Question: 1. What impact does the repurchase plan have on M&Ms weighted-average cost of capital? Complete the table below (No Corporate Taxes) Income Statement Debt =

1. What impact does the repurchase plan have on M&Ms weighted-average cost of capital? Complete the table below (No Corporate Taxes)

| Income Statement | Debt = 0 | Debt = 500 | ||

| Revenue | 1500 | 1500 | ||

| Operating expenses | 1375 | 1375 | ||

| Operating profit | 125 | 125 | ||

| Interest payments | 0 | |||

| Taxes | 0 | 0 | ||

| Net profit | 125 |

| ||

|

| ||||

| Dividends | 125 |

| ||

| Shares outstanding | 62.5 |

| ||

| Dividends per share | 2.00 |

| ||

| Cost of Capital | ||||

| Cost of debt | 4.00% | 4.00% | ||

| Beta | 0.800 | Levered Beta | ||

| Cost of equity | CAPM |

| ||

| WACC | = D / V * Kd (1 - t) + (1 - D/V) * Ke

|

| ||

| Cash flows | ||||

| Debt holders | = Interest payments |

| ||

| Equity holders | = Dividend payments |

| ||

| Free cash flow | = Op profit |

| ||

| Value | ||||

| Debt | = Int payments / Kd |

| ||

| Equity | = Div payments / Ke |

| ||

| Total | = Sum or FCF / WACC |

| ||

| Share price 1 | = Equity / Shares outstanding |

| ||

| Share price 2 | = DPS / Ke |

| ||

| Value of Firm | = Value of unlevered + Tax shield |

| ||

| D/E | = D / (V - D) |

| ||

| D/V | = D / V |

| ||

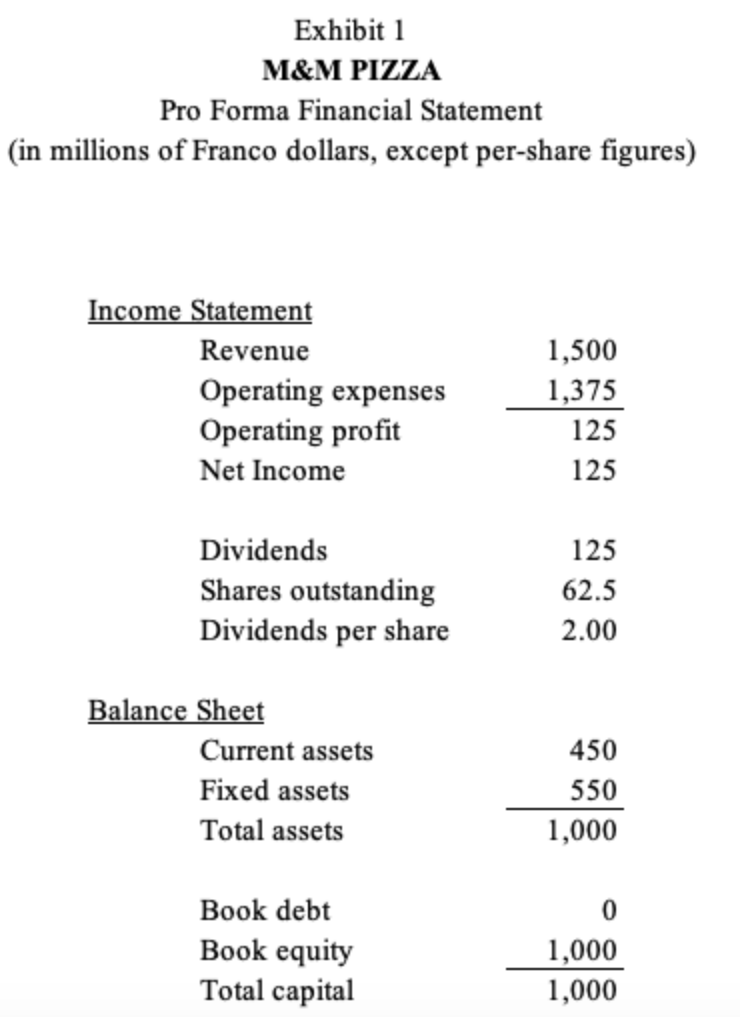

Information about M&M pizza - Despite generating strong and steady profitability of about $125 million per year over recent memory, M&M Pizzas stock price had been flat for years, at about $25 per share. M&M pizza manager Moe Millers proposed recapitalization involved raising $500 million in cash by issuing new debt at the prevailing 4% borrowing rate and using the cash to repurchase company shares. Miller was confident that shareholders would be better off. Not only would they receive $500 million in cash, but Miller expected that the share price would rise. M&M maintained a dividend policy 2 of returning all company profits to equity holders in the form of dividends. Although total dividends would decline under the new plan, Miller anticipated that the reduction in the number of shares would allow for a net increase in the dividends paid per remaining share outstanding. Based on a rudimentary knowledge of corporate finance, Miller estimated the current cost of equity (and WACC) for M&M with the current no-debt policy at 8% based on a market risk premium of 5% and a company beta of 0.8. Miller appreciated that, because equity holders bore the business risk, they deserved to receive a higher return. Nonetheless, from a simple comparison of the 8% cost of equity with the 4% cost of debt, equity appeared to be an expensive source of funds. To Miller, substituting debt for equity was a superior financial policy because it gave the company cheaper capital. Short and long-term interest rates for government and business debt were steady at 4%. No corporate tax.

Exhibit1 M&M PIZZA Pro Forma Financial Statement (in millions of Franco dollars, except per-share figures) Income Statement 1,500 1,375 125 125 Revenue Operating expenses Operating profit Net Income 125 62.5 2.00 Dividends Shares outstanding Dividends per share Balance Sheet 450 550 1,000 Current assets Fixed assets Total assets Book debt Book equity Total capital 0 1,000 1,000 Exhibit1 M&M PIZZA Pro Forma Financial Statement (in millions of Franco dollars, except per-share figures) Income Statement 1,500 1,375 125 125 Revenue Operating expenses Operating profit Net Income 125 62.5 2.00 Dividends Shares outstanding Dividends per share Balance Sheet 450 550 1,000 Current assets Fixed assets Total assets Book debt Book equity Total capital 0 1,000 1,000

Step by Step Solution

There are 3 Steps involved in it

To assess the impact of the repurchase plan on MMs weightedaverage cost of capital WACC lets proceed ... View full answer

Get step-by-step solutions from verified subject matter experts