Question: 1. What is each stocks holding period return? 2. Using the holding period returns and the data above, calculate your expected return on your portfolio.

1. What is each stocks holding period return?

2. Using the holding period returns and the data above, calculate your expected return on your portfolio.

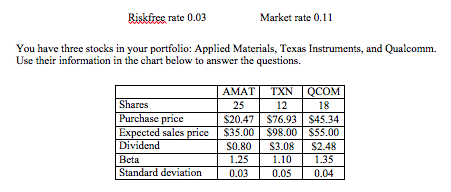

Riskfres rate 0.03 Market rate 0.11 You have three stocks in your portfolio: Applied Materials, Texas Instruments, and Qualcomm. Use their information in the chart below to answer the questions. Shares Purchase price Expected sales price Dividend Beta Standard deviation AMAT TXN QCOM 25 12 18 $20.47 $76.93 $45.34 $35.00 $98.00 $55.00 SO 80 S308 52.48 1.25 1.10 1.35 0.03 0.05 0.04 Riskfres rate 0.03 Market rate 0.11 You have three stocks in your portfolio: Applied Materials, Texas Instruments, and Qualcomm. Use their information in the chart below to answer the questions. Shares Purchase price Expected sales price Dividend Beta Standard deviation AMAT TXN QCOM 25 12 18 $20.47 $76.93 $45.34 $35.00 $98.00 $55.00 SO 80 S308 52.48 1.25 1.10 1.35 0.03 0.05 0.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts