Question: please do not use table, use calculations and formulas III. (Example problem: Don't turn in): Esteez Construction company has an overhead crane that has an

please do not use table, use calculations and formulas

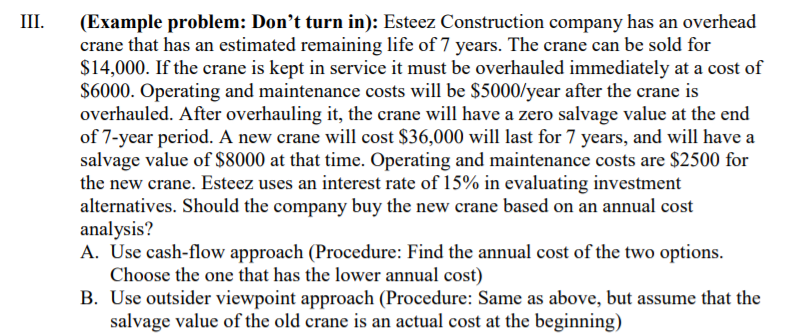

III. (Example problem: Don't turn in): Esteez Construction company has an overhead crane that has an estimated remaining life of 7 years. The crane can be sold for $14,000. If the crane is kept in service it must be overhauled immediately at a cost of S6000. Operating and maintenance costs will be $5000/year after the crane is overhauled. After overhauling it, the crane will have a zero salvage value at the end of 7-year period. A new crane will cost S36,000wl last for 7 years, and will havea salvage value of $8000 at that time. Operating and maintenance costs are $2500 for the new crane. Esteez uses an interest rate of 15% in evaluating investment alternatives. Should the company buy the new crane based on an annual cost analysis? A. Use cash-flow approach (Procedure: Find the annual cost of the two options Choose the one that has the lower annual cost) B. Use outsider viewpoint approach (Procedure: Same as above, but assume that the salvage value of the old crane is an actual cost at the beginning)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts