Question: 1. Using concepts and theories from Block 1, explore how the marketing and operations functions are integrated at IKEA. You should consider what might be

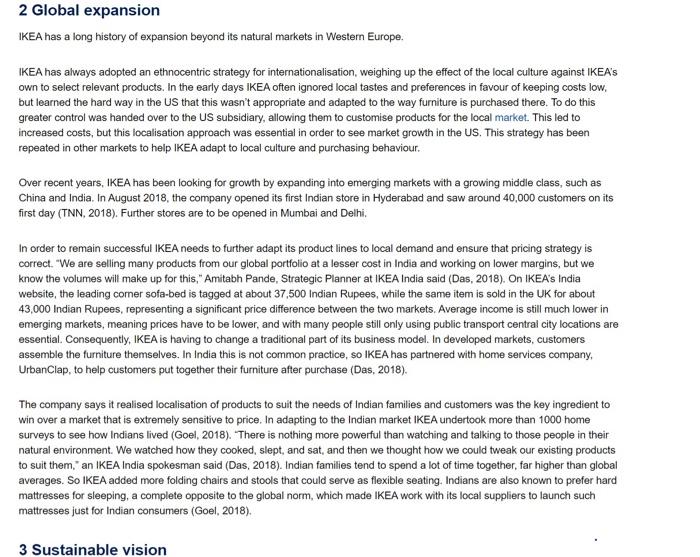

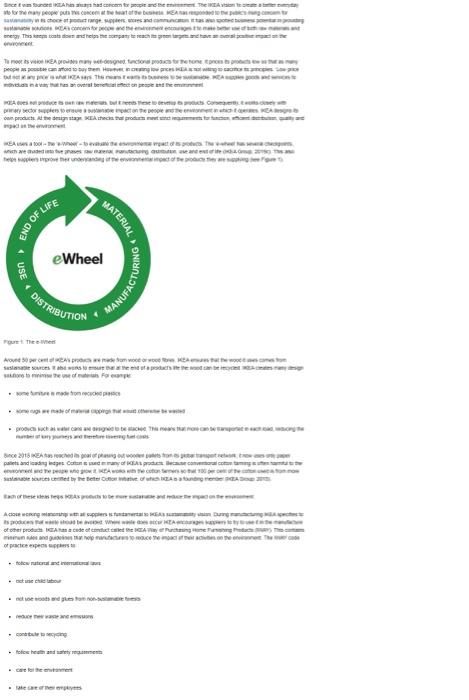

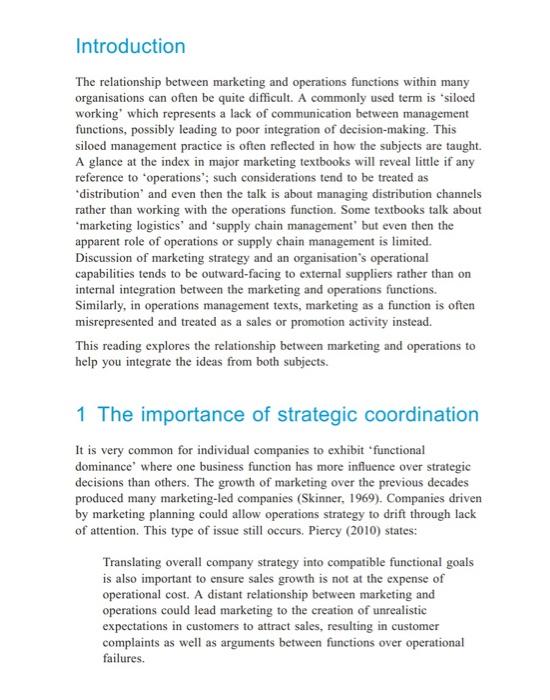

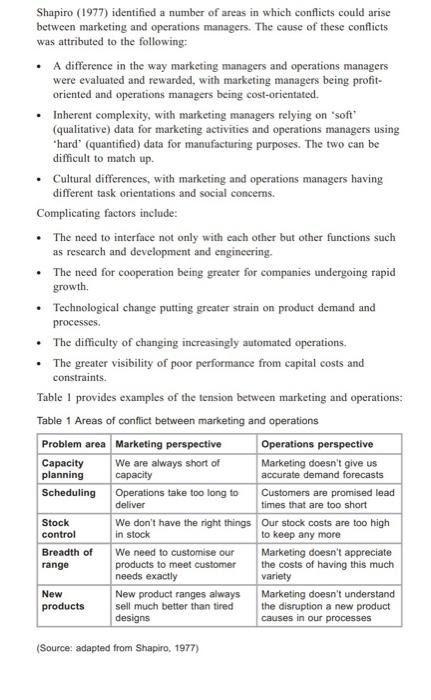

1. Using concepts and theories from Block 1, explore how the marketing and operations functions are integrated at IKEA. You should consider what might be some of the challenges IKEA faces in maintaining a consistent and integrated business strategy. (20 marks) 1 Flat-pack pioneers IKEA is associated with products that are simple, low cost but also stylish. This has given IKEA a very broad appeal to different groups of consumers and ensured that IKEA products appealed in both the business and consumer markets. Starting as early as 1956, the company were the pioneers of flat-pack furniture. This offered a great solution for all sorts of customers who were looking for stylish high quality furniture at an affordable price. The flat-pack approach to furniture design allows IKEA to reduce costs across the supply chain, from initial design, standardised manufacturing of components, to transport costs and warehousing. Part of the approach to cost saving is in store location. IKEA stores are commonly built on the outskirts of cities where business rates and operational costs are cheaper and customers can park easily. Due to the way IKEA produces and sells its fumiture it has also ensured that it is readily available and convenient. Conventional furniture makers often only begin production once an order has been placed by a customer. This means that it can often take several weeks for delivery. By contrast, IKEA's products are instantly available in their stores and easy to transport home in customers own vehicles. The flat-pack business model has continued to be beneficial for IKEA as it allows a further significant cost saving at the end of the value chain. Effectively, IKEA have outsourced the highly costly assembly part of the value chain directly to customers who are willing to trade the extra work of self-assembly for a large saving on the retail price they pay. This helps IKEA maintain high profits. The IKEA business model is reliant on a highly offective approach to procurement. With 31 trading service offices of procurement staff in 26 countries, IKEA sources from over 1400 worldwide suppliers. With the bulk purchasing power behind IKEA and the large procurement team it is able to negotiate prices between 20% and 40% lower than any of its competitors. Over time, IKEA has demonstrated that it can successfully manage global suppliers while also maintaining the quality of its products, key to maintaining its brand reputation. The network of service offices is crucial to their global procurement activity, as each office is geographically spread out so that they can cultivata strong working relationships with all local suppliers, wherever in the world they happen to be IKEA staff also visit all of the suppliers on a regular basis, not only to continue to build relationships with their suppliers but also to build on their quality control processes. As part of this, IKEA is a strong believer that it should only work with ethical suppliers and as such it inspects the working conditions and the social conditions surrounding the factories, ensuring it adds value to the local communities it works with Some 66 per cent of IKEAs products are sourced from Europe. However, to keep costs down IKEA's largest supplier in China, which provides 18% of all IKEA products. Production of a single product is spread across multiple suppliers and optimised in order to reduce prices. IKEA also purchases raw materials and hardware in bulk which is sold to its suppliers to help them keep the final cost down IKEA's supply chain is supported by cutting-edge IT infrastructure. The complexity of the supplier network and the large range of products has meant that over time IKEA has found it necessary to develop its own systems. This is more expensive than buying standard IT systems to manage its stocks. However, this does mean it can manage the demands of stores and ensure effective distribution of its stock between them. Ensuring that nothing stays in storage for long is key to keeping IKEAs inventory costs low as everything is built to shelf rather than built to order like most other furniture manufacturers. 2 Global expansion IKEA has a long history of expansion beyond its natural markets in Western Europe. IKEA has always adopted an ethnocentric strategy for internationalisation, weighing up the effect of the local culture against IKEA's own to select relevant products. In the early days IKEA often ignored local tastes and preferences in favour of keeping costs low, but learned the hard way in the US that this wasn't appropriate and adapted to the way furniture is purchased there. To do this greater control was handed over to the US subsidiary, allowing them to customise products for the local market. This led to increased costs, but this localisation approach was essential in order to see market growth in the US. This strategy has been repeated in other markets to help IKEA adapt to local culture and purchasing behaviour. Over recent years, IKEA has been looking for growth by expanding into emerging markets with a growing middle class, such as China and India. In August 2018, the company opened its first Indian store in Hyderabad and saw around 40,000 customers on its first day (TNN, 2018). Further stores are to be opened in Mumbai and Delhi. In order to remain successful IKEA needs to further adapt its product lines to local demand and ensure that pricing strategy is correct. "We are selling many products from our global portfolio at a lesser cost in India and working on lower margins, but we know the volumes will make up for this," Amitabh Pande, Strategic Planner at IKEA India said (Das, 2018). On IKEA's India website, the leading corner sofa-bed is tagged at about 37,500 Indian Rupees, while the same item is sold in the UK for about 43,000 Indian Rupees, representing a significant price difference between the two markets. Average income is still much lower in emerging markets, meaning prices have to be lower, and with many people still only using public transport central city locations are essential. Consequently, IKEA is having to change a traditional part of its business model. In developed markets, customers assemble the furniture themselves. In India this is not common practice, so IKEA has partnered with home services company, UrbanClap, to help customers put together their furniture after purchase (Das, 2018). The company says it realised localisation of products to suit the needs of Indian families and customers was the key ingredient to win over a market that is extremely sensitive to price. In adapting to the Indian market IKEA undertook more than 1000 home surveys to see how Indians lived (Goel, 2018). "There is nothing more powerful than watching and talking to those people in their natural environment. We watched how they cooked, slept, and sat, and then we thought how we could tweak our existing products to suit them, an IKEA India spokesman said (Das, 2018). Indian families tend to spend a lot of time together, far higher than global averages. So IKEA added more folding chairs and stools that could serve as flexible seating. Indians are also known to prefer hard mattresses for sleeping, a complete opposite to the global norm, which made IKEA work with its local suppliers to launch such mattresses just for Indian consumers (Goel, 2018). 3 Sustainable vision Since the accomplemente e people concentreret chorage and Arco This em todos los espany teen Timot so Aretonction posterone propos propis prostoran HK WASTA EAST pmay sex samples weresmerpecrape prope mom romemaanorammxcAampus com pouch the Acest producto Awwwwww we were END OF LIFE MATERIAL (USE e Wheel TURING DISTRIBUTION MANUFA out Teens Avec Sommer Saree . prova acta con noso Since 2015 sred spare penger pallies and des Concerts to selected by the Believe SAS tares she pe www of the producede el contacter mech occe expenses Introduction The relationship between marketing and operations functions within many organisations can often be quite difficult. A commonly used term is siloed working which represents a lack of communication between management functions, possibly leading to poor integration of decision-making. This siloed management practice is often reflected in how the subjects are taught. A glance at the index in major marketing textbooks will reveal little if any reference to operations'; such considerations tend to be treated as distribution and even then the talk is about managing distribution channels rather than working with the operations function. Some textbooks talk about "marketing logistics' and supply chain management' but even then the apparent role of operations or supply chain management is limited. Discussion of marketing strategy and an organisation's operational capabilities tends to be outward-facing to external suppliers rather than on internal integration between the marketing and operations functions. Similarly, in operations management texts, marketing as a function is often misrepresented and treated as a sales or promotion activity instead. This reading explores the relationship between marketing and operations to help you integrate the ideas from both subjects. 1 The importance of strategic coordination It is very common for individual companies to exhibit functional dominance' where one business function has more influence over strategie decisions than others. The growth of marketing over the previous decades produced many marketing-led companies (Skinner, 1969). Companies driven by marketing planning could allow operations strategy to drift through lack of attention. This type of issue still occurs. Piercy (2010) states: Translating overall company strategy into compatible functional goals is also important to ensure sales growth is not at the expense of operational cost. A distant relationship between marketing and operations could lead marketing to the creation of unrealistic expectations in customers to attract sales, resulting in customer complaints well as arguments between functions over operational failures. Shapiro (1977) identified a number of areas in which conflicts could arise between marketing and operations managers. The cause of these conflicts was attributed to the following: A difference in the way marketing managers and operations managers were evaluated and rewarded with marketing managers being profit- oriented and operations managers being cost-orientated. Inherent complexity, with marketing managers relying on "soft" (qualitative) data for marketing activities and operations managers using hard' (quantified) data for manufacturing purposes. The two can be difficult to match up . Cultural differences, with marketing and operations managers having different task orientations and social concems. Complicating factors include: The need to interface not only with each other but other functions such as research and development and engineering. The need for cooperation being greater for companies undergoing rapid growth Technological change putting greater strain on product demand and processes. The difficulty of changing increasingly automated operations. The greater visibility of poor performance from capital costs and constraints. Table 1 provides examples of the tension between marketing and operations: Table 1 Areas of conflict between marketing and operations Problem area Marketing perspective Operations perspective Capacity We are always short of Marketing doesn't give us planning capacity accurate demand forecasts Scheduling Operations take too long to Customers are promised lead deliver times that are too short Stock We don't have the right things Our stock costs are too high control to keep any more Breadth of We need to customise our Marketing doesn't appreciate range products to meet customer the costs of having this much needs exactly variety New product ranges always Marketing doesn't understand products sell much better than tired the disruption a new product designs causes in our processes in stock New (Source: adapted from Shapiro, 1977) Speed - to increase responsiveness and reduce the cost of life cycle times Insight - to improve understanding of customers, target segments and use the best mix of media to reach them Access - to provide dynamic capability through continuous input facility (including data, creative assets and business decisions) Flexibility - to adapt to changing needs, priorities, preferences and demand. In other sectors there is further recognition that extended supply chains need better coordination of marketing and supply. The activities of demand creation and demand fulfilment should be brought closer together. Onc example of this is from Christopher and Ryals (2014), who propose a new discipline of demand chain management (Figure 1). Marketing function Supply chain function Demand creation Demand fulfilment Limited joint planning Demand creation Demand fulfilment Alignment of strategy, processes, KPIs, etc. Demand chain management Alignment of demand creation and fulfilment processes across functional and organisational boundaries Customers Producer Suppliers Noto: KPI = key performance indicator Figure 1 Demand chain management This framework shows how there might be degrees of coordination between marketing and operations functions. In some cases this could be limited to short-term collaboration on activities such as promotions that create demand surges. At the fullest extent the process of developing marketing and operations plans could be fully integrated