Question: 1. The two components that are required in order to carry out asset valuation are (1) the stream of expected cash flows and (2) the

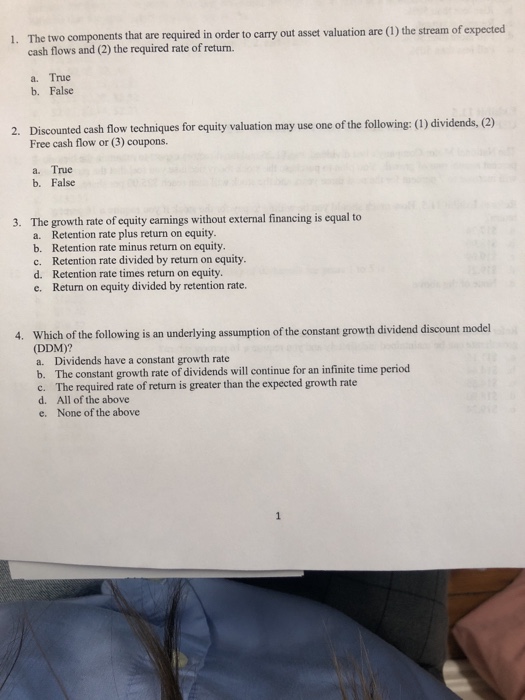

1. The two components that are required in order to carry out asset valuation are (1) the stream of expected cash flows and (2) the required rate of return. a. True b. False 2. Discounted cash flow techniques for equity valuation may use one of the following: (1) dividends, (2) Free cash flow or (3) coupons. a. True b. False 3. The growth rate of equity earnings without external financing is equal to a. Retention rate plus return on equity b. Retention rate minus return on equity c. Retention rate divided by return on equity. d. Retention rate times return on equity c. Return on equity divided by retention rate. Which of the following is an underlying assumption of the constant growth dividend discount model (DDM)? a. Dividends have a constant growth rate b. The constant growth rate of dividends will continue for an infinite time period c. The required rate of return is greater than the expected growth rate d. All of the above e. None of the above 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts