Question: The table provides data on two risky assets, A and B, the market portfolio Mand the risk- free asset F. Asset Expected Covariances (%) Return

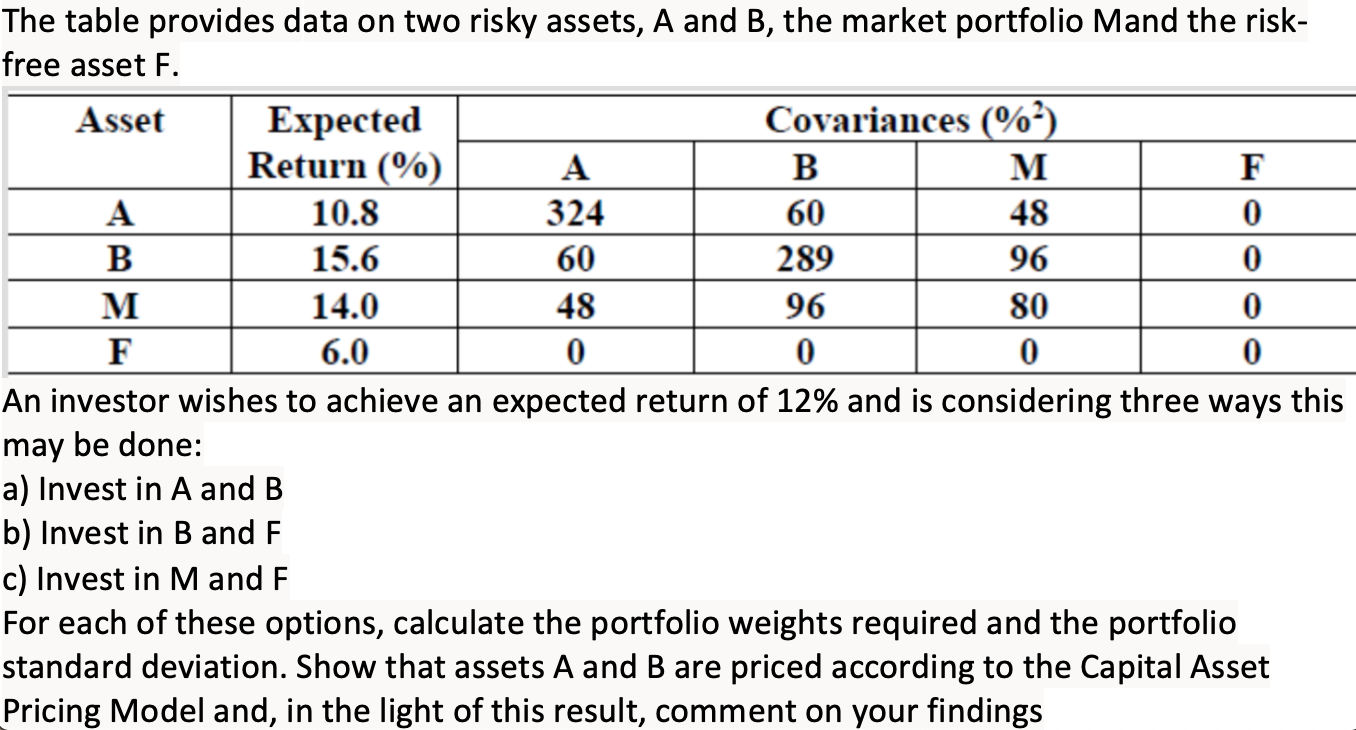

The table provides data on two risky assets, A and B, the market portfolio Mand the risk- free asset F. Asset Expected Covariances (%) Return (%) A B M F 10.8 324 60 48 0 B 15.6 60 289 96 0 M 14.0 48 96 80 0 F 6.0 0 0 0 0 An investor wishes to achieve an expected return of 12% and is considering three ways this may be done: a) Invest in A and B b) Invest in B and F c) Invest in M and F For each of these options, calculate the portfolio weights required and the portfolio standard deviation. Show that assets A and B are priced according to the Capital Asset Pricing Model and, in the light of this result, comment on your findings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts