Question: 2. Cakk Arr Enterprise is considering two mutually exclusive project for their future investment. The company requires a rate of return to be 10 percent

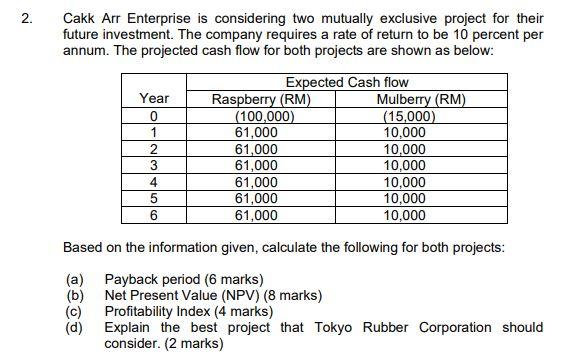

2. Cakk Arr Enterprise is considering two mutually exclusive project for their future investment. The company requires a rate of return to be 10 percent per annum. The projected cash flow for both projects are shown as below: Expected Cash flow Year Raspberry (RM) Mulberry (RM) 0 (100,000) (15,000) 1 61,000 10,000 2 61,000 10.000 3 61,000 10,000 4 61,000 10,000 5 61,000 10,000 6 61,000 10,000 Based on the information given, calculate the following for both projects: (a) Payback period (6 marks) (b) Net Present Value (NPV) (8 marks) (c) Profitability Index (4 marks) (d) Explain the best project that Tokyo Rubber Corporation should consider. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts