Question: 1. Though providing less well-defined growth prospects compared with other REITs, Bond- proxy REITs provide high dividend yieldsin the range of a. 3 to 4

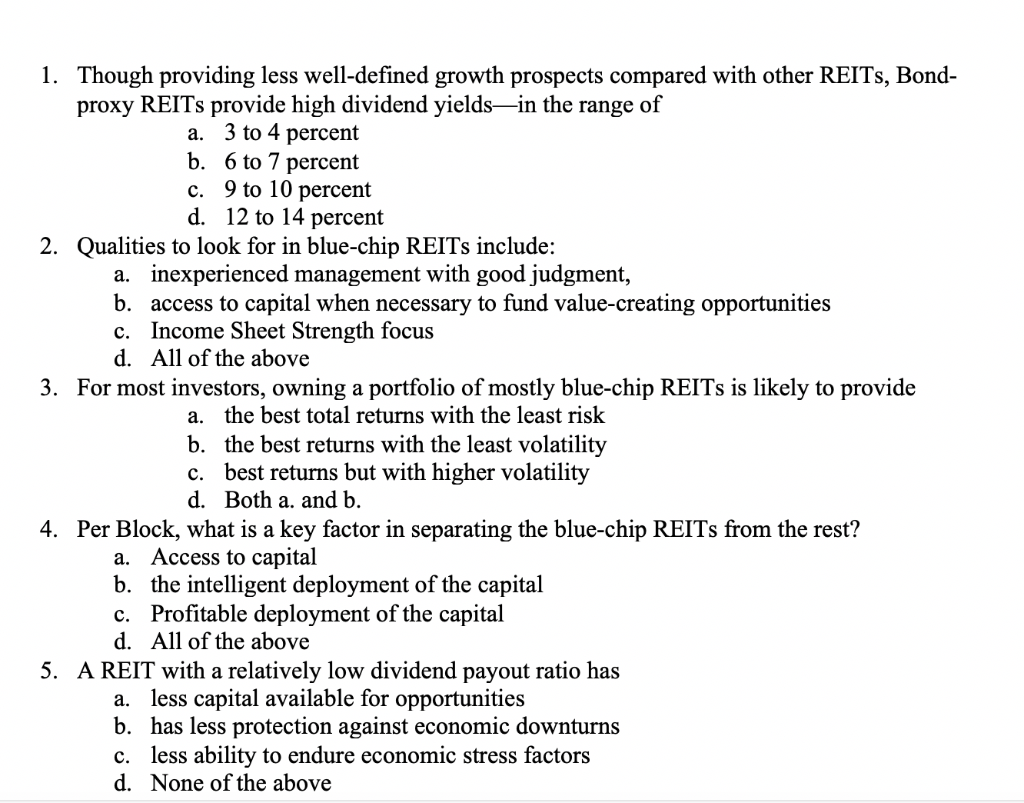

1. Though providing less well-defined growth prospects compared with other REITs, Bond- proxy REITs provide high dividend yieldsin the range of a. 3 to 4 percent b. 6 to 7 percent c. 9 to 10 percent d. 12 to 14 percent 2. Qualities to look for in blue-chip REITs include: a. inexperienced management with good judgment, b. access to capital when necessary to fund value-creating opportunities c. Income Sheet Strength focus d. All of the above 3. For most investors, owning a portfolio of mostly blue-chip REITs is likely to provide a. the best total returns with the least risk b. the best returns with the least volatility c. best returns but with higher volatility d. Both a. and b. 4. Per Block, what is a key factor in separating the blue-chip REITs from the rest? a. Access to capital b. the intelligent deployment of the capital c. Profitable deployment of the capital d. All of the above 5. A REIT with a relatively low dividend payout ratio has less capital available for opportunities b. has less protection against economic downturns c. less ability to endure economic stress factors d. None of the above a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts