Question: 1. Using the net present value? method, calculate the comparative cost of each of the three payment plans being considered by New Med 2. Which

1.Using the net present value? method, calculate the comparative cost of each of the three payment plans being considered by New Med

2.Which payment plan should New Med choose? Explain.

3.Discuss the financial? factors, other than the cost of the? plan, and the nonfinancial factors that should be considered in selecting an appropriate payment plan.

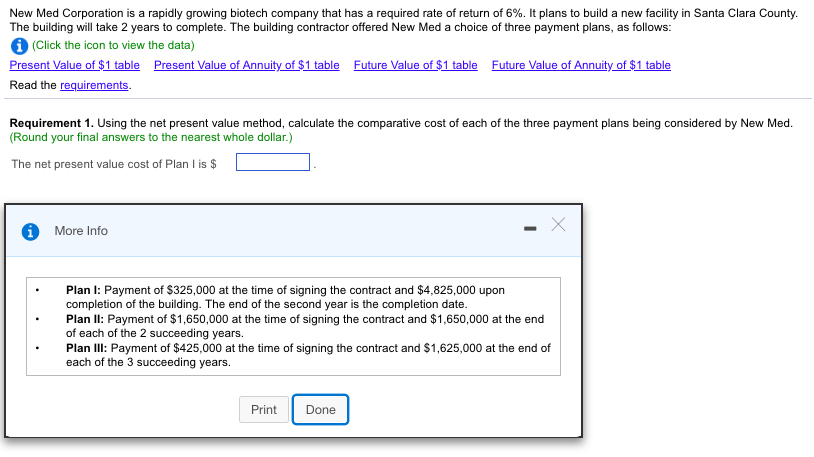

New Med Corporation is a rapidly growing biotech company that has a required rate of return of 6%. It plans to build a new facility in Santa Clara County. The building will take 2 years to complete. The building contractor offered New Med a choice of three payment plans, as follows: (Click the icon to view the data) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. Requirement 1. Using the net present value method, calculate the comparative cost of each of the three payment plans being considered by New Med. (Round your final answers to the nearest whole dollar.) The net present value cost of Plan I is $ More Info Plan I: Payment of $325,000 at the time of signing the contract and $4,825,000 upon completion of the building. The end of the second year is the completion date. Plan II: Payment of $1,650,000 at the time of signing the contract and $1,650,000 at the end of each of the 2 succeeding years. Plan III: Payment of $425,000 at the time of signing the contract and $1,625,000 at the end of each of the 3 succeeding years. Print Done

Step by Step Solution

There are 3 Steps involved in it

Requirement 1 Plan 1 It is given that an amount of 325000 is paid immediately on signing the contrac... View full answer

Get step-by-step solutions from verified subject matter experts