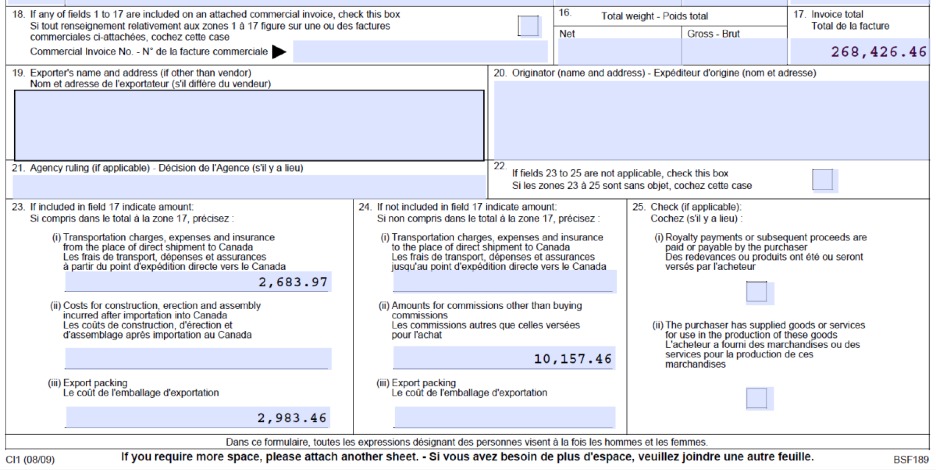

Question: 1 - Using the information shown from the bottom portion of a Canada Customs Invoice, what is the value for currency conversion? Both the invoice

Using the information shown from the bottom portion of a Canada Customs

Invoice, what is the value for currency conversion? Both the invoice total and Fields.

and are in USD. The exchange rate is for the date of direct shipment.

Assuming that the goods are liable for the SIMA, calculate the GST in the following scenario.

Commodity: Concrete reinforcing bar

Classification:

Country of origin: Russia

Export Price: $ USD

USD exchange rate:

Calculate the SIMA assessment

Certain Concrete Reinforcing Bar imported from China, weighted MT and valued CNYFOB

Use the CBSA website and indicate the amount of field of the B

CADCNYChinese Yuan Renminbi

Excise Tax is Not Applicable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock