Question: 1. There are only two securities (A and B, no risk free asset) in the market. The correlation between returns of A and B is

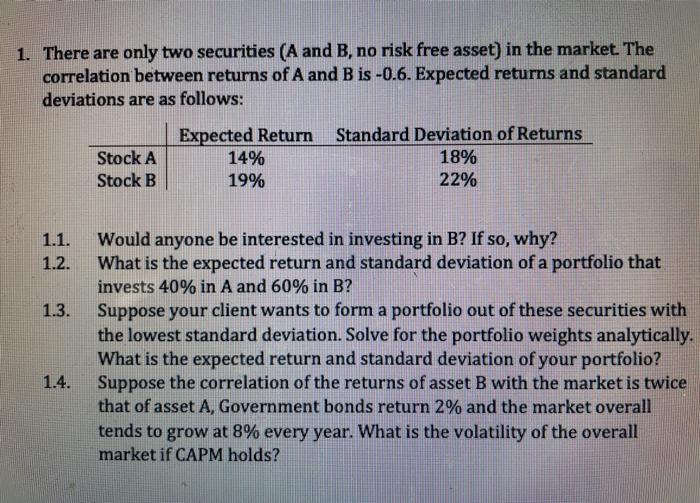

1. There are only two securities (A and B, no risk free asset) in the market. The correlation between returns of A and B is -0.6. Expected returns and standard deviations are as follows: Expected Return Standard Deviation of Returns Stock A 14% 18% Stock B 19% 22% 1.1. 1.2. 1.3. Would anyone be interested in investing in B? If so, why? What is the expected return and standard deviation of a portfolio that invests 40% in A and 60% in B? Suppose your client wants to form a portfolio out of these securities with the lowest standard deviation. Solve for the portfolio weights analytically. What is the expected return and standard deviation of your portfolio? Suppose the correlation of the returns of asset B with the market is twice that of asset A, Government bonds return 2% and the market overall tends to grow at 8% every year. What is the volatility of the overall market if CAPM holds? 1.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts