Question: 4. Consider two different bonds X and Y where we expect at most one of them to default. The face value of both bonds is

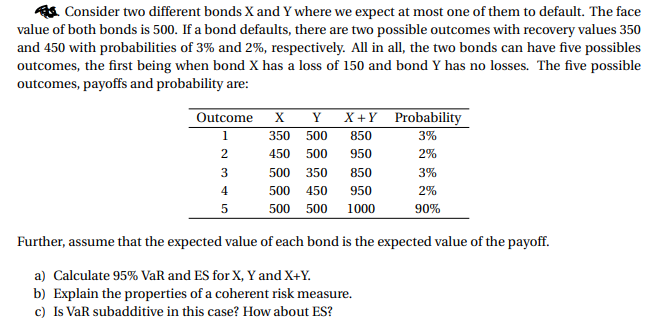

4. Consider two different bonds X and Y where we expect at most one of them to default. The face value of both bonds is 500. If a bond defaults, there are two possible outcomes with recovery values 350 and 450 with probabilities of 3% and 2%, respectively. All in all, the two bonds can have five possibles outcomes, the first being when bond X has a loss of 150 and bond Y has no losses. The five possible outcomes, payoffs and probability are: Outcome X Y 350 500 450 500 500 350 500 450 500 500 WN X+Y 850 950 850 950 1000 Probability 3% 2% 3% 2% 90% Further, assume that the expected value of each bond is the expected value of the payoff. a) Calculate 95% VaR and ES for X, Y and X+Y. b) Explain the properties of a coherent risk measure. c) Is VaR subadditive in this case? How about ES? 4. Consider two different bonds X and Y where we expect at most one of them to default. The face value of both bonds is 500. If a bond defaults, there are two possible outcomes with recovery values 350 and 450 with probabilities of 3% and 2%, respectively. All in all, the two bonds can have five possibles outcomes, the first being when bond X has a loss of 150 and bond Y has no losses. The five possible outcomes, payoffs and probability are: Outcome X Y 350 500 450 500 500 350 500 450 500 500 WN X+Y 850 950 850 950 1000 Probability 3% 2% 3% 2% 90% Further, assume that the expected value of each bond is the expected value of the payoff. a) Calculate 95% VaR and ES for X, Y and X+Y. b) Explain the properties of a coherent risk measure. c) Is VaR subadditive in this case? How about ES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts