Question: Please answer by hand and not Excel 17) There are only two securities (A and B, no risk free asset) in the market. Expected returns

Please answer by hand and not Excel

Please answer by hand and not Excel

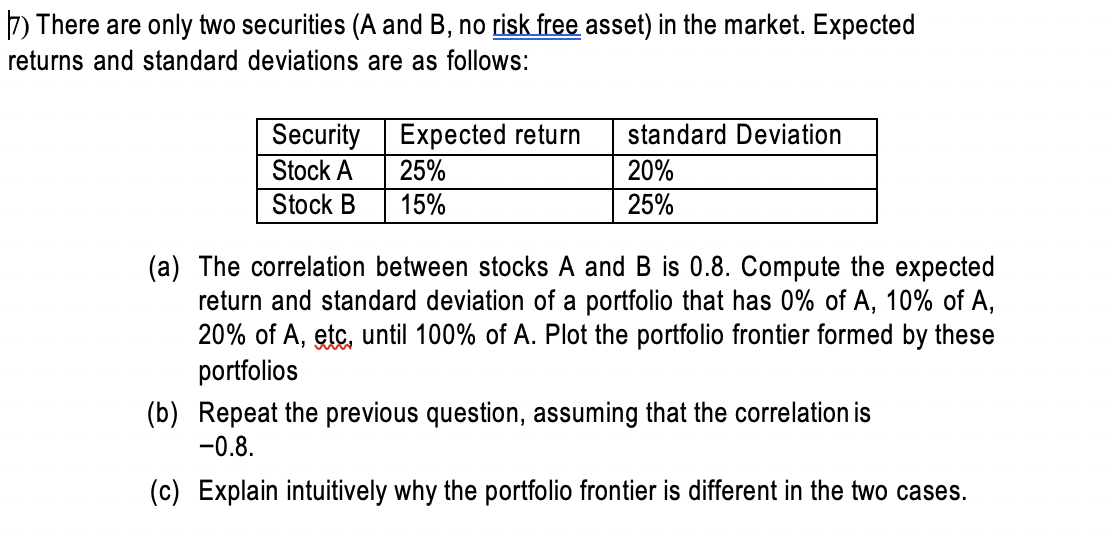

17) There are only two securities (A and B, no risk free asset) in the market. Expected returns and standard deviations are as follows: Security Expected return Stock A 25% Stock B 15% standard Deviation 20% 25% (a) The correlation between stocks A and B is 0.8. Compute the expected return and standard deviation of a portfolio that has 0% of A, 10% of A, 20% of A, etc, until 100% of A. Plot the portfolio frontier formed by these portfolios (b) Repeat the previous question, assuming that the correlation is -0.8. (c) Explain intuitively why the portfolio frontier is different in the two cases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts