Question: 1. Using the financial statements given, compute the following ratios for both companies for 2019 and 2018. Assume all sales are credit sales. Round all

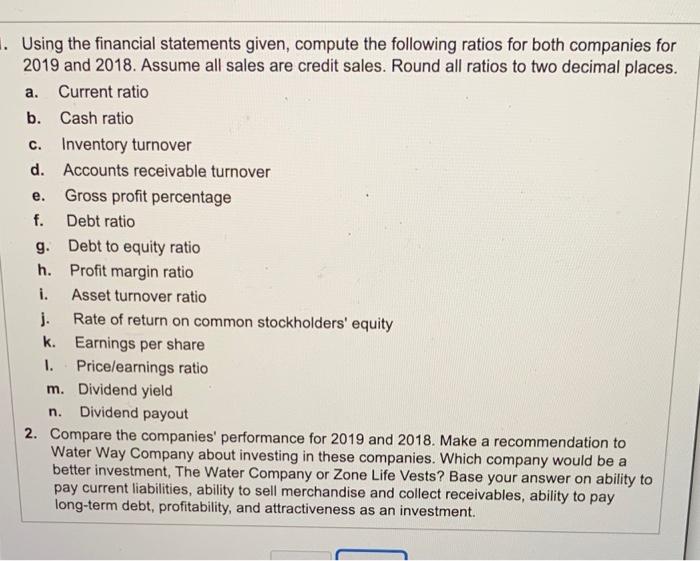

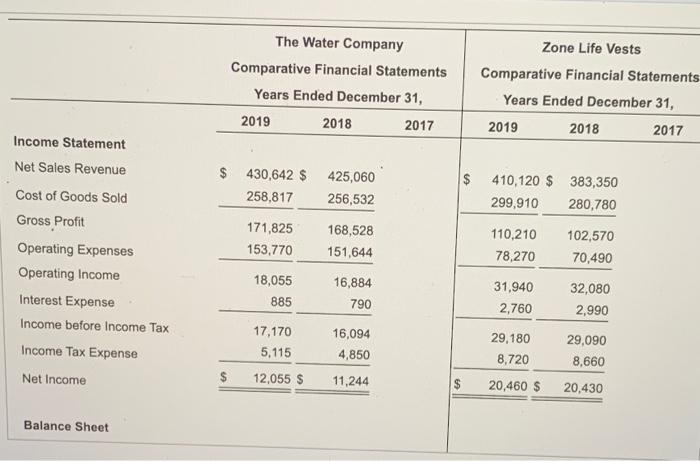

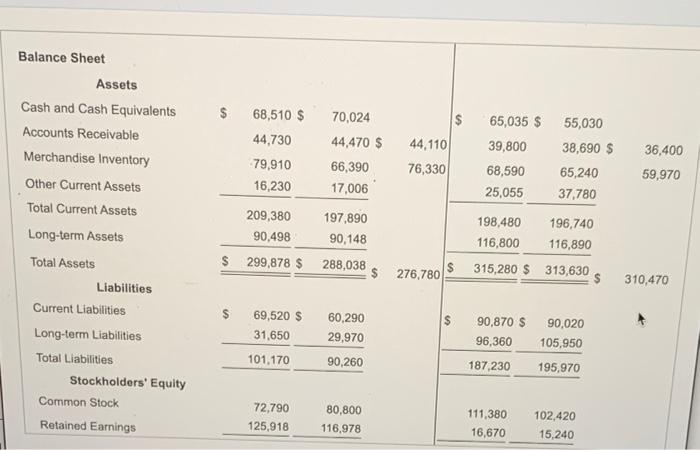

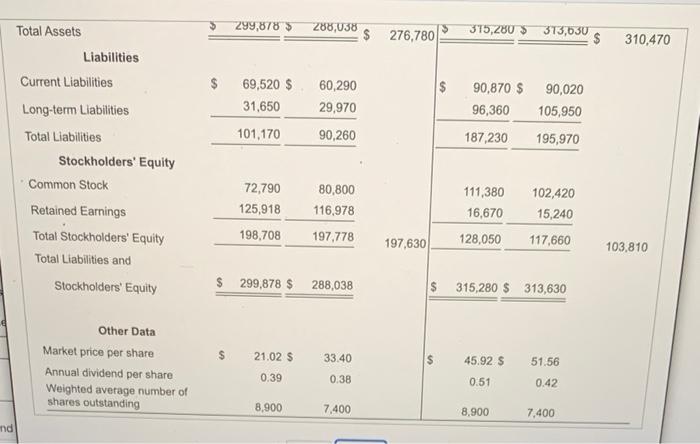

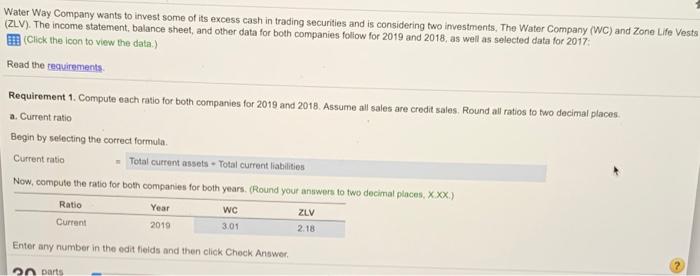

1. Using the financial statements given, compute the following ratios for both companies for 2019 and 2018. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio b. Cash ratio c. Inventory turnover d. Accounts receivable turnover e. Gross profit percentage f. Debt ratio g. Debt to equity ratio h. Profit margin ratio i. Asset turnover ratio j. Rate of return on common stockholders' equity k. Earnings per share 1. Pricelearnings ratio m. Dividend yield n. Dividend payout 2. Compare the companies' performance for 2019 and 2018. Make a recommendation to Water Way Company about investing in these companies. Which company would be a better investment, The Water Company or Zone Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. The Water Company Comparative Financial Statements Years Ended December 31, 2019 2018 2017 Zone Life Vests Comparative Financial Statements Years Ended December 31, 2019 2018 2017 Income Statement Net Sales Revenue $ 430,642 $ 258,817 425,060 256,532 $ 410,120 $ 383,350 299,910 280,780 171,825 153,770 168,528 151,644 110,210 78,270 102,570 70,490 Cost of Goods Sold Gross Profit Operating Expenses Operating Income Interest Expense Income before Income Tax Income Tax Expense Net Income 18,055 16,884 790 885 31,940 2,760 32,080 2,990 17,170 5,115 16,094 4,850 29,180 8,720 29,090 8,660 $ 12,055 $ 11,244 $ 20,460 $ 20,430 Balance Sheet $ $ 68,510 $ 44,730 79,910 16,230 70,024 44,470 $ 66,390 17,006 44,110 76,330 65,035 $ 39,800 68,590 25,055 36,400 55,030 38,690 $ 65,240 37,780 59,970 Balance Sheet Assets Cash and Cash Equivalents Accounts Receivable Merchandise Inventory Other Current Assets Total Current Assets Long-term Assets Total Assets Liabilities Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Common Stock Retained Earnings 209,380 90,498 299,878 $ 197,890 198,480 196,740 90,148 116,800 116,890 288,038 $ 276,780 $ 315,280 $ 313,630 $ 310,470 $ 69,520 $ 31,650 101,170 60,290 29,970 90,260 90,870 $ 96,360 187.230 90,020 105,950 195,970 72,790 125,918 80,800 116.978 111.380 16,670 102,420 15,240 299,878 $ 288,038 $ 276,780 375,280 $ 373,630 $ 310,470 $ 69,520 $ 31,650 60,290 29,970 90,260 90,870 $ 90,020 96,360 105,950 187,230 195,970 101,170 Total Assets Liabilities Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 72,790 125,918 80,800 116,978 111,380 16,670 128,050 102,420 15,240 198,708 197,778 197,630 117,660 103,810 299,878 $ 288,038 $ 315,280 $ 313,630 21.02 $ 33.40 Other Data Market price per share Annual dividend per share Weighted average number of shares outstanding 45.92 $ 51.56 0.39 0.38 0.51 0.42 8.900 7,400 8.900 7,400 nd Water Way Company wants to invest some of its excess cash in trading securities and is considering two investments, The Water Company (WC) and Zone Life Vests (ZLV). The income statement. balance sheet, and other data for both companies follow for 2019 and 2018, as well as selected data for 2017, (Click the icon to view the data) Read the requirements Requirement 1. Compute each ratio for both companies for 2019 and 2018. Assume all sales are credit sales. Round all ratios to two decimal places a. Current ratio Begin by selecting the correct formula Current ratio Total current assets + Total current liabilities Now.compute the ratio for both companies for both years. (Round your answers to two decimal places, XXX) Ratio WC ZLV Current 2019 3.01 2.18 Year Enter any number in the edit fields and then click Check Answer on Darts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts