Question: What impact does the repurchase plan have on M&Ms weighted-average cost of capital? Complete the table below (No Corporate Taxes) Income Statement Debt = 0

- What impact does the repurchase plan have on M&Ms weighted-average cost of capital? Complete the table below (No Corporate Taxes)

| Income Statement | Debt = 0 | Debt = 500 | ||

| Revenue | 1500 | 1500 | ||

| Operating expenses | 1375 | 1375 | ||

| Operating profit | 125 | 125 | ||

| Interest payments | 0 | |||

| Taxes | 0 | 0 | ||

| Net profit | 125 |

| ||

|

| ||||

| Dividends | 125 |

| ||

| Shares outstanding | 62.5 |

| ||

| Dividends per share | 2.00 |

| ||

| Cost of Capital | ||||

| Cost of debt | 4.00% | 4.00% | ||

| Beta | 0.800 | Levered Beta | ||

| Cost of equity | CAPM |

| ||

| WACC | = D / V * Kd (1 - t) + (1 - D/V) * Ke

|

| ||

| Cash flows | ||||

| Debt holders | = Interest payments |

| ||

| Equity holders | = Dividend payments |

| ||

| Free cash flow | = Op profit |

| ||

| Value | ||||

| Debt | = Int payments / Kd |

| ||

| Equity | = Div payments / Ke |

| ||

| Total | = Sum or FCF / WACC |

| ||

| Share price 1 | = Equity / Shares outstanding |

| ||

| Share price 2 | = DPS / Ke |

| ||

| Value of Firm | = Value of unlevered + Tax shield |

| ||

| D/E | = D / (V - D) |

| ||

| D/V | = D / V |

| ||

3) Complete the same table as in question 2 with a tax rate of 20%.

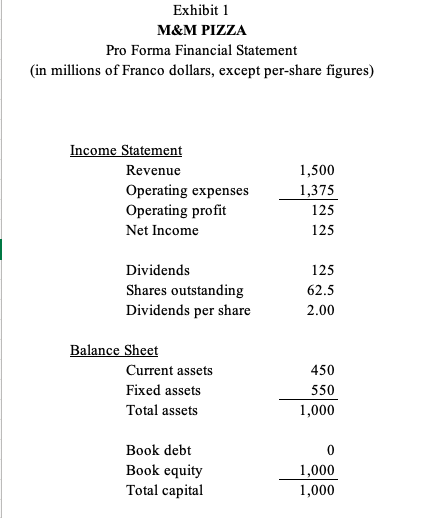

Exhibit 1 M&M PIZZA Pro Forma Financial Statement (in millions of Franco dollars, except per-share figures) Income Statement Revenue Operating expenses Operating profit Net Income 1,500 1,375 125 125 Dividends Shares outstanding Dividends per share 125 62.5 2.00 Balance Sh Current assets Fixed assets Total assets 450 550 1,000 Book debt Book equity Total capital 1,000 1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts