Question: 1) Using the attached data, which represents five years of actual results of a publicly traded company, please create a dynamic financial model. The financial

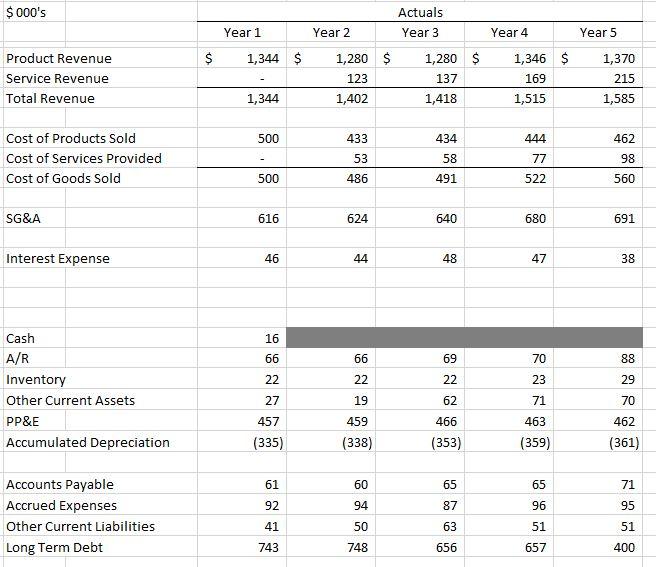

1) Using the attached data, which represents five years of actual results of a publicly traded company, please create a dynamic financial model. The financial model should include a P&L, Balance Sheet, and Cash Flow statement for Years 1 through 5, as well as project out Years 6 through 8. The financial model should allow for dynamic adjustment of business case assumptions.

2) Based upon your analysis, what insights can you derive about the business? Please include a summary of meaningful business metrics and a brief (~1 page) narrative explaining what you observed, what key assumptions you made, and how you used those to determine your findings.

$ 000's Actuals Year 3 Year 1 Year 2 Year 4 Year 5 $ 1,344 $ Product Revenue Service Revenue Total Revenue 1,280 $ 123 1,280 $ 137 1,418 1,346 $ 169 1,515 1,370 215 1,585 1,344 1,402 500 433 444 462 Cost of Products Sold Cost of Services Provided Cost of Goods Sold 434 58 53 77 98 500 486 491 522 560 SG&A 616 624 640 680 691 Interest Expense 46 44 48 47 38 16 66 66 69 70 88 22 22 22 23 29 Cash A/R Inventory Other Current Assets PP&E Accumulated Depreciation 27 19 62 71 70 459 466 463 462 457 (335) (338) (353) (359) (361) 61 60 65 65 71 92 94 87 96 95 Accounts Payable Accrued Expenses Other Current Liabilities Long Term Debt 41 50 63 51 51 743 748 656 657 400 $ 000's Actuals Year 3 Year 1 Year 2 Year 4 Year 5 $ 1,344 $ Product Revenue Service Revenue Total Revenue 1,280 $ 123 1,280 $ 137 1,418 1,346 $ 169 1,515 1,370 215 1,585 1,344 1,402 500 433 444 462 Cost of Products Sold Cost of Services Provided Cost of Goods Sold 434 58 53 77 98 500 486 491 522 560 SG&A 616 624 640 680 691 Interest Expense 46 44 48 47 38 16 66 66 69 70 88 22 22 22 23 29 Cash A/R Inventory Other Current Assets PP&E Accumulated Depreciation 27 19 62 71 70 459 466 463 462 457 (335) (338) (353) (359) (361) 61 60 65 65 71 92 94 87 96 95 Accounts Payable Accrued Expenses Other Current Liabilities Long Term Debt 41 50 63 51 51 743 748 656 657 400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts