Question: 1) Using the Black-Scholes pricing function in Excel, compute an option value for each strike price and maturity date in case Exhibit 2. For simplicity,

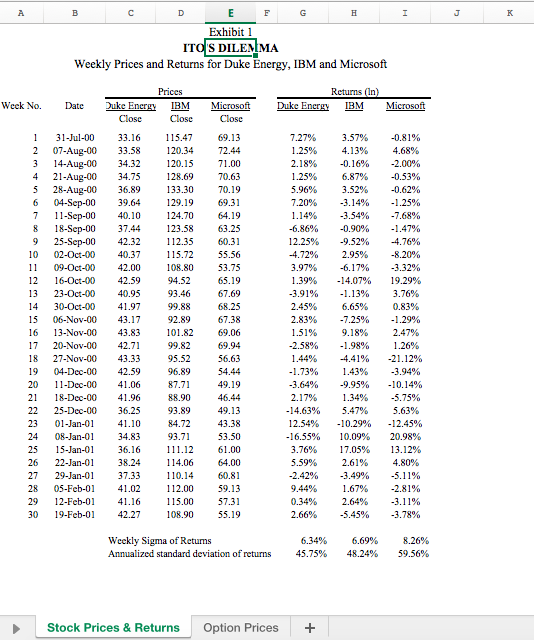

1) Using the Black-Scholes pricing function in Excel, compute an option value for each strike price and maturity date in case Exhibit 2. For simplicity, assume zero dividend yield. Also, use Louise Itos volatility estimates, provided in case Exhibit 1 2) Does the model yield logical estimates with respect to intrinsic value and time-to-maturity? What happens to the option premiums as you change the volatility? Can you explain why volatility affects prices in such a manner? 3) How do your estimates compare with the actual quoted prices? Can you explain the differences? Assuming your prices are correct, which options would you buy or sell? 4) Are there any problems with the way Ito estimated the volatility numbers? Can you think of another way to estimate volatility that might yield estimates closer to the actual quotes?

Exhibit 1 ITO S DILEM MA Weekly Prices and Returns for Duke Energy, IBM and Microsoft Exhibit 1 ITO S DILEM MA Weekly Prices and Returns for Duke Energy, IBM and Microsoft

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts