Question: can you use cell references so I know how exactly to find a solution. Anything that is blue needs to be solved. I did some

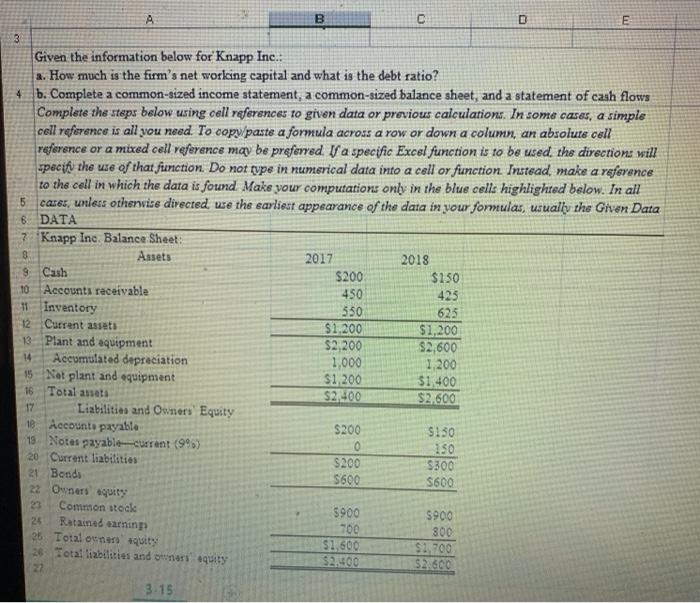

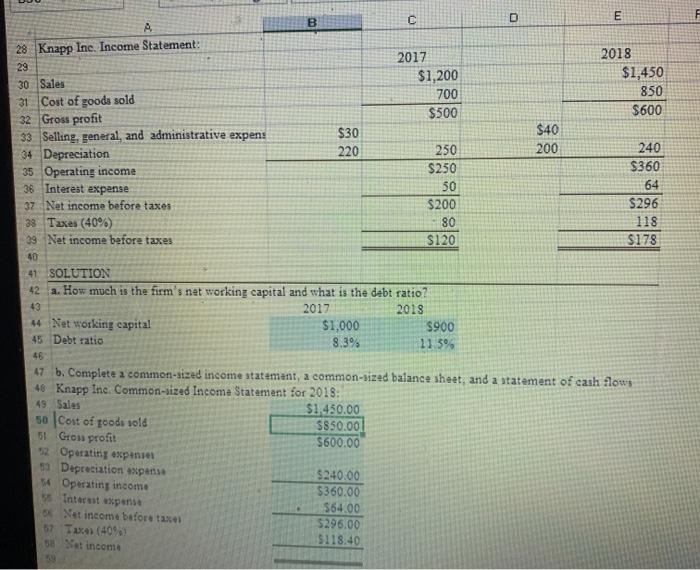

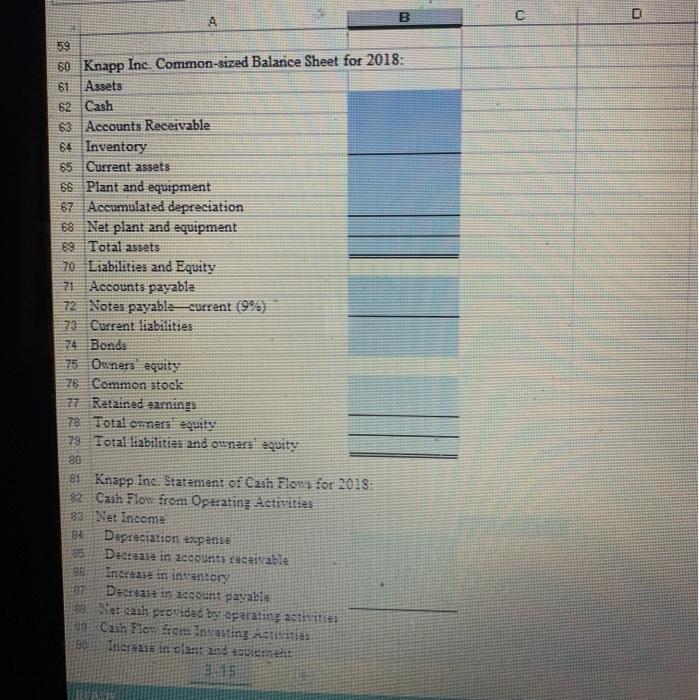

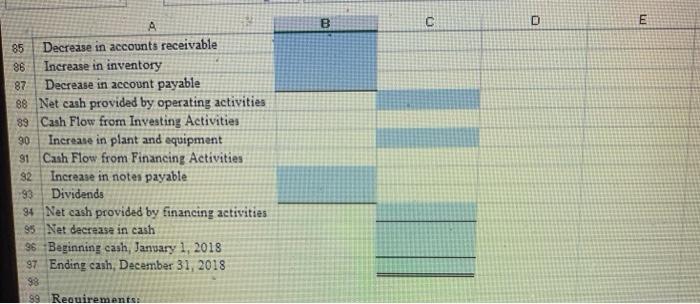

B D 4 3 Given the information below for Knapp Inc.: a. How much is the firm's net working capital and what is the debt ratio? b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flows Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all 5 cases, unless otherwise directed, uze the earliest appearance of the data in your formulas, usually the Given Data 8 DATA 7 Knapp Inc. Balance Sheet: 8 Assets 2017 2018 9 Cash $200 $150 10 Accounts receivable 450 423 11 Inventory 550 625 12 Current assets $1,200 $1,200 13 Plant and equipment $2,200 $2,600 Accumulated depreciation 1,000 1.200 15 Net plant and equipment $1,200 $1,400 15 Total ants $2.400 $2.600 Liabilitia and Owners Equity 18. Accounts payable $200 $130 13 Notes payable curent (99) 0 150 20 Current liabilities $200 $300 21 Bonds 5600 5600 22 Owners equity Common stock 5900 $900 Ratained earning 700 800 25 Total onant quity 26 Total liabilities and contri equity $1,600 $1,700 $2.400 52.600 22 3-15 14 17 23 24 C D E A B 28 Knapp Inc. Income Statement: 2017 2018 29 $1,200 $1,450 30 Sales 700 850 31 Cost of goods sold $500 $600 32 Grou profit $30 $40 33 Selling, general, and administrative expens 220 34 Depreciation 250 200 240 35 Operating income $250 $360 36 Interest expense 50 64 37 Net income before taxes $200 $296 38 Taxas (40%) 80 118 39 Net income before taxes $120 $178 40 41 SOLUTION 42 a. How much is the firm's net working capital and what is the debt ratio? 43 2017 2018 14 Networking capital $1,000 $900 45 Debt ratio 8.3% 11 5% 46 47 b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flow 46 Knapp Inc. Common-sized Income Statement for 2018: 49. Sales $1,450.00 50 Cost of goods sold $850.00 51 Gron profit $600.00 52 Operating expenses $240.00 $360.00 $64.00 Net income before taxe 67 Tax (40% 5296.00 $118.40 51 Depreciation expense * Operating income Interest expert 38 Set income C D A B 59 60 Knapp Inc. Common-sized Balance Sheet for 2018: 61 Assets 62 Cash 63 Accounts Receivable 64 Inventory 65 Current assets 66 Plant and equipment B7 Accumulated depreciation 68 Net plant and equipment 69 Total assets 70 Liabilities and Equity Accounts payable 72 Notes payable current (9%) 73 Current liabilities 74 Bonds 75 Owners equity 78 Common stock 77 Retained eamings 78 Total owners equity 79 Total liabilities and owners' equity 80 81 Knapp Inc. Statement of Cash Flows for 2018- 2 Cash Flow from Operating Activities 83 Net Income 84 Depreciation spense Decrease in accounts receivable 86 Increase in inventory 187 Decrease in account payable 38. et cash peonidad by operating activities 89 Cash Flow om nating sites 180 Incr=238 in plant and tigeant ES B C D E A 85 Decrease in accounts receivable 86 Increase in inventory 87 Decrease in account payable 88 Net cash provided by operating activities 39 Cash Flow from Investing Activities 30 Increase in plant and equipment 91 Cash Flow from Financing Activities 92 Increase in note payable 93 Dividends 94 Net cash provided by financing activities 95 Net decrease in cash 36 Beginning cash, January 1, 2018 97 Ending cash, December 31, 2018 98 99 Requirements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts