Question: 1. value: 30.00 points A company decides to borrow $ 100 000 at j1 = 12% in order to finance a new equipment purchase. One

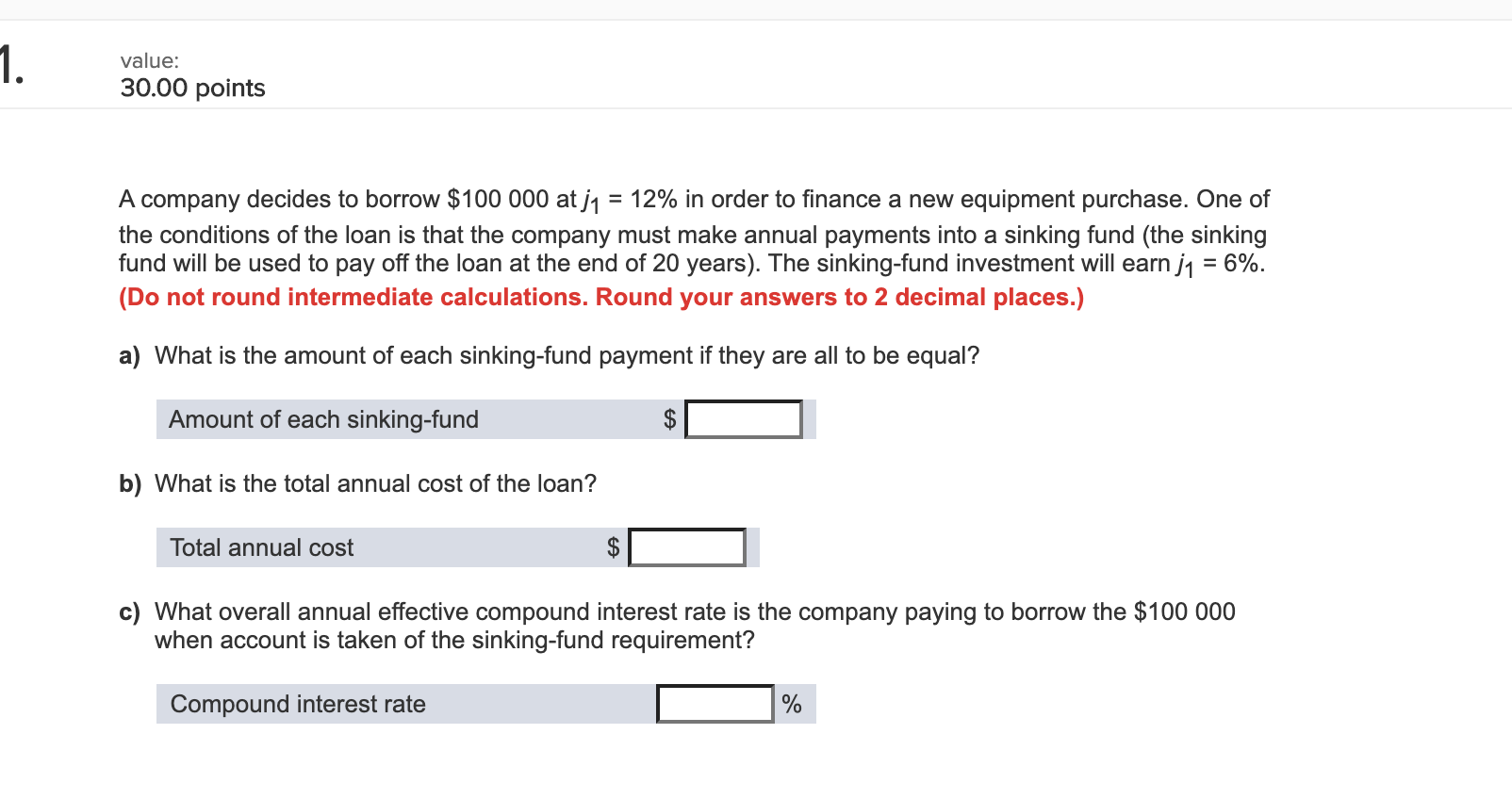

1. value: 30.00 points A company decides to borrow $ 100 000 at j1 = 12% in order to finance a new equipment purchase. One of the conditions of the loan is that the company must make annual payments into a sinking fund (the sinking fund will be used to pay off the loan at the end of 20 years). The sinking-fund investment will earn j1 = 6%. (Do not round intermediate calculations. Round your answers to 2 decimal places.) a) What is the amount of each sinking-fund payment if they are all to be equal? Amount of each sinking-fund $ b) What is the total annual cost of the loan? Total annual cost $ c) What overall annual effective compound interest rate is the company paying to borrow the $100 000 when account is taken of the sinking-fund requirement? Compound interest rate %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts