Question: 1. the weighted average annual interest rate on John's current loan portfolio is %. (Round to two decimal places.) 2. John should a. consolidate the

1. the weighted average annual interest rate on John's current loan portfolio is %. (Round to two decimal places.)

2. John should

a. consolidate the three loans into one

b. do nothing and leave the three individual loans as is

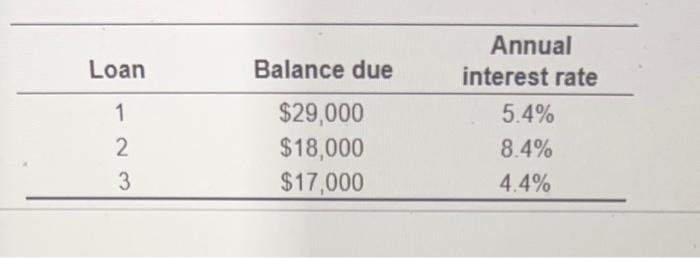

Weighted average cost of capital Personal Finance Problem John Dough has just been awarded his degree in business He has three education loans outstanding. They all mature in 5 years and he can repay them without penalty any time before maturity The amounts owed on each loan and the annual interest rate associated with each loan are given in the following table John can also combine the total of his three debts (that is, $64,000 ) and create a consolidated loan from his bank His bank will charge an annual interest rate of 47% for a period of 5 years Should John do nothing (leave the three individual loans as is) or create a consolidated loan (the $64,000 question)? \begin{tabular}{ccc} \hline Loan & Balance due & Annualinterestrate \\ \hline 1 & $29,000 & 5.4% \\ 2 & $18,000 & 8.4% \\ 3 & $17,000 & 4.4% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts