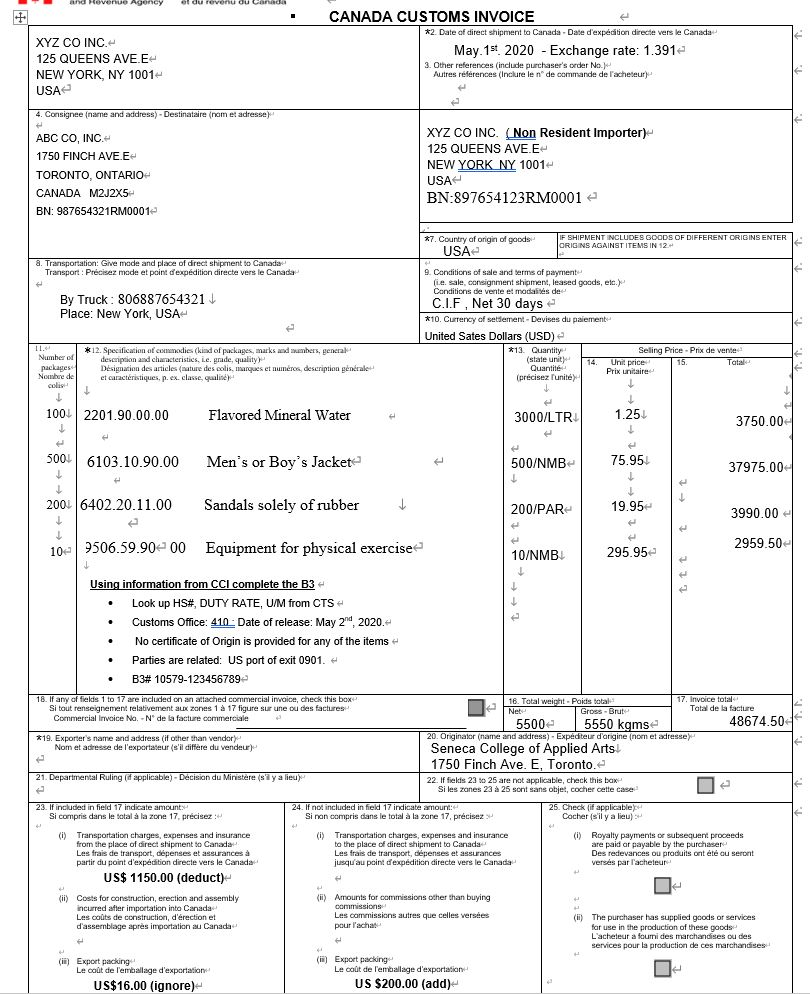

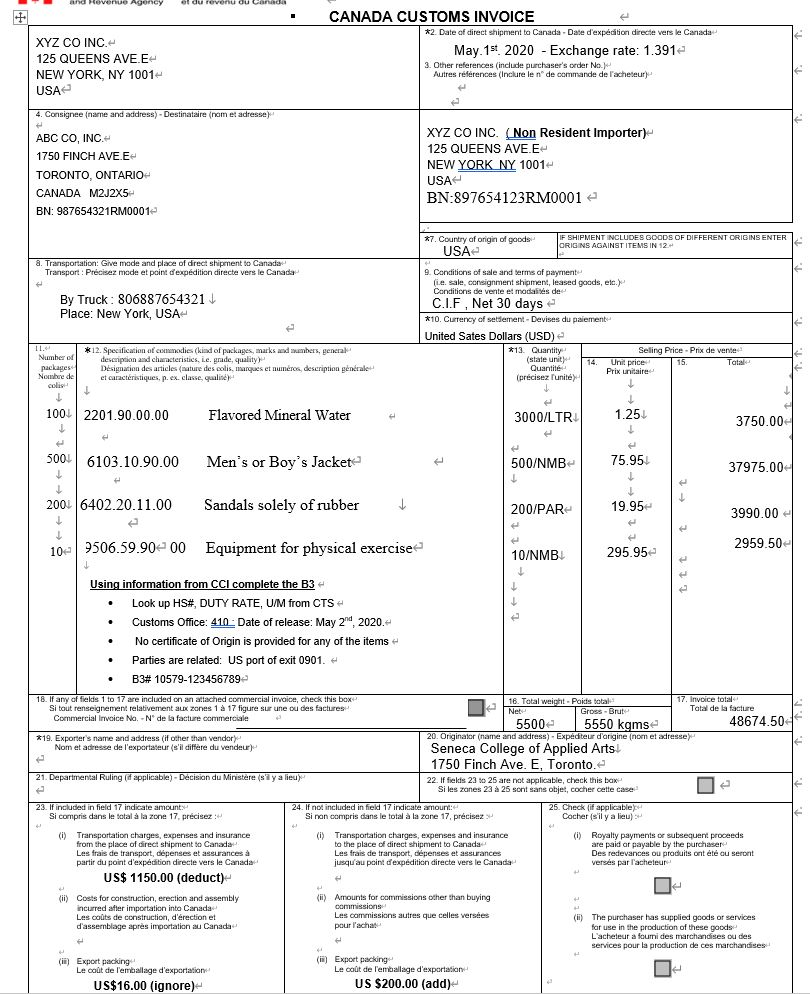

Question: Use provided CCI information to create a B3. und d Havenue Agency et du revenu du Can XYZ CO INC. 125 QUEENS AVE.E- NEW YORK,

Use provided CCI information to create a B3.

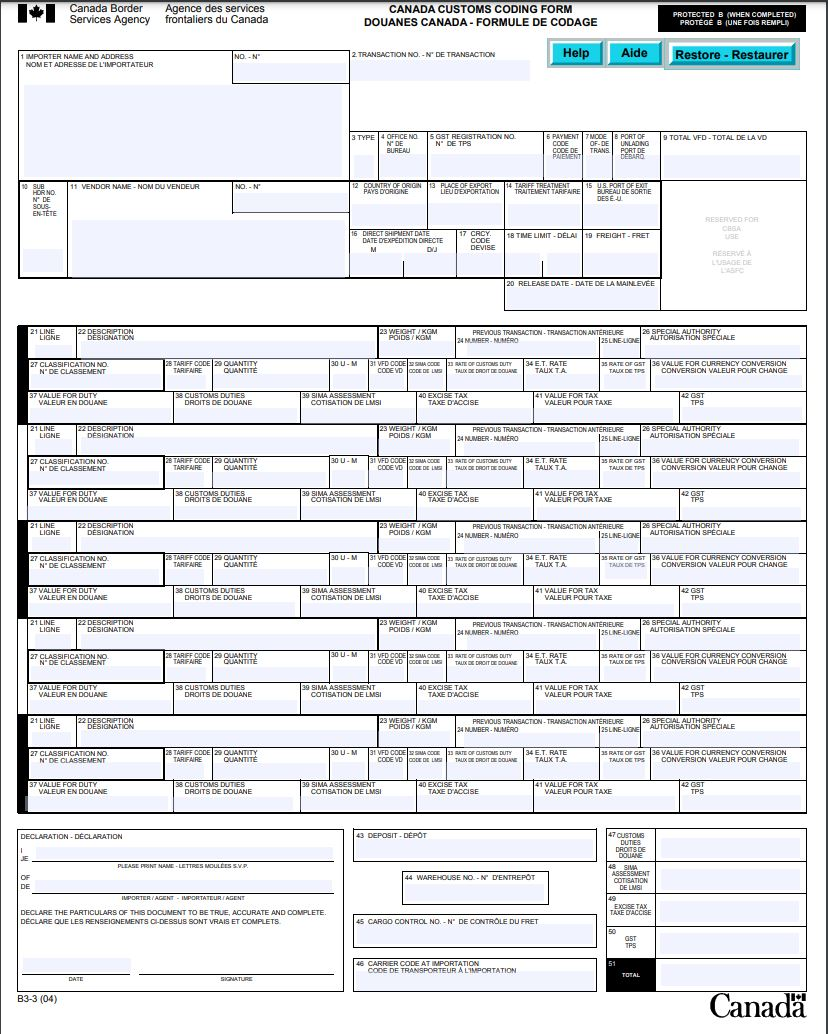

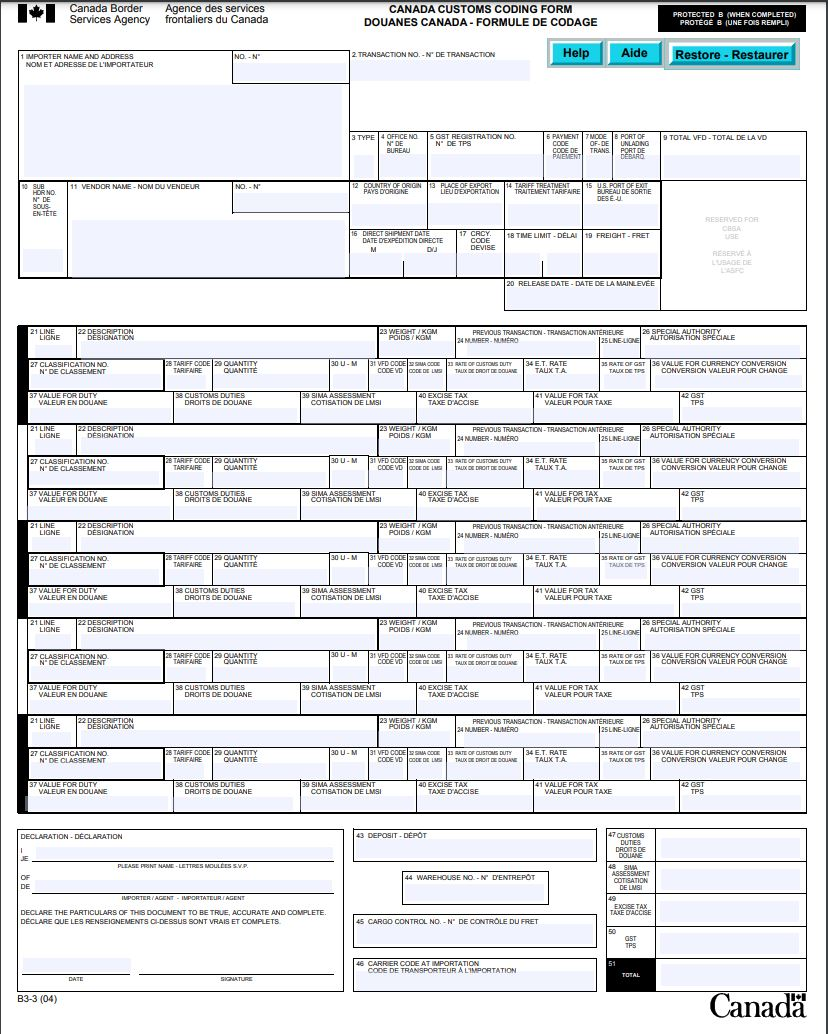

und d Havenue Agency et du revenu du Can XYZ CO INC. 125 QUEENS AVE.E- NEW YORK, NY 1001 CANADA CUSTOMS INVOICE *2. Date of direct shipment to Canada - Date d'expdition directe vers le Canada May 1st 2020 - Exchange rate: 1.3912 3. Other references (include purchaser's order Now Autres rfrences (Inclure le n de commande de l'acheteur) USA 4. Consignee (name and address) - Destinataire (nom et adresse) ABC CO, INC.- 1750 FINCH AVE.E TORONTO, ONTARIO- CANADA M2J2X5- BN: 987654321RM00012 XYZ CO INC. (Non Resident Importer) 125 QUEENS AVE.E- NEW YORK NY 1001 USA BN:897654123RM0001 2 *7. Country of origin of goods USA IF SHIPMENT INCLUDES GOODS OF DIFFERENT ORIGINS ENTER ORIGINS AGAINST ITEMS IN 12 a. Transportation: Give made and place of direct shipment to Canada Transport: Prcisez mode et point d'expdition directe vers le Canada By Truck: 806887654321 Place: New York, USA 9. Conditions of sale and terms of payment fi.e. sale, consignment shipment, leased goods, etc.) Conditions de vente et modalits de C.I.F, Net 30 days *10. Currency of setlement - Devises du paiement United Sates Dollars (USD) *13. Quantity Selling Price - Prix de vere (state unit) Unit price 15. Tatal Quantit Prix unitaire (prcisez l'unit 11. Number of packages Nombre de colis * 12. Specification of comedies (kind of packages, marks and numbers, general description and characteristics, Le grade, quality Designation des articles (nature des colis, marques et numro description gnrale et caractristiques, p.ex. classe, qualit 10012201.90.00.00 Flavored Mineral Water 3000/LTRI 1.25 3750.00 500 6103.10.90.00 Men's or Boy's Jacket 500/NMB 75.95 37975.00 20016402.20.11.00 Sandals solely of rubber 200/PAR 19.95 3990.00 t 109506.59.904 00 Equipment for physical exercise 2959.50 10/NMB 295.95 C Using information from CCI complete the B3 Look up HS#, DUTY RATE, U/M from CTS- Customs Office: 410 - Date of release: May 2nd, 2020.- No certificate of Origin is provided for any of the items Parties are related: US port of exit 0901. B3# 10579-123456789 . . . 18. If any of fields 1 to 17 are included on an attached commercial invoice, check this box 17. Invoice total 16. Total weight - Poids total Si tout renseignement relativement aux zones 1 A 17 figure sur une ou des factures Net Gross - Brut Tatal de la facture Commercial Invoice No. -N' de la facture commerciale 55000 5550 kgmse 48674.50 *19. Exporter's name and address (if other than vendor 20. Originator (name and address). Expditeur d'origine (nom et adresse) Nom et adresse de l'exportateur (s'il differe du vendeur) Seneca College of Applied Arts! 1750 Finch Ave. E, Toronto.e 21. Departmental Ruling (if applicable) - Dcision du Ministre (s? y a lieu) 22. If fields 23 to 25 are not applicable, check this bar le Si les zones 23 a 25 sont sans objet, cocher cette case 23. If included in field 17 indicate amount 24. If not included in field 17 indicate amount 25. Check it applicable Si compris dans le total a la zone 17. prcisez : Si non compris dans le total la zone 17, prcisez Cocher (s'il y a lieu) (i) Transportation charges, expenses and insurance (i) Transportation charges, expenses and insurance (i) Royalty payments or subsequent proceeds from the place of direct shipment to Canada to the place of direct shipment to Canada are paid ar payable by the purchaser Les frais de transport, dpenses et assurances Les frais de transport, dpenses et assurances Des redevances ou produits ont t au seront partir du point d'expdition directe vers le Canada jusqu'au point d'expdition directe vers le Canada verses par l'acheteur US$ 1150.00 (deduct) (ii) Costs for construction, erection and assembly (ii) Amounts for commissions other than buying incurred after importation into Canada commissions Les couts de construction, d'rection et Les commissions autres que celles verses (i) The purchaser has supplied goods or services d'assernblage aprs importation au Canada pour l'achat for use in the production of these goods L'acheteur a fourni des marchandises ou des services pour la production de ces marchandises (in) Export packing (in) Export packing Le cot de l'emballage d'exportation Le cot de l'emballage d'exportation US$16.00 (ignore) US $200.00 (add) IT Services Agency frontaliers du Canada CANADA CUSTOMS CODING FORM DOUANES CANADA - FORMULE DE CODAGE PROTECTED B (WHEN COMPLETED) PROTEGE B (UNE FOIS REMPLI) 2. TRANSACTION NO.-N' DE TRANSACTION Help Aide Restore - Restaurer 5 GST REGISTRATION NO. N" DE TPS TMODE 3 TYPE 4 OFFICE NO N'DE BUREAU 9 TOTAL VFD - TOTAL DE LA VD 5 PAYMENT CODE CODE PORT OF UNLADNG OF DE 12 COUNTRY OF ORON PAYS DORIGINE 13 PLACE OF EXPORT LIEU DE PORTATION 14 TARIFF TREATMENT TRAITEMENT TARIFARE 15 US.PORT OF EXIT BUREAU DE SORTIE DESEU RESERVED FOR CEEA UBE 18 TIME LIMIT-DLAI 19 FREIGHT - FRET 16 DIRECT SHIPMENT DATE DATE D'EXPEDITION DIRECTE M DIJ 17 CACY. CODE DEVISE RESERVE LUBASE DE 20 RELEASE DATE - DATE DE LA MAINLEVEE | 23 WEIGHT / KGM POIDS/KGM PREVIOUS TRANSACTION - TRANSACTION ANTERIEURE 26 SPECIAL AUTHORITY 24 NUMBER-NUMERO 25 LINE-LIGNE AUTORISATION SPECIALE a0 S - M 31 VFD CODESIMA GODE 23 RATE OF CUSTOMS DUTY CODE VD CODE DE LMS TALIX DE DROIT DE DOUANE 34 ET RATE TAUXTA 35 RATE OF GST 36 VALUE FOR CURRENCY CONVERSION TALDE DE TIPS CONVERSION VALEUR POUR CHANGE 29 SIMA ASSESSMENT COTISATION DE LMS 40 EXCISE TAX TAXE D'ACCISE 41 VALUE FOR TAX VALEUR POUR TAXE 42 GST TPS 23 WEIGHT / KGM POIDS / GM PREVIOUS TRANSACTION - TRANSACTION ANTERIEURE 28 SPECIAL AUTHORITY 24 NUMBER-NUMERO 25 LINE-LIGNE AUTORISATION SPECIALE DECLARE THE PARTICULARS OF THIS DOCUMENT TO BE TRUE, OSE AND COMPLETE Canada Border 1 PORTER NAME AND ADDRESS INO-N" NOM ET ADRESSE DE L'IMPORTATEUR 10 SUR 11 VENDOR NAME - NOM DU VENDEUR NO. - N HORNO N" DE SOUS EN-TTE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO 28 TARIFF CODE 20 QUANTITY N' DE CLASSEMENT TARIFAIRE QUANTIT 37 VALUE FOR DUTY 38 CUSTOMS DUTIES VALEUR EN DOUANE DROITS DE DOUANE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO 28 TARIFF CODE 29 QUANTITY N" DE CLASSEMENT TARIFARE QUANTIT 37 VALUE FOR DUTY 38 CUSTOMS DUTES VALEUR EN DOUANE DROITS DE DOUANE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO. 28 TARIFF CODE 29 QUANTITY N" DE CLASSEMENT TARIFAIRE QUANTIT 37 VALUE FOR DUTY CUSTOMS DUTIES VALEUR EN DOUANE DROITS DE DOUANE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO. TARIFF CODE 29 QUANTITY N DE CLASSEMENT TARIFARE 37 VALUE FOR DUTY 38 CUSTOMS DUTIES VALEUR EN DOUANE DROITS DE DOUANE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO. TARIFF CODE 29 QUANTITY N DE CLASSEMENT TARFARE QUANTIT 37 VALUE FOR DUTY 38 CUSTOMS DUTIES VALEUR EN DOUANE DROITS DE DOUANE DECLARATION - DECLARATION JE PLEASE PRINT NAME - LETTRES MOULES SV.P. OF DE IMPORTER / AGENT - IMPORTATEURI AGENT l U - M. 31 VFD COSIMA CODE CODE VD ODE DE LES 23 RATE OF CUSTOMS DUTY TALIX DE DROIT DE BOLAN 34 ET RATE TALIK TA 33 RATE OF GST VALUE FOR CURRENCY CONVERSION TAUX DE TPS CONVERSION VALEUR POUR CHANGE 39 SIMA ASSESSMENT COTISATION DE LMSI 40 EXCISE TAX TAXE D'ACCISE 41 VALUE FOR TAX VALEUR POUR TAXE 42 OST TPS 23 WEIGHT KGM POIDS / KGM PREVIOUS TRANSACTION - TRANSACTION ANTRIEURE 26 SPECIAL AUTHORITY L 24 NUMBER - NUMERO 125 LINE-LINE AUTORISATION SPECIALE lau U - M 31 VFD COCESIMA COBEATE OF CUSTOMS DUTY COCEVD CODE DE LAS TALIX DE CROIT DE DOLAN 34 E.T. RATE TAUX TA 35 RATE OF GST 36 VALUE FOR CURRENCY CONVERSION TAUSC DE TPS CONVERSION VALEUR POUR CHANGE LE TIDE 39 SIMA ASSESSMENT COTISATION DE LMSI 40 EXCISE TAX TAXE D'ACCISE 41 VALUE FOR TAX VALEUR POUR TAXE 42 GST TPS 23 WEIGHT (KGM POIDS / KOM PREVIOUS TRANSACTION-TRANSACTION ANTRIEURE 24 NUMBER. NUMERO 25LINE-LINE 28 SPECIAL AUTHORITY AUTORISATION SPECIALE | 0 U - M 31 VFD CODE 22 SMACERATE OF CUSTOMS DUTY CODE VD CODE DE LMS TAUX DE CROIT DE DOLANC 34 ET RATE TAUX TA 35 RATE OF GST 36 VALUE FOR CURRENCY CONVERSION TALDE DE TIPS CONVERSION VALEUR POUR CHANGE 39 SIMA ASSESSMENT COTISATION DE LMS 40 EXCISE TAX TAXE D'ACCISE 41 VALUE FOR TAX VALEUR POUR TAXE 42 GST TPS 23 WEIGHT KGM POIDS / KGM PREVIOUS TRANSACTION-TRANSACTION ANTERIEURE 25 SPECIAL AUTHORITY 24 NUMBER. NUMERO 25L NE-LION AUTORISATION SPECIALE 0 U - M | 31 VFD CODE 22 MACOCERUTE OF CUSTOMS DUTY 34 E.T. RATE CODE VD GODE DE LMS TALIX DE DROIT DE DOUANE TAUX TA 35 RATE OF GST 36 VALUE FOR CURRENCY CONVERSION TALDE DE TPS CONVERSION VALEUR POUR CHANGE 39 SIMA ASSESSMENT COTISATION DE LMSI 40 EXCISE TAK TASE D'ACCISE 141 VALUE FOR TAX VALEUR POUR TAXE 42 GST TPS 43 DEPOSIT - DEPOT 44 WAREHOUSE NON D'ENTREPT 47 CUSTOMS DUTIES DROITS DE DOLANE 48 SIMA ASSESSMENT COTISATION DE LMS 49 EXCISE TAX TAXE D'ACCISE DECLARE QUE LES RENSEIGNEMENTS CI-DESSUS SONT VRAIS ET COMPLETS 45 CARGO CONTROL NO.-N" DE CONTROLE DU FRET 50 GST TPS 51 46 CARRIER CODE AT IMPORTATION CODE DE TRANSPORTEUR A L'IMPORTATION DATE SIMATURE TOTAL B3-3 (04) Canada und d Havenue Agency et du revenu du Can XYZ CO INC. 125 QUEENS AVE.E- NEW YORK, NY 1001 CANADA CUSTOMS INVOICE *2. Date of direct shipment to Canada - Date d'expdition directe vers le Canada May 1st 2020 - Exchange rate: 1.3912 3. Other references (include purchaser's order Now Autres rfrences (Inclure le n de commande de l'acheteur) USA 4. Consignee (name and address) - Destinataire (nom et adresse) ABC CO, INC.- 1750 FINCH AVE.E TORONTO, ONTARIO- CANADA M2J2X5- BN: 987654321RM00012 XYZ CO INC. (Non Resident Importer) 125 QUEENS AVE.E- NEW YORK NY 1001 USA BN:897654123RM0001 2 *7. Country of origin of goods USA IF SHIPMENT INCLUDES GOODS OF DIFFERENT ORIGINS ENTER ORIGINS AGAINST ITEMS IN 12 a. Transportation: Give made and place of direct shipment to Canada Transport: Prcisez mode et point d'expdition directe vers le Canada By Truck: 806887654321 Place: New York, USA 9. Conditions of sale and terms of payment fi.e. sale, consignment shipment, leased goods, etc.) Conditions de vente et modalits de C.I.F, Net 30 days *10. Currency of setlement - Devises du paiement United Sates Dollars (USD) *13. Quantity Selling Price - Prix de vere (state unit) Unit price 15. Tatal Quantit Prix unitaire (prcisez l'unit 11. Number of packages Nombre de colis * 12. Specification of comedies (kind of packages, marks and numbers, general description and characteristics, Le grade, quality Designation des articles (nature des colis, marques et numro description gnrale et caractristiques, p.ex. classe, qualit 10012201.90.00.00 Flavored Mineral Water 3000/LTRI 1.25 3750.00 500 6103.10.90.00 Men's or Boy's Jacket 500/NMB 75.95 37975.00 20016402.20.11.00 Sandals solely of rubber 200/PAR 19.95 3990.00 t 109506.59.904 00 Equipment for physical exercise 2959.50 10/NMB 295.95 C Using information from CCI complete the B3 Look up HS#, DUTY RATE, U/M from CTS- Customs Office: 410 - Date of release: May 2nd, 2020.- No certificate of Origin is provided for any of the items Parties are related: US port of exit 0901. B3# 10579-123456789 . . . 18. If any of fields 1 to 17 are included on an attached commercial invoice, check this box 17. Invoice total 16. Total weight - Poids total Si tout renseignement relativement aux zones 1 A 17 figure sur une ou des factures Net Gross - Brut Tatal de la facture Commercial Invoice No. -N' de la facture commerciale 55000 5550 kgmse 48674.50 *19. Exporter's name and address (if other than vendor 20. Originator (name and address). Expditeur d'origine (nom et adresse) Nom et adresse de l'exportateur (s'il differe du vendeur) Seneca College of Applied Arts! 1750 Finch Ave. E, Toronto.e 21. Departmental Ruling (if applicable) - Dcision du Ministre (s? y a lieu) 22. If fields 23 to 25 are not applicable, check this bar le Si les zones 23 a 25 sont sans objet, cocher cette case 23. If included in field 17 indicate amount 24. If not included in field 17 indicate amount 25. Check it applicable Si compris dans le total a la zone 17. prcisez : Si non compris dans le total la zone 17, prcisez Cocher (s'il y a lieu) (i) Transportation charges, expenses and insurance (i) Transportation charges, expenses and insurance (i) Royalty payments or subsequent proceeds from the place of direct shipment to Canada to the place of direct shipment to Canada are paid ar payable by the purchaser Les frais de transport, dpenses et assurances Les frais de transport, dpenses et assurances Des redevances ou produits ont t au seront partir du point d'expdition directe vers le Canada jusqu'au point d'expdition directe vers le Canada verses par l'acheteur US$ 1150.00 (deduct) (ii) Costs for construction, erection and assembly (ii) Amounts for commissions other than buying incurred after importation into Canada commissions Les couts de construction, d'rection et Les commissions autres que celles verses (i) The purchaser has supplied goods or services d'assernblage aprs importation au Canada pour l'achat for use in the production of these goods L'acheteur a fourni des marchandises ou des services pour la production de ces marchandises (in) Export packing (in) Export packing Le cot de l'emballage d'exportation Le cot de l'emballage d'exportation US$16.00 (ignore) US $200.00 (add) IT Services Agency frontaliers du Canada CANADA CUSTOMS CODING FORM DOUANES CANADA - FORMULE DE CODAGE PROTECTED B (WHEN COMPLETED) PROTEGE B (UNE FOIS REMPLI) 2. TRANSACTION NO.-N' DE TRANSACTION Help Aide Restore - Restaurer 5 GST REGISTRATION NO. N" DE TPS TMODE 3 TYPE 4 OFFICE NO N'DE BUREAU 9 TOTAL VFD - TOTAL DE LA VD 5 PAYMENT CODE CODE PORT OF UNLADNG OF DE 12 COUNTRY OF ORON PAYS DORIGINE 13 PLACE OF EXPORT LIEU DE PORTATION 14 TARIFF TREATMENT TRAITEMENT TARIFARE 15 US.PORT OF EXIT BUREAU DE SORTIE DESEU RESERVED FOR CEEA UBE 18 TIME LIMIT-DLAI 19 FREIGHT - FRET 16 DIRECT SHIPMENT DATE DATE D'EXPEDITION DIRECTE M DIJ 17 CACY. CODE DEVISE RESERVE LUBASE DE 20 RELEASE DATE - DATE DE LA MAINLEVEE | 23 WEIGHT / KGM POIDS/KGM PREVIOUS TRANSACTION - TRANSACTION ANTERIEURE 26 SPECIAL AUTHORITY 24 NUMBER-NUMERO 25 LINE-LIGNE AUTORISATION SPECIALE a0 S - M 31 VFD CODESIMA GODE 23 RATE OF CUSTOMS DUTY CODE VD CODE DE LMS TALIX DE DROIT DE DOUANE 34 ET RATE TAUXTA 35 RATE OF GST 36 VALUE FOR CURRENCY CONVERSION TALDE DE TIPS CONVERSION VALEUR POUR CHANGE 29 SIMA ASSESSMENT COTISATION DE LMS 40 EXCISE TAX TAXE D'ACCISE 41 VALUE FOR TAX VALEUR POUR TAXE 42 GST TPS 23 WEIGHT / KGM POIDS / GM PREVIOUS TRANSACTION - TRANSACTION ANTERIEURE 28 SPECIAL AUTHORITY 24 NUMBER-NUMERO 25 LINE-LIGNE AUTORISATION SPECIALE DECLARE THE PARTICULARS OF THIS DOCUMENT TO BE TRUE, OSE AND COMPLETE Canada Border 1 PORTER NAME AND ADDRESS INO-N" NOM ET ADRESSE DE L'IMPORTATEUR 10 SUR 11 VENDOR NAME - NOM DU VENDEUR NO. - N HORNO N" DE SOUS EN-TTE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO 28 TARIFF CODE 20 QUANTITY N' DE CLASSEMENT TARIFAIRE QUANTIT 37 VALUE FOR DUTY 38 CUSTOMS DUTIES VALEUR EN DOUANE DROITS DE DOUANE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO 28 TARIFF CODE 29 QUANTITY N" DE CLASSEMENT TARIFARE QUANTIT 37 VALUE FOR DUTY 38 CUSTOMS DUTES VALEUR EN DOUANE DROITS DE DOUANE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO. 28 TARIFF CODE 29 QUANTITY N" DE CLASSEMENT TARIFAIRE QUANTIT 37 VALUE FOR DUTY CUSTOMS DUTIES VALEUR EN DOUANE DROITS DE DOUANE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO. TARIFF CODE 29 QUANTITY N DE CLASSEMENT TARIFARE 37 VALUE FOR DUTY 38 CUSTOMS DUTIES VALEUR EN DOUANE DROITS DE DOUANE 21 LINE 22 DESCRIPTION LIGNE DESIGNATION 27 CLASSIFICATION NO. TARIFF CODE 29 QUANTITY N DE CLASSEMENT TARFARE QUANTIT 37 VALUE FOR DUTY 38 CUSTOMS DUTIES VALEUR EN DOUANE DROITS DE DOUANE DECLARATION - DECLARATION JE PLEASE PRINT NAME - LETTRES MOULES SV.P. OF DE IMPORTER / AGENT - IMPORTATEURI AGENT l U - M. 31 VFD COSIMA CODE CODE VD ODE DE LES 23 RATE OF CUSTOMS DUTY TALIX DE DROIT DE BOLAN 34 ET RATE TALIK TA 33 RATE OF GST VALUE FOR CURRENCY CONVERSION TAUX DE TPS CONVERSION VALEUR POUR CHANGE 39 SIMA ASSESSMENT COTISATION DE LMSI 40 EXCISE TAX TAXE D'ACCISE 41 VALUE FOR TAX VALEUR POUR TAXE 42 OST TPS 23 WEIGHT KGM POIDS / KGM PREVIOUS TRANSACTION - TRANSACTION ANTRIEURE 26 SPECIAL AUTHORITY L 24 NUMBER - NUMERO 125 LINE-LINE AUTORISATION SPECIALE lau U - M 31 VFD COCESIMA COBEATE OF CUSTOMS DUTY COCEVD CODE DE LAS TALIX DE CROIT DE DOLAN 34 E.T. RATE TAUX TA 35 RATE OF GST 36 VALUE FOR CURRENCY CONVERSION TAUSC DE TPS CONVERSION VALEUR POUR CHANGE LE TIDE 39 SIMA ASSESSMENT COTISATION DE LMSI 40 EXCISE TAX TAXE D'ACCISE 41 VALUE FOR TAX VALEUR POUR TAXE 42 GST TPS 23 WEIGHT (KGM POIDS / KOM PREVIOUS TRANSACTION-TRANSACTION ANTRIEURE 24 NUMBER. NUMERO 25LINE-LINE 28 SPECIAL AUTHORITY AUTORISATION SPECIALE | 0 U - M 31 VFD CODE 22 SMACERATE OF CUSTOMS DUTY CODE VD CODE DE LMS TAUX DE CROIT DE DOLANC 34 ET RATE TAUX TA 35 RATE OF GST 36 VALUE FOR CURRENCY CONVERSION TALDE DE TIPS CONVERSION VALEUR POUR CHANGE 39 SIMA ASSESSMENT COTISATION DE LMS 40 EXCISE TAX TAXE D'ACCISE 41 VALUE FOR TAX VALEUR POUR TAXE 42 GST TPS 23 WEIGHT KGM POIDS / KGM PREVIOUS TRANSACTION-TRANSACTION ANTERIEURE 25 SPECIAL AUTHORITY 24 NUMBER. NUMERO 25L NE-LION AUTORISATION SPECIALE 0 U - M | 31 VFD CODE 22 MACOCERUTE OF CUSTOMS DUTY 34 E.T. RATE CODE VD GODE DE LMS TALIX DE DROIT DE DOUANE TAUX TA 35 RATE OF GST 36 VALUE FOR CURRENCY CONVERSION TALDE DE TPS CONVERSION VALEUR POUR CHANGE 39 SIMA ASSESSMENT COTISATION DE LMSI 40 EXCISE TAK TASE D'ACCISE 141 VALUE FOR TAX VALEUR POUR TAXE 42 GST TPS 43 DEPOSIT - DEPOT 44 WAREHOUSE NON D'ENTREPT 47 CUSTOMS DUTIES DROITS DE DOLANE 48 SIMA ASSESSMENT COTISATION DE LMS 49 EXCISE TAX TAXE D'ACCISE DECLARE QUE LES RENSEIGNEMENTS CI-DESSUS SONT VRAIS ET COMPLETS 45 CARGO CONTROL NO.-N" DE CONTROLE DU FRET 50 GST TPS 51 46 CARRIER CODE AT IMPORTATION CODE DE TRANSPORTEUR A L'IMPORTATION DATE SIMATURE TOTAL B3-3 (04) Canada