Question: 1- What effect will diversifying your portfolio have on your returns and your level of risk? 2- What is a beta? How is it used

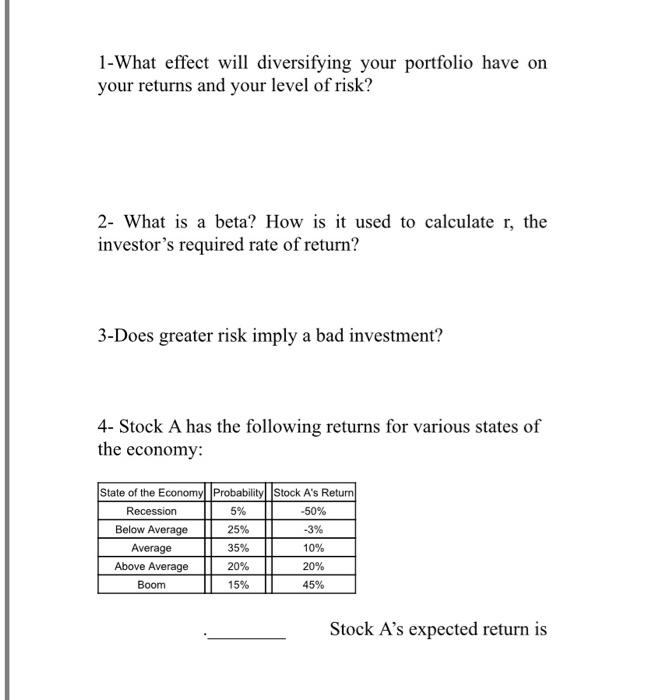

1- What effect will diversifying your portfolio have on your returns and your level of risk? 2- What is a beta? How is it used to calculate r, the investor's required rate of return? 3-Does greater risk imply a bad investment? 4- Stock A has the following returns for various states of the economy: State of the Economy Probability Stock A's Return Recession 5% -50% Below Average 25% -3% Average 35% 10% Above Average 20% 20% Boom 15% 45% Stock A's expected return is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts