Question: 1. We tend to place a greater value on avoiding losses (over potential equivalent gains), due to the associated negative emotional impact. The priority of

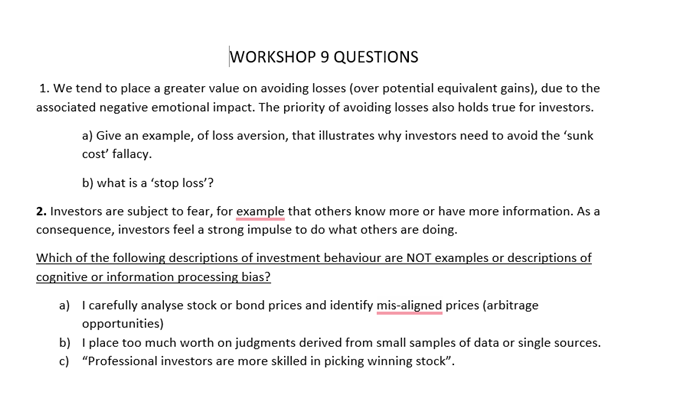

1. We tend to place a greater value on avoiding losses (over potential equivalent gains), due to the associated negative emotional impact. The priority of avoiding losses also holds true for investors. a) Give an example, of loss aversion, that illustrates why investors need to avoid the 'sunk cost' fallacy. b) what is a 'stop loss'? 2. Investors are subject to fear, for example that others know more or have more information. As a consequence, investors feel a strong impulse to do what others are doing. Which of the following descriptions of investment behaviour are NOT examples or descriptions of cognitive or information processing bias? a) I carefully analyse stock or bond prices and identify mis-aligned prices (arbitrage opportunities) b) I place too much worth on judgments derived from small samples of data or single sources. c) "Professional investors are more skilled in picking winning stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts