Question: 1. value: 2.00 points Exercise 15-2 Operating lease; advance payment; leasehold improvement [LO15-4] On January 1, 2016, Winn Heat Transfer leased office space under a

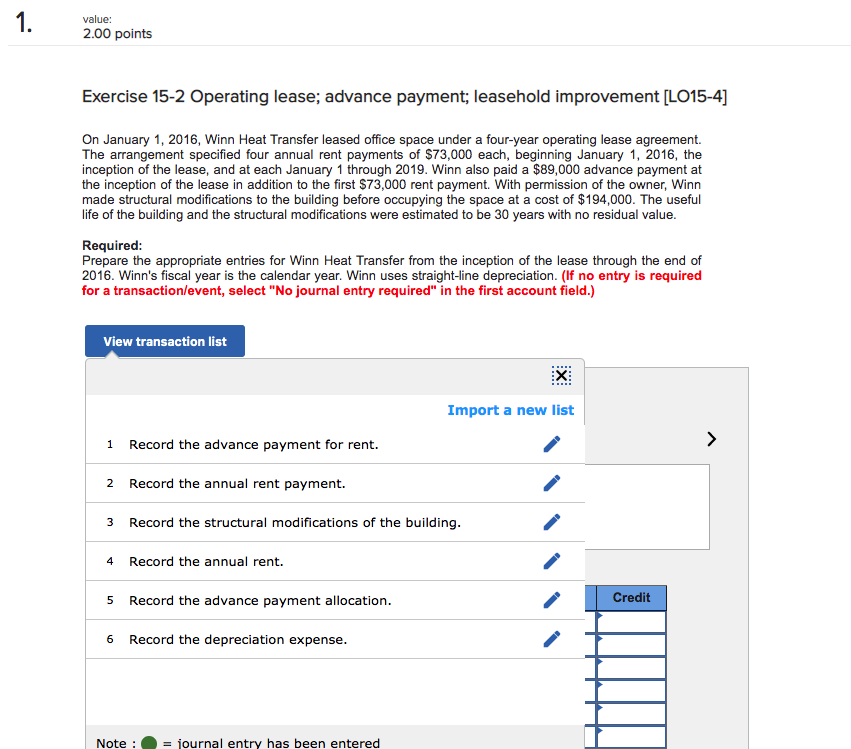

1. value: 2.00 points Exercise 15-2 Operating lease; advance payment; leasehold improvement [LO15-4] On January 1, 2016, Winn Heat Transfer leased office space under a four-year operating lease agreement. The arrangement specified four annual rent payments of $73,000 each, beginning January 1, 2016, the inception of the lease, and at each January 1 through 2019. Winn also paid a $89,000 advance payment at the inception of the lease in addition to the first $73,000 rent payment. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $194,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Required: Prepare the appropriate entries for Winn Heat Transfer from the inception of the lease through the end of 2016. Winn's fiscal year is the calendar year. Winn uses straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Import a new list Record the advance payment for rent 1 Record the annual rent payment 2 Record the structural modifications of the building. 3 4 Record the annual rent. Credit Record the advance payment allocation. 5 Record the depreciation expense 6 journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts