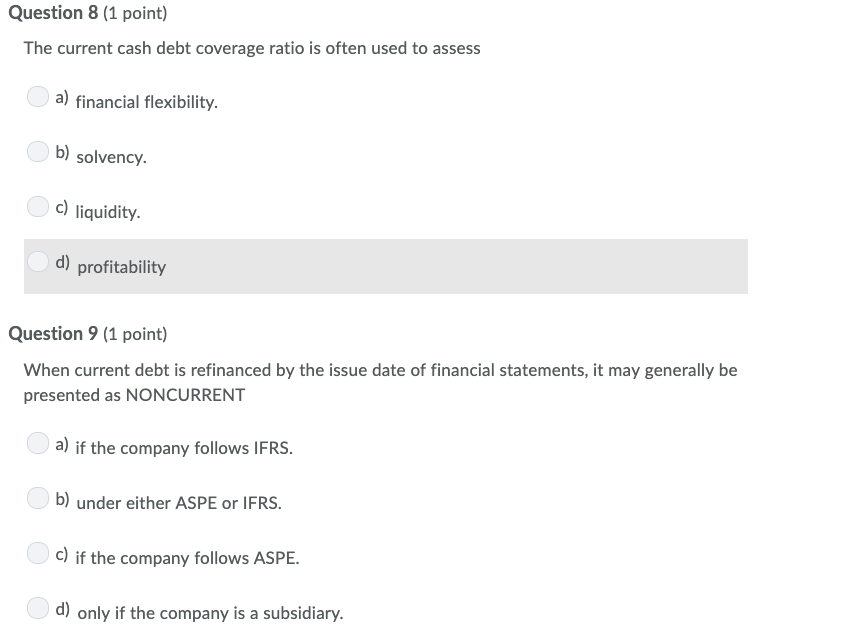

Question: Question 8 (1 point) The current cash debt coverage ratio is often used to assess a) financial flexibility b) solvency. c) liquidity d) profitability Question

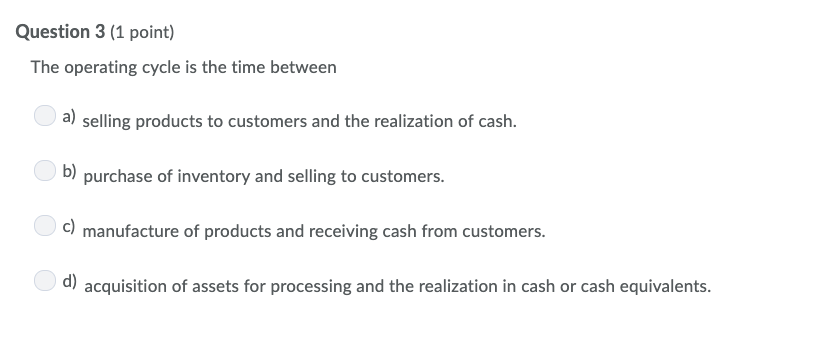

Question 8 (1 point) The current cash debt coverage ratio is often used to assess a) financial flexibility b) solvency. c) liquidity d) profitability Question 9 (1 point) When current debt is refinanced by the issue date of financial statements, it may generally be presented as NONCURRENT a) if the company follows IFRS. b) under either ASPE or IFRS. c) if the company follows ASPE. d) only if the company is a subsidiary Question 3 (1 point) The operating cycle is the time between a) selling products to customers and the realization of cash. b) purchase of inventory and selling to customers. c) manufacture of products and receiving cash from customers. d) acquisition of assets for processing and the realization in cash or cash equivalents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts