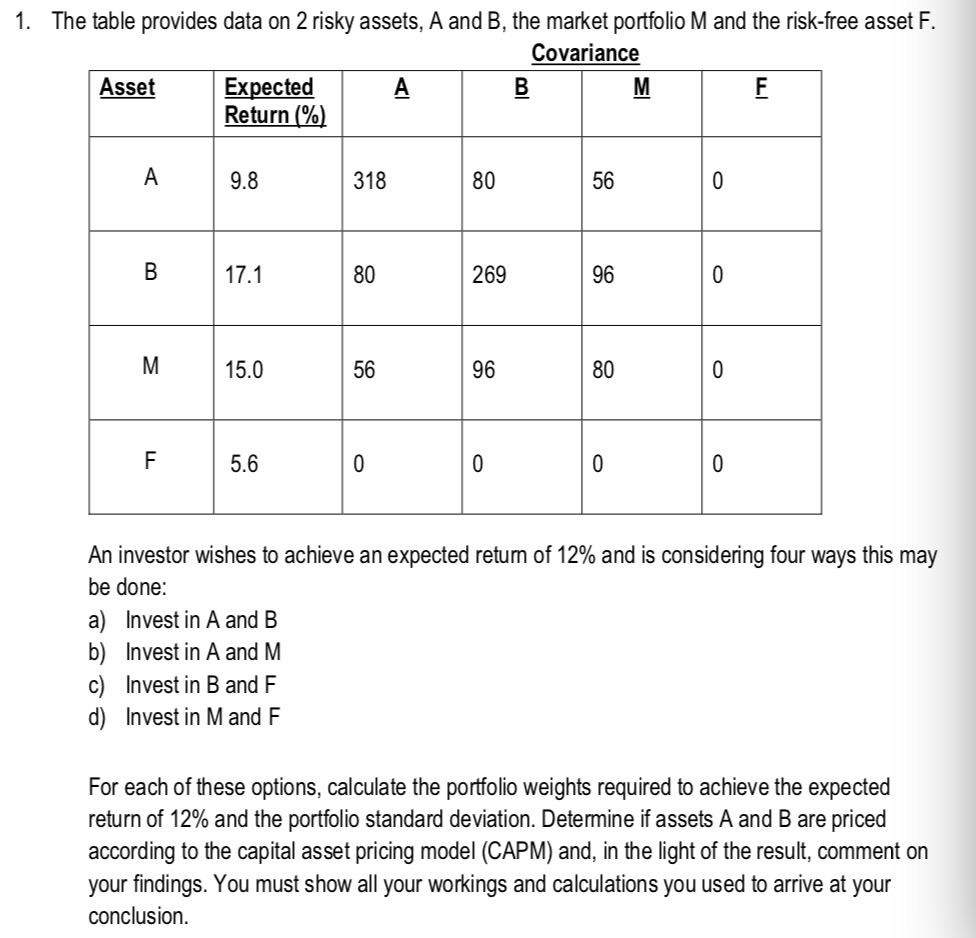

Question: 1. The table provides data on 2 risky assets, A and B, the market portfolio M and the risk-free asset F Covariance Expected Return (90)

1. The table provides data on 2 risky assets, A and B, the market portfolio M and the risk-free asset F Covariance Expected Return (90) Asset 318 80 56 80 269 96 56 96 80 An investor wishes to achieve an expected retum of 12% and is considering four ways this may be done a) Invest in A and B b) Invest in A and M c) Invest in B and F d) Invest in M and F For each of these options, calculate the portfolio weights required to achieve the expected return of 12% and the portfolio standard deviation. Determine if assets A and B are priced according to the capital asset pricing model (CAPM) and, in the light of the result, comment on your findings. You must show all your workings and calculations you used to arrive at your conclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts