Question: 1. Using the Dividend Growth Model for valuation Companies MAX and MIN are in the same industry and have no debt. Max is planning

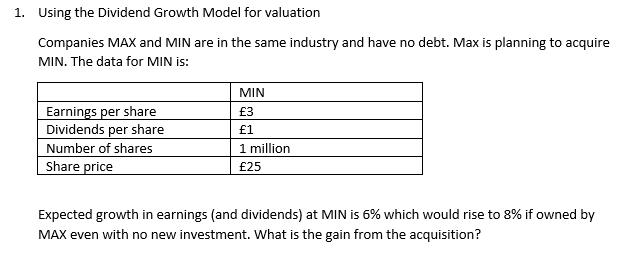

1. Using the Dividend Growth Model for valuation Companies MAX and MIN are in the same industry and have no debt. Max is planning to acquire MIN. The data for MIN is: Earnings per share Dividends per share Number of shares Share price MIN 3 1 1 million 25 Expected growth in earnings (and dividends) at MIN is 6% which would rise to 8% if owned by MAX even with no new investment. What is the gain from the acquisition?

Step by Step Solution

There are 3 Steps involved in it

To calculate the gain from the acquisition using the Dividend Growth Model we need to determine the ... View full answer

Get step-by-step solutions from verified subject matter experts