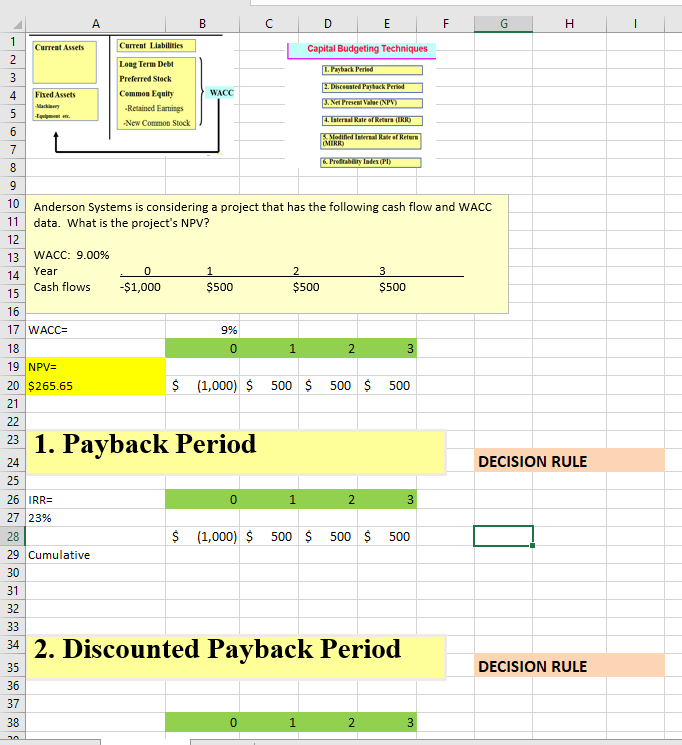

Question: Complete using each requested Capital Budgeting Technique A B C D E F G H 1 Current Assets Current Liabilities Capital Budgeting Techniques 2 Long

Complete using each requested Capital Budgeting Technique

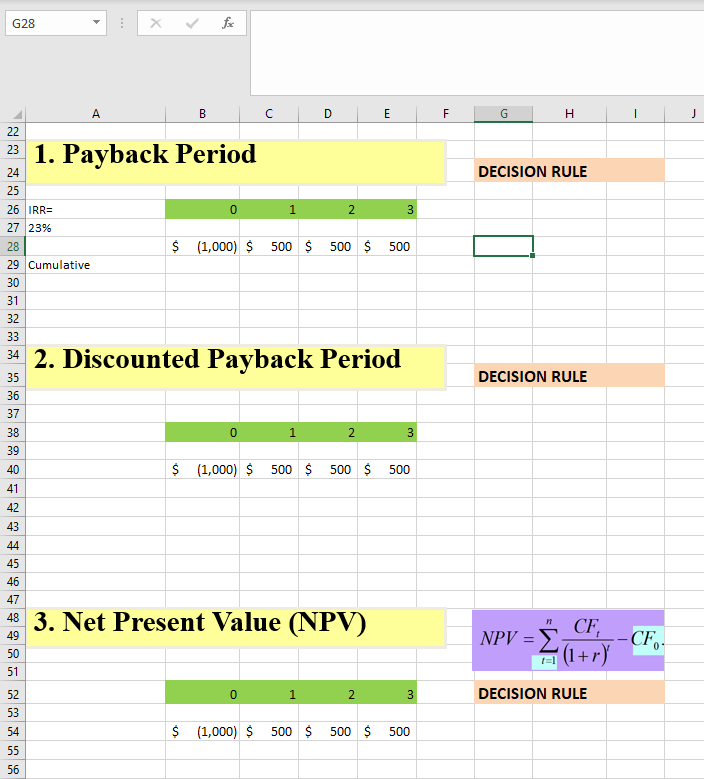

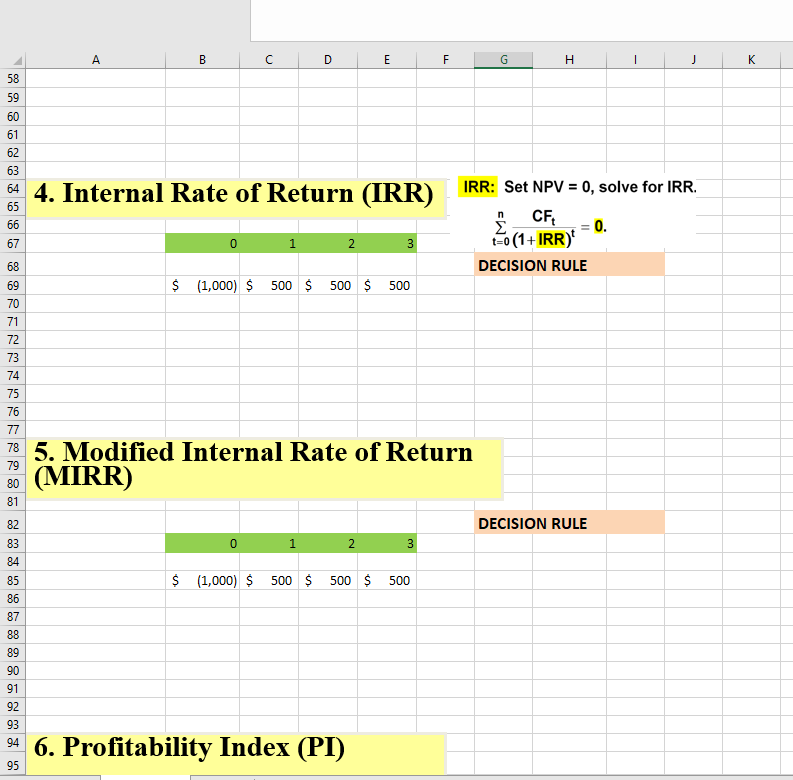

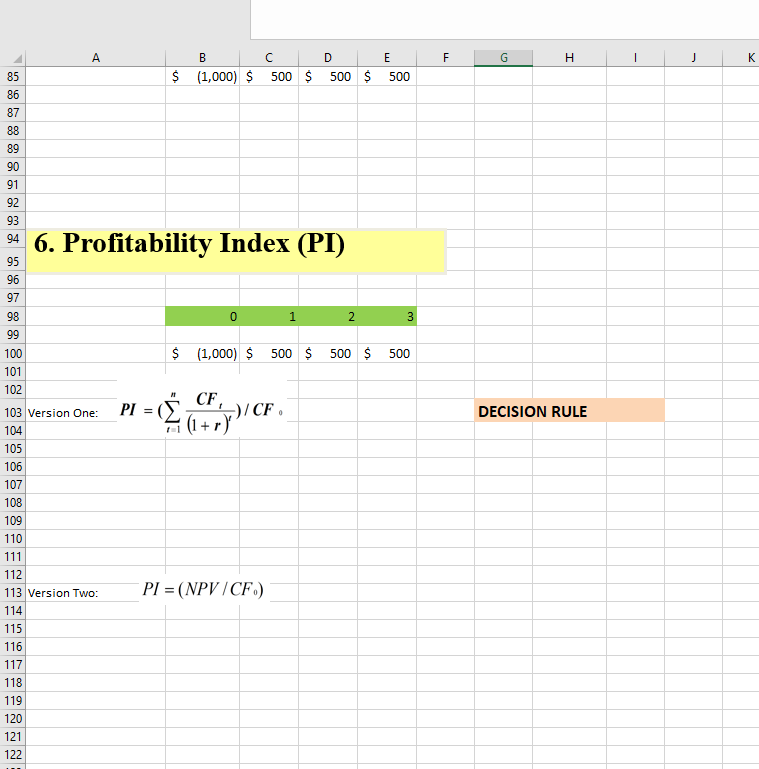

A B C D E F G H 1 Current Assets Current Liabilities Capital Budgeting Techniques 2 Long Term Debt L. Payback Period 3 Preferred Stock 4 Fixed Assets Common Equity WACC 5 -Retained Earnings New Common Stock 2. Discounted Payback Period 3. Net Prescal Value (NPV) 4. lateraal Kate afetar (1) Modified Tere Rates Return (MIRR Profitability Index (PE 6 7 8 9 10 Anderson Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? 11 12 13 WACC: 9.00% Year 1 2 3 14 Cash flows 0 -$1,000 $500 $500 $500 15 16 17 WACC= 9% 0 1 2 3 18 19 NPV= 20 $265.65 21 $ (1,000) $500 $ 500 $ 500 22 33 1. Payback Period 24 DECISION RULE 25 26 IRRE 27 23% 0 1 2 3 28 $ (1,000) $ 500 $ 500 $ 500 29 Cumulative 30 31 32 33 34 2. Discounted Payback Period 35 DECISION RULE 36 37 38 0 1 2 3 G28 A B D E F H J 22 23 1. Payback Period 24 DECISION RULE 25 0 1 2 3 26 IRR= 27 23% 28 $ (1,000) $ 500 $ 500 $ 500 29 Cumulative 30 31 32 33 34 2. Discounted Payback Period 35 DECISION RULE 36 37 38 0 1 2 3 39 40 $ (1,000) $500 $ 500 $ 500 41 42 43 44 45 46 47 48 3. Net Present Value (NPV) 11 49 CF, NPV = *(1+r) CF, 50 51 52 0 1 2 3 DECISION RULE 53 54 $ (1,000) $ 500 $ 500 $ 500 55 56 A B C D E F G H J K 58 59 60 61 62 63 64 4. Internal Rate of Return (IRR) IRR: Set NPV = 0, solve for IRR. CF 66 = 0. t-0(1+IRR) 67 0 1 2 3 68 DECISION RULE 69 $ (1,000) $ 500 $ 500 $ 500 70 71 72 73 74 75 76 77 78 5. Modified Internal Rate of Return (MIRR) 79 80 81 82 DECISION RULE 83 0 1 2 3 84 85 $ (1,000) $ 500 $ 500 $ 500 86 87 88 89 90 91 92 93 94 6. Profitability Index (PI) 95 A B D E F H J K 85 $ (1,000) $ 500 $ 500 $ 500 86 87 88 89 90 91 92 93 94 6. Profitability Index (PI) 95 96 97 98 0 1 2 3 99 100 $ (1,000) $ 500 $ 500 $ 500 101 102 AT 103 Version One: CF PI = ( (1+r) /CF DECISION RULE 104 105 106 107 108 109 110 111 112 113 Version Two: PI = (NPV/CF) 114 115 116 117 118 119 120 121 122

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts