Question: 1. To save for a new car, Samuel Smith will invest $23,000 at the end of each year for the next 5 years. The interest

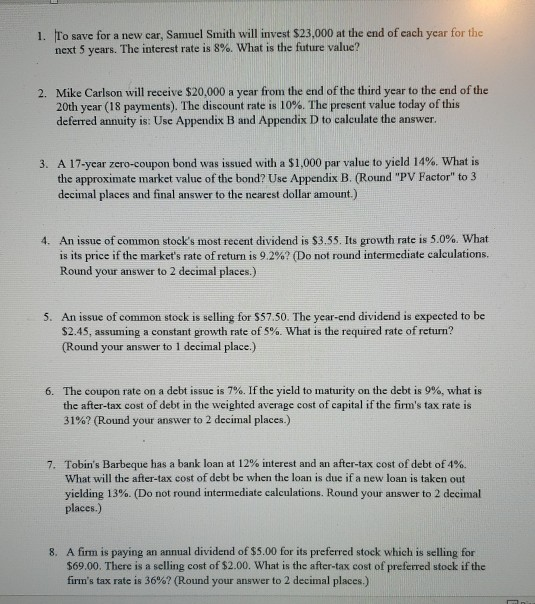

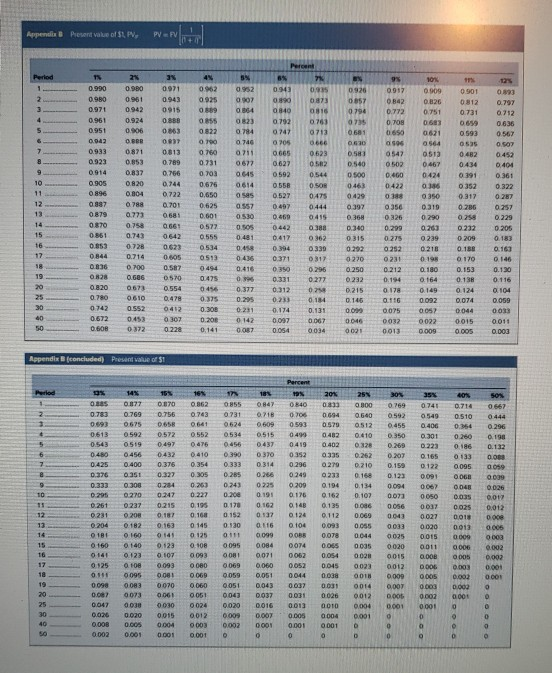

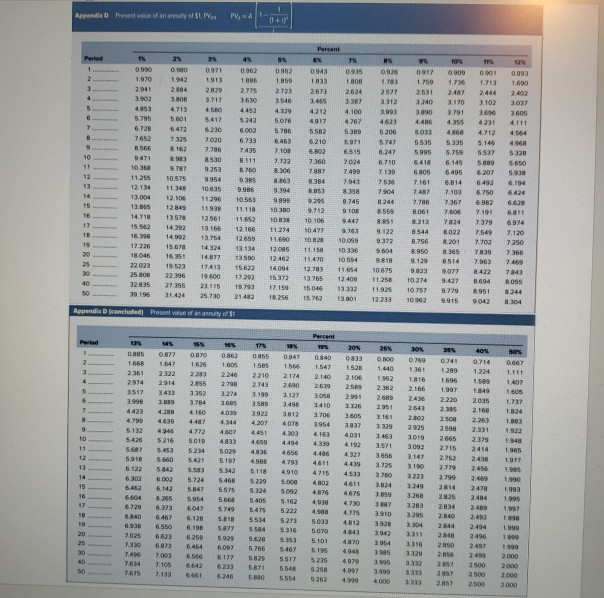

1. To save for a new car, Samuel Smith will invest $23,000 at the end of each year for the next 5 years. The interest rate is 8%. What is the future value? 2. Mike Carlson will receive $20,000 a year from the end of the third year to the end of the 20th year (18 payments). The discount rate is 10%. The present value today of this deferred annuity is: Use Appendix B and Appendix D to calculate the answer. 3. A 17-year zero-coupon bond was issued with a $1,000 par value to yield 14%. What is the approximate market value of the bond? Use Appendix B. (Round "PV Factor" to 3 decimal places and final answer to the nearest dollar amount.) 4. An issue of common stock's most recent dividend is $3.55. Its growth rate is 5.0%. What is its price if the market's rate of return is 9.2%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 5. An issue of common stock is selling for $57.50. The year-end dividend is expected to be $2.45, assuming a constant growth rate of 5%. What is the required rate of return? (Round your answer to 1 decimal place.) 6. The coupon rate on a debt issue is 7%. If the yield to maturity on the debt is 9%, what is the after-tax cost of debt in the weighted average cost of capital if the firm's tax rate is 31%? (Round your answer to 2 decimal places.) 7. Tobin's Barbeque has a bank loan at 12% interest and an after-tax cost of debt of 4%. What will the after-tax cost of debt be when the loan is due if a new loan is taken out yielding 13%. (Do not found intermediate calculations. Round your answer to 2 decimal places.) 8. A fimm is paying an annual dividend of $5.00 for its preferred stock which is selling for $69.00. There is a selling cost of $2.00. What is the after-tax cost of preferred stock if the firm's tax rate is 36%? (Round your answer to 2 decimal places.) Appendia Present value of PV, PVFV Percent XE 5% 9 0.943 Period 1 2 3 2560 2060 060 0935 6873 816 0.763 4 5 6 7 T 0.990 0.980 0.971 0.961 0.951 0.042 0.933 0.923 0914 0.905 0896 0.987 0.879 0.870 0861 0.853 0.844 0.836 0828 0820 0.780 0.742 0:672 0.600 2 090 0.961 0942 0.924 0906 D.BBB 0871 0.853 0.837 0.820 0.804 0788 0.773 0.758 0.743 4 0.962 0925 0889 0.85 0.822 0790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0534 0513 0494 0.475 0.971 0.943 0915 0.888 0.863 0837 0.813 0.789 0.766 0.744 0.722 0.701 0.68 0.661 0642 0.623 0.605 0.587 0.570 0.554 0.478 0412 0307 0.228 0.854 0823 0784 0.746 0711 0677 0645 0.614 ses 0.557 0530 0.50 0.481 0.458 0416 0.416 0895 0.377 0.295 0.251 0142 0840 0.792 0747 O 705 0.665 0.627 0592 0558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.233 0.174 0,097 0.05 10 11 12 13 14 15 16 17 18 19 20 25 30 40 50 0.917 0842 0.772 0.709 0.650 1996 0547 0502 0.460 0422 0388 0.356 0326 0.299 0.926 0.857 0794 025 0581 0630 0581 0.540 0500 0463 0.429 0.392 0.368 0.340 0.315 0.292 0270 0.250 0.232 0.215 0.145 0.000 0046 0021 0666 0.623 052 0544 0.50 0475 0444 0415 0.388 0362 0339 0317 0.296 0277 0259 0.114 0.131 0067 0034 10% 0.909 0.826 0.751 0683 0621 0564 0.513 0467 0.424 0386 0.350 0.319 0 290 0.263 0239 0218 0:19 0.180 0.164 0.149 0.092 0057 0022 0.009 0.901 0812 0.731 0.699 0.593 0535 0.482 0.434 0391 0.352 0.317 0.286 0.258 0.232 0.209 0.180 0170 033 0.797 0.712 0.636 0567 OSOT 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0033 0.011 0.003 0275 0728 0.153 0.714 0.700 0.686 0673 0.610 0.552 0453 0372 0.252 0231 0.212 0.194 0.178 O.116 0.375 0.308 0.200 0.138 0.124 0.074 0.044 0.015 0.005 0075 0032 0.013 Appendix concluded) Present value of $1 0.783 0.693 0613 17 0855 0.731 0.624 0.534 0.714 0.510 0.164 0.250 0 186 0133 0.095 0456 0.480 0.425 0376 0.333 9 TO 0060 0.048 0035 14% 0.177 0.769 0.675 0592 0519 0456 0.400 0.351 0.300 0270 0.237 0208 0.182 0 160 0.140 0.123 0.108 0095 0.083 0073 0038 0.020 0.00 0.001 15 0.070 0.756 0.658 0.572 0.497 0.432 0.376 0.322 0284 0247 0.215 0.187 0.163 0 141 0.123 0.107 0093 0.083 0070 0.061 0.030 0.015 0.004 0.001 0.261 0.231 0.204 0.181 0 160 0 141 0125 0110 0098 0.087 0.047 0.026 0.008 0.002 Perce 12% 0840 0706 0593 0.490 0.419 0352 0.296 0249 0.209 0.176 0.14B 0124 0.104 DOBB 0.074 0062 0.052 0.044 0.037 0.031 0.013 16N O 862 0.743 0.641 0552 0.476 0.410 0.354 0.305 0.263 0.222 0.195 0.168 0 145 0 125 0.108 0.093 0 080 0.069 0.060 0.051 0024 0012 0003 0.001 18 084 0.718 0.609 0515 0.437 0 370 0.314 0.286 0225 0.191 0162 0.137 0116 0.099 0084 0.071 0.060 0.051 0.043 0.037 0.016 0.007 0001 0390 0.333 0.289 0.243 0.200 0.170 0.152 0.130 0111 0095 008 0069 0.059 0.051 0043 0.020 0.009 0.002 12 13 14 15 16 17 18 19 29 20% 0.833 0.694 0579 0.482 0.402 0335 0.279 0233 0.194 0.162 0.135 0.112 0.093 0.070 0.065 0.014 0.045 0.038 0.031 0026 0010 0.004 0001 25% 0300 0.540 0.512 0.610 0.328 0.262 0.210 0.160 0.134 0.107 0086 0.069 0.055 0044 0.035 0028 0023 0018 0014 0012 0.004 0.001 D D 30% 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 0.073 0.056 0043 0.033 0025 0020 0015 0012 0.000 0.007 0.001 0.001 0 0 0 50% 0.667 0444 0.296 0.190 0.132 0.06 09 0009 0.026 0.012 0.012 0 000 0006 0003 0.002 0.002 0.008 0001 0741 0549 0.406 0.301 0.223 0.165 0.122 0.091 0067 0050 0.037 0027 0.020 0.015 0011 ODOB D006 0.005 0.003 0.002 0.001 0 0.025 0.018 0.013 0.009 0006 O 005 0.003 0.003 0.000 0001 O 25 30 O O D o 0.001 0 D OG O 0 0 D D Appendix D Present of an amatyal PV PVDA 11+ Percent 2 ME EN NG Period 1 2 W EVO 0952 3 4 45 0962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7435 0.990 1.970 2.941 3.902 4153 5.795 6720 7652 3566 9.471 10.368 11.255 12134 13.004 13.BES 14.718 15.562 16.398 5 6 2 B 9 10 11 12 13 0.000 1942 2.884 3808 4.713 5601 6.472 7.325 8162 8.983 9.787 10.575 11145 12.106 12 849 13.57 14292 14.992 15.678 16. 351 19.523 22.396 27 355 31424 0.971 1913 2829 3.717 4.500 5.417 6.230 7.020 7.786 8.530 9253 9.954 10835 11296 11938 12561 13.166 13.754 14.324 14.877 17.413 19.600 21115 25.730 0.935 1 808 2624 3.387 4.100 4.767 5.389 5.971 6.515 7024 7.499 7.943 8.358 8.745 TO 9.447 9.73 10.059 10336 10504 7.723 3.546 4.329 5076 5786 6463 7.100 2722 8.306 8.863 9.394 9999 10300 10.33 11.274 11.690 12 095 12.462 14094 15372 17.159 18.256 2.673 3.465 4.212 4917 5582 6.210 6.BOZ 7.360 7.987 8.34 853 9.295 9.712 10 106 10477 28 11.15 11.470 12.783 13.765 15046 15.762 8.750 9.365 9.985 0.036 1.3 2577 3312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.535 7.904 8244 8.550 8851 9.122 9372 9.604 9.818 10675 11.256 11.925 12.233 0917 1 759 2.531 1240 3.890 4.4 5033 5.535 5.995 6418 6305 7 161 7487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 982 10 274 10.757 10962 10 0909 1,736 2487 3.170 3.791 4.355 4868 5335 5.759 6.145 6.495 6.814 7.103 7367 7.606 7824 022 OSO 1.713 2.444 3.102 3.6 4231 4712 5.146 5.537 5.9 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.700 7839 7.963 8422 R 694 8951 9.042 0.893 1.690 2402 3.097 3605 4111 4344 4968 $320 5.650 5.938 6.194 6.424 14 15 16 17 18 19 20 25 30 40 10563 17.226 3.201 11.118 11652 12.166 12/650 13.134 13500 15.622 17292 19.790 21.482 6811 6.974 7.120 7.250 7.366 7.469 7843 18.046 22.023 25.800 32.835 8305 8514 9.077 9.427 9.279 9.915 8055 12.409 13.312 13 801 OS 39.196 8.244 8304 Appendix concluded Present value of an any of Percent Period 145 20% 0.677 0.741 1299 2 3 4 5 6 7 8 9 1.647 2.322 2914 3.433 2059 1 66B 2.361 2974 2517 3.998 4423 4.799 5132 5.476 5.687 5.91 6.122 6.302 6.462 56% 0862 1.605 2.246 2.790 3274 1685 4039 4.344 4.607 4833 5029 5.197 5.342 5.46B 5575 0170 1626 2.28 2855 1152 3.784 4160 4487 4.772 5019 5234 5.421 5.58 5.724 5847 5954 0840 1547 2.140 2.619 3.05 1410 1706 3.954 4163 4.339 4.486 4.611 4715 4802 0855 1585 2210 2.743 3.199 3.589 3922 4.207 4.451 4.659 4.836 498 5118 5.229 5.324 5.405 5.475 5.534 5.584 5.628 5.766 5829 5871 SO to 0.847 1 566 2.174 24.90 1.127 3498 3812 4.078 4.303 4.494 4.656 4793 4.910 5.ORG 5.092 5.162 5222 5273 5.316 5.353 5.467 5517 5.548 4639 4.946 5216 5.453 5.660 5842 6.DOZ 6.142 6.265 6.373 6.467 6.550 6623 6873 7.003 7.105 7.133 25% OBDO 1.440 1.952 2.362 2689 2.951 3.161 1.329 3.463 3.571 3656 3725 3.70 3.824 1.859 152 2106 2.59 2991 126 3.805 3837 4031 4.192 4.327 4.4.19 4.53 4611 4675 4730 4.775 4.B12 12 10 0.709 3361 1816 2.166 2.436 2.643 2.802 2.925 1019 3.092 3.147 2190 3.223 3.249 3.28 3283 3.295 3.304 2.311 3316 1329 son 0667 1.11 1407 1.60 1737 1824 1.883 1.922 1948 1965 1977 1.985 1990 1993 1.995 1992 1990 1 696 1.997 2.220 2.185 2.500 2.598 2665 2715 2.952 2.779 2.799 2814 2825 2.834 2540 2.544 2.840 2850 2.856 2052 2857 2857 40% 0714 1.224 1.589 1849 2035 2.168 2.263 2.331 2379 2454 2.438 2.456 2.469 2478 2.484 2.489 2.42 2494 2.496 2.497 3,499 2.500 2500 2.500 4816 37 15 16 17 10 19 20 25 6007 3910 6.729 6.840 6.99 7025 7.330 7.4 7634 6.128 6.198 6259 6.454 6.566 6642 6.661 5749 58 5877 5.929 6097 6177 6.233 6.246 4.938 4.98 5033 5070 5.101 6195 5.235 5.258 5.262 2962 3.954 7.985 1995 3999 4.000 4870 4948 4979 4.997 4.99 40 reet CEEE EEEE 1.999 1999 2.000 2.000 2.000 2 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts