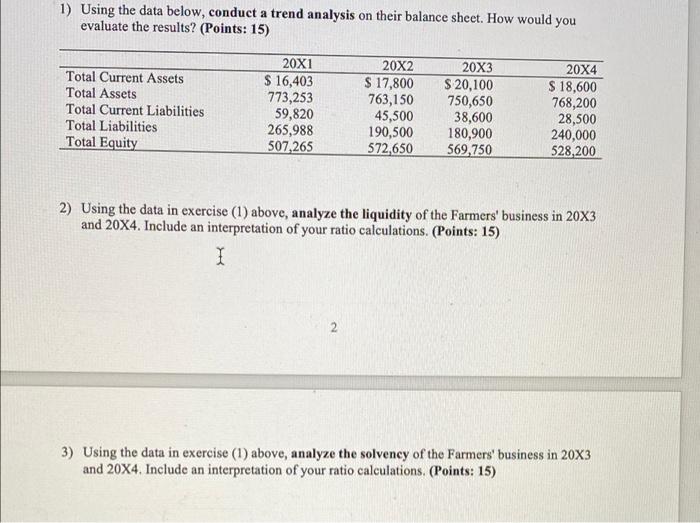

Question: 1) Using the data below, conduct a trend analysis on their balance sheet. How would you evaluate the results? (Points: 15) Total Current Assets Total

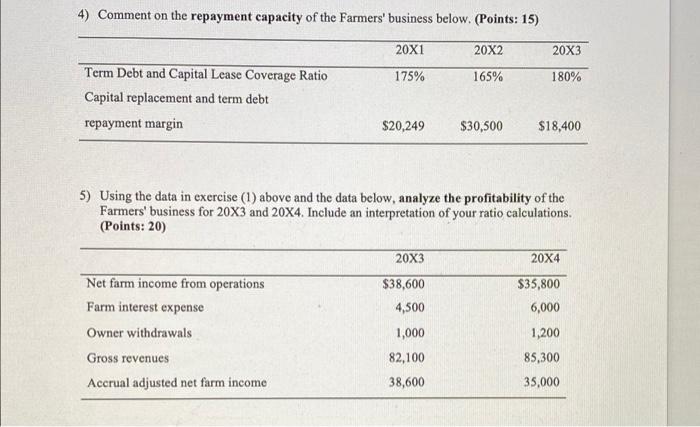

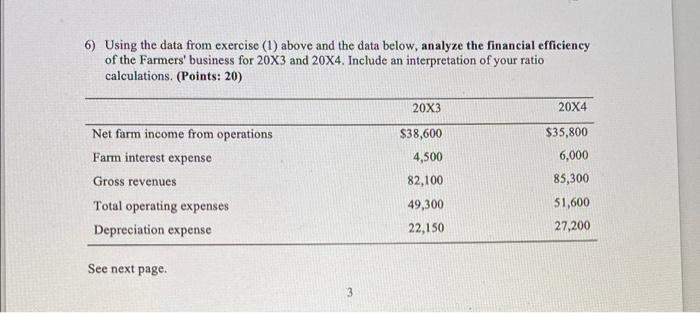

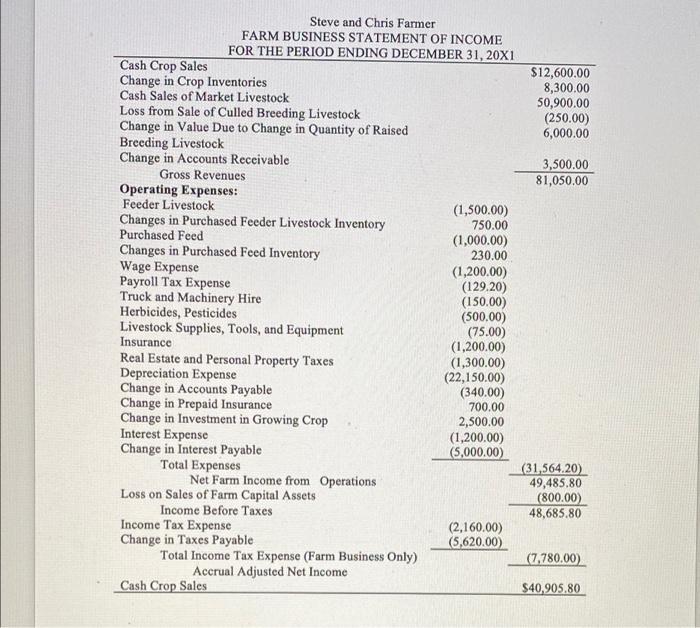

1) Using the data below, conduct a trend analysis on their balance sheet. How would you evaluate the results? (Points: 15) Total Current Assets Total Assets Total Current Liabilities Total Liabilities Total Equity 20X1 $ 16,403 773,253 59,820 265,988 507 265 20X2 $ 17,800 763,150 45,500 190,500 572,650 20X3 $ 20,100 750,650 38,600 180,900 569,750 20X4 $ 18,600 768,200 28,500 240,000 528,200 2) Using the data in exercise (1) above, analyze the liquidity of the Farmers' business in 20X3 and 20X4. Include an interpretation of your ratio calculations. (Points: 15) I 3) Using the data in exercise (1) above, analyze the solvency of the Farmers' business in 20X3 and 20X4. Include an interpretation of your ratio calculations. (Points: 15) 4) Comment on the repayment capacity of the Farmers' business below. (Points: 15) 20X1 20X2 20X3 175% 165% 180% Term Debt and Capital Lease Coverage Ratio Capital replacement and term debt repayment margin $20,249 $30,500 $18,400 5) Using the data in exercise (1) above and the data below, analyze the profitability of the Farmers' business for 20X3 and 20X4. Include an interpretation of your ratio calculations. (Points: 20) 20x3 20X4 $38,600 4,500 $35,800 6,000 Net farm income from operations Farm interest expense Owner withdrawals Gross revenues Accrual adjusted net farm income 1,200 1,000 82,100 38,600 85,300 35,000 6) Using the data from exercise (1) above and the data below, analyze the financial efficiency of the Farmers' business for 20x3 and 20X4. Include an interpretation of your ratio calculations. (Points: 20) 20X3 20X4 Net farm income from operations $38,600 $35,800 6,000 Farm interest expense Gross revenues 85,300 4,500 82,100 49,300 22,150 Total operating expenses Depreciation expense 51,600 27,200 See next page. 3 Steve and Chris Farmer FARM BUSINESS STATEMENT OF INCOME FOR THE PERIOD ENDING DECEMBER 31, 20X1 Cash Crop Sales $12,600.00 Change in Crop Inventories 8,300.00 Cash Sales of Market Livestock 50,900.00 Loss from Sale of Culled Breeding Livestock (250.00) Change in Value Due to Change in Quantity of Raised 6,000.00 Breeding Livestock Change in Accounts Receivable 3,500.00 Gross Revenues 81,050.00 Operating Expenses: Feeder Livestock (1,500.00) Changes in Purchased Feeder Livestock Inventory 750.00 Purchased Feed (1,000.00) Changes in Purchased Feed Inventory 230.00 Wage Expense (1,200.00) Payroll Tax Expense (129.20) Truck and Machinery Hire (150.00) Herbicides, Pesticides (500.00) Livestock Supplies, Tools, and Equipment (75.00) Insurance (1,200.00) Real Estate and Personal Property Taxes (1,300.00) Depreciation Expense (22,150.00) Change in Accounts Payable (340.00) Change in Prepaid Insurance 700.00 Change in Investment in Growing Crop 2,500.00 Interest Expense (1,200.00) Change in Interest Payable (5,000.00) Total Expenses (31,564.20) Net Farm Income from Operations 49,485.80 Loss on Sales of Farm Capital Assets (800.00) Income Before Taxes 48,685.80 Income Tax Expense (2,160.00) Change in Taxes Payable (5,620.00) Total Income Tax Expense (Farm Business Only) (7,780.00) Accrual Adjusted Net Income Cash Crop Sales $40,905.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts