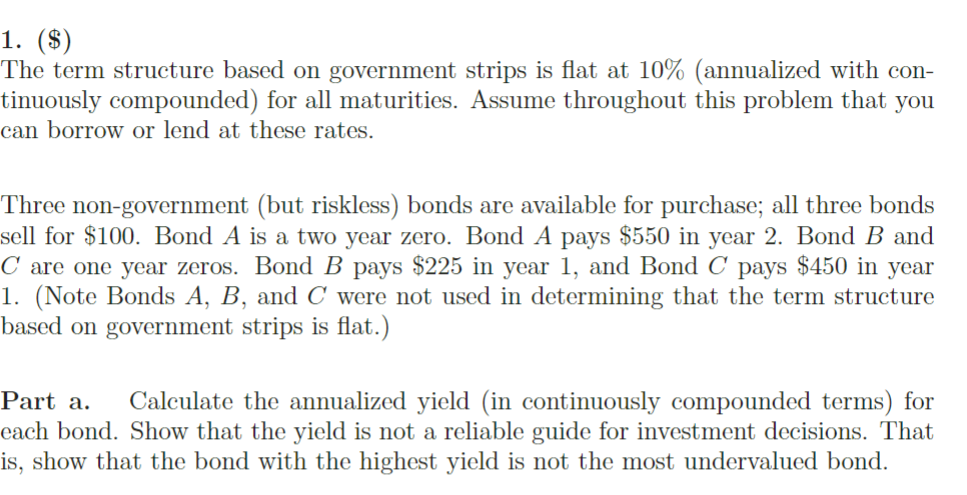

Question: 1. ($) The term structure based on government strips is flat at 10% (annualized with continuously compounded) for all maturities. Assume throughout this problem that

1. (\$) The term structure based on government strips is flat at 10% (annualized with continuously compounded) for all maturities. Assume throughout this problem that you can borrow or lend at these rates. Three non-government (but riskless) bonds are available for purchase; all three bonds sell for $100. Bond A is a two year zero. Bond A pays $550 in year 2 . Bond B and C are one year zeros. Bond B pays $225 in year 1 , and Bond C pays $450 in year 1. (Note Bonds A,B, and C were not used in determining that the term structure based on government strips is flat.) Part a. Calculate the annualized yield (in continuously compounded terms) for each bond. Show that the yield is not a reliable guide for investment decisions. That is, show that the bond with the highest yield is not the most undervalued bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts