Question: (1) Use the information below to answer questions below (5 Points) The prices and yields for on-the-run Treasury's were collected from the Wall Street Journal

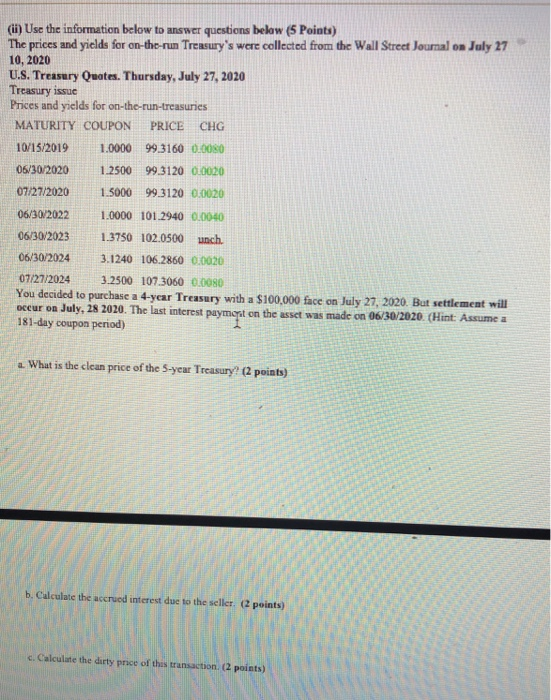

(1) Use the information below to answer questions below (5 Points) The prices and yields for on-the-run Treasury's were collected from the Wall Street Journal on July 27 10, 2020 U.S. Treasury Quotes. Thursday, July 27, 2020 Treasury issue Prices and yields for on-the-run-treasures MATURITY COUPON PRICE CHG 10/15/2019 1.0000 99.3160 0.0080 06/30/2020 1.2500 99.3120 CL0020 07/27/2020 1.5000 99.3120 0.0020 06/30/2022 1.0000 101.2940 0.0040 06/30/2023 1.3750 102.0500 unch. 06/30/2024 3.1240 106.2860 0.0020 07/27/2024 3.2500 107.30600080 You decided to purchase a 4-year Treasury with a $100,000 face on July 27, 2020. But settlement will secur on July, 28 2020. The last interest paymeyit on the asset was made on 06/30/2020. (Hint: Assume a 181-day coupon period) 2. What is the clean price of the 5-year Treasury? (2 points) b. Calculate the accrued interest due to the seller. (2 points) c. Calculate the dirty price of this transaction (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts