Question: 1. U.S. Treasury Notes and Bonds trade in a large, liquid, and global secondary market. Who are the intermediaries in this market, what is their

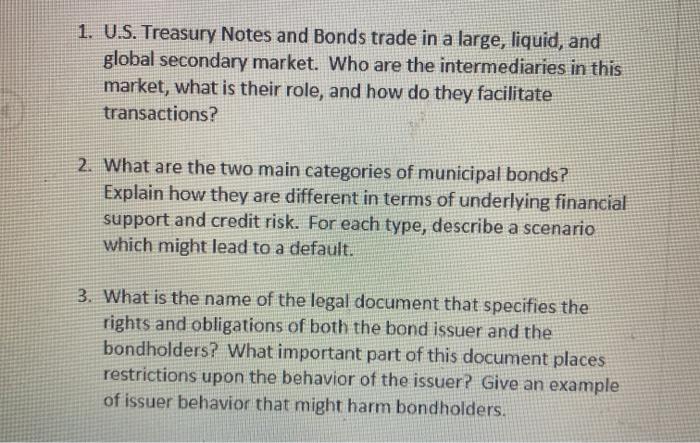

1. U.S. Treasury Notes and Bonds trade in a large, liquid, and global secondary market. Who are the intermediaries in this market, what is their role, and how do they facilitate transactions? 2. What are the two main categories of municipal bonds? Explain how they are different in terms of underlying financial support and credit risk. For each type, describe a scenario which might lead to a default. 3. What is the name of the legal document that specifies the rights and obligations of both the bond issuer and the bondholders? What important part of this document places restrictions upon the behavior of the issuer? Give an example of issuer behavior that might harm bondholders. 1. U.S. Treasury Notes and Bonds trade in a large, liquid, and global secondary market. Who are the intermediaries in this market, what is their role, and how do they facilitate transactions? 2. What are the two main categories of municipal bonds? Explain how they are different in terms of underlying financial support and credit risk. For each type, describe a scenario which might lead to a default. 3. What is the name of the legal document that specifies the rights and obligations of both the bond issuer and the bondholders? What important part of this document places restrictions upon the behavior of the issuer? Give an example of issuer behavior that might harm bondholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts