Question: 1. VaR and ES. (40 marks) Consider two defaultable bonds X and Y where at most one of them can default. The face value of

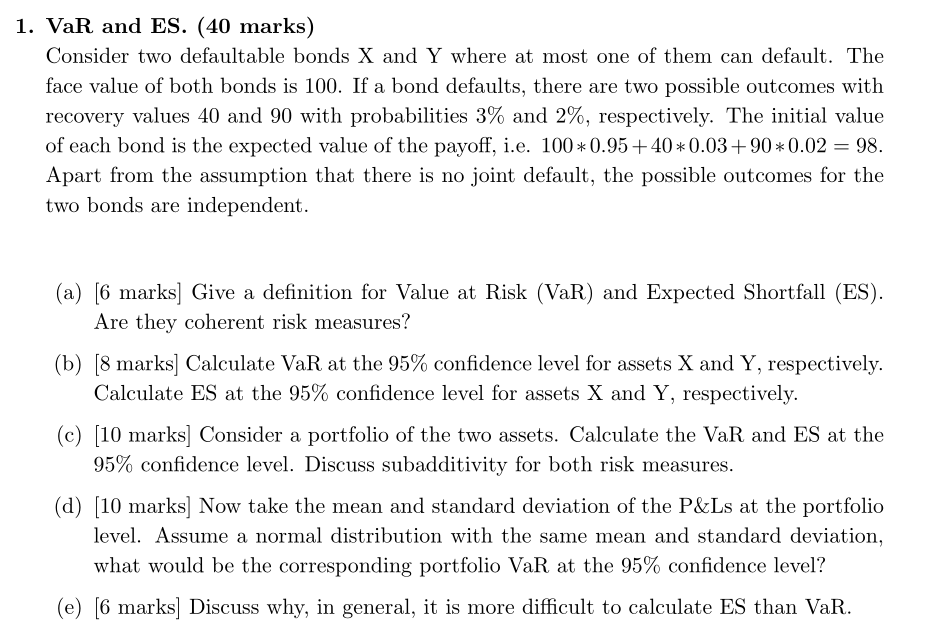

1. VaR and ES. (40 marks) Consider two defaultable bonds X and Y where at most one of them can default. The face value of both bonds is 100. If a bond defaults, there are two possible outcomes with recovery values 40 and 90 with probabilities 3% and 2%, respectively. The initial value of each bond is the expected value of the payoff, i.e. 100*0.95 +40*0.03+90*0.02 = 98. Apart from the assumption that there is no joint default, the possible outcomes for the two bonds are independent. (a) [6 marks] Give a definition for Value at Risk (VaR) and Expected Shortfall (ES). Are they coherent risk measures? (b) [8 marks] Calculate VaR at the 95% confidence level for assets X and Y, respectively. Calculate ES at the 95% confidence level for assets X and Y, respectively. (c) [10 marks] Consider a portfolio of the two assets. Calculate the VaR and ES at the 95% confidence level. Discuss subadditivity for both risk measures. (d) (10 marks] Now take the mean and standard deviation of the P&Ls at the portfolio level. Assume a normal distribution with the same mean and standard deviation, what would be the corresponding portfolio VaR at the 95% confidence level? (e) [6 marks] Discuss why, in general, it is more difficult to calculate ES than VaR. 1. VaR and ES. (40 marks) Consider two defaultable bonds X and Y where at most one of them can default. The face value of both bonds is 100. If a bond defaults, there are two possible outcomes with recovery values 40 and 90 with probabilities 3% and 2%, respectively. The initial value of each bond is the expected value of the payoff, i.e. 100*0.95 +40*0.03+90*0.02 = 98. Apart from the assumption that there is no joint default, the possible outcomes for the two bonds are independent. (a) [6 marks] Give a definition for Value at Risk (VaR) and Expected Shortfall (ES). Are they coherent risk measures? (b) [8 marks] Calculate VaR at the 95% confidence level for assets X and Y, respectively. Calculate ES at the 95% confidence level for assets X and Y, respectively. (c) [10 marks] Consider a portfolio of the two assets. Calculate the VaR and ES at the 95% confidence level. Discuss subadditivity for both risk measures. (d) (10 marks] Now take the mean and standard deviation of the P&Ls at the portfolio level. Assume a normal distribution with the same mean and standard deviation, what would be the corresponding portfolio VaR at the 95% confidence level? (e) [6 marks] Discuss why, in general, it is more difficult to calculate ES than VaR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts