Question: 1) What did Intel expense for share-based compensation for 2008? How many options did Intel grant in 2008? 2) Compute the fair value of all

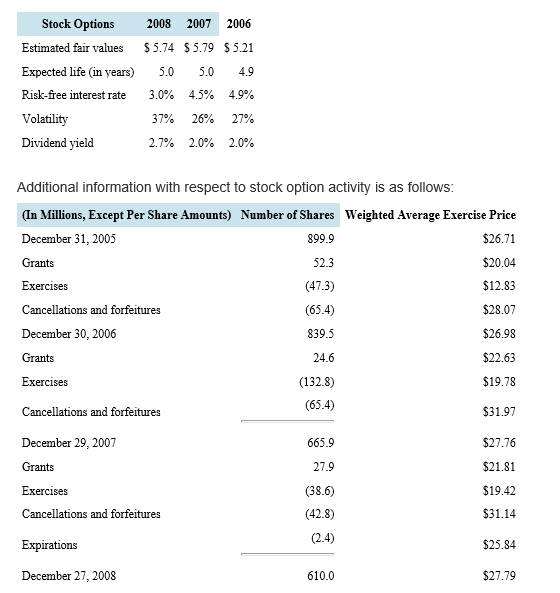

1) What did Intel expense for share-based compensation for 2008? How many options did Intel grant in 2008?

2) Compute the fair value of all options granted during 2008. (Round your answer to one decimal place.)

3) Estimate the cash that Intel received from its employees when these options were exercised?

If employees who exercised options in 2008 immediately sold them, what "profit" did they make from the shares?

4) The tax benefit that Intel will receive on the options exercised is computed based on the intrinsic value of the options exercised. Estimate Intel's tax benefit from the 2008 option exercises assuming a tax rate of 34.7%. (Round your answer to one decimal place.)

5) What was the intrinsic value per share of the options exercised in 2008? (Hint: Assume that Intel grants options at-the-money.)

What was the average exercise price of the options that expired in 2008?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts