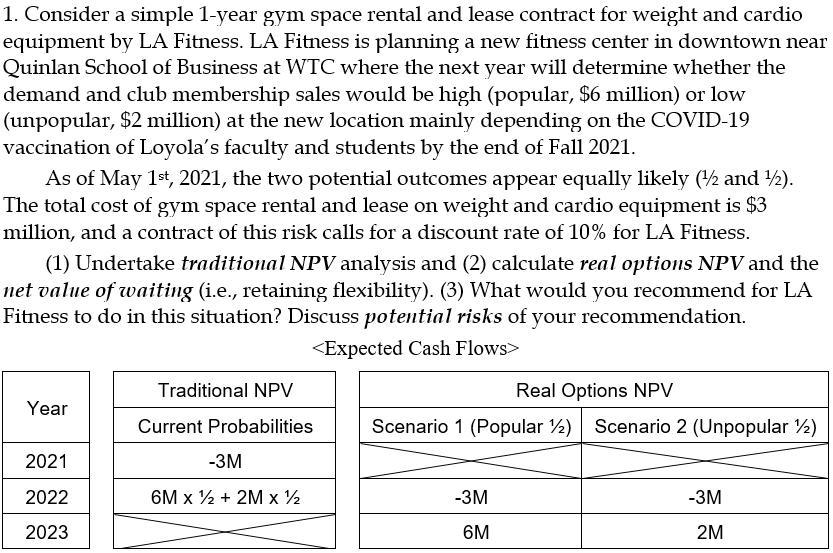

Question: (1) Traditional NPV Analysis: NPV = $ ______million Decision based on Traditional NPV? (2) Real Options NPV Analysis: ($ million) Scenario 1 (Popular, ): NPV1

(1) Traditional NPV Analysis: NPV = $ ______million

Decision based on Traditional NPV?

(2) Real Options NPV Analysis: ($ million)

- Scenario 1 (Popular, ): NPV1 = ______

- Scenario 2 (Unpopular, ): NPV2 = _________

- Combined Real Options NPV = ________ x + ________x = _________

- Net value of waiting = ________ - _________= ___________

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts