Question: (1) Two sales-people in analytical systems are making a presentation to you about the merits of their respective systems. One sales-person states that in valuing

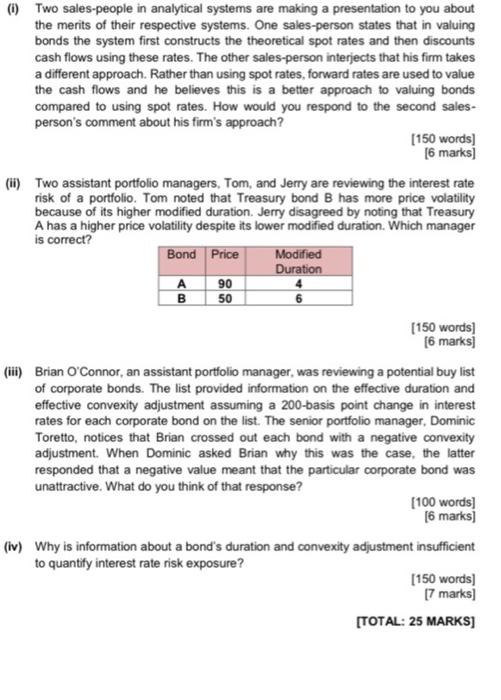

(1) Two sales-people in analytical systems are making a presentation to you about the merits of their respective systems. One sales-person states that in valuing bonds the system first constructs the theoretical spot rates and then discounts cash flows using these rates. The other sales-person interjects that his firm takes a different approach. Rather than using spot rates, forward rates are used to value the cash flows and he believes this is a better approach to valuing bonds compared to using spot rates. How would you respond to the second sales- person's comment about his firm's approach? [150 words] [6 marks] (ii) Two assistant portfolio managers, Tom and Jerry are reviewing the interest rate risk of a portfolio. Tom noted that Treasury bond B has more price volatility because of its higher modified duration. Jerry disagreed by noting that Treasury A has a higher price volatility despite its lower modified duration. Which manager is correct? Bond Price Modified Duration . 90 B 50 [150 words! [6 marksi (iii) Brian O'Connor, an assistant portfolio manager, was reviewing a potential buy list of corporate bonds. The list provided information on the effective duration and effective convexity adjustment assuming a 200-basis point change in interest rates for each corporate bond on the list. The senior portfolio manager, Dominic Toretto, notices that Brian crossed out each bond with a negative convexity adjustment. When Dominic asked Brian why this was the case, the latter responded that a negative value meant that the particular corporate bond was unattractive. What do you think of that response? [100 words) [6 marks] (iv) Why is information about a bond's duration and convexity adjustment insufficient to quantify interest rate risk exposure? [150 words) [7 marks] [TOTAL: 25 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts