Question: 1- What is the best way forward for Altice? Does it have all the necessary resources and capabilities to stay competitive in the long term?

1- What is the best way forward for Altice? Does it have all the necessary resources and capabilities to stay competitive in the long term? If not, then what is missing?

2- What could your company/industry learn from Altice?

3- How sustainable is Altice Co's business model and what can go wrong?

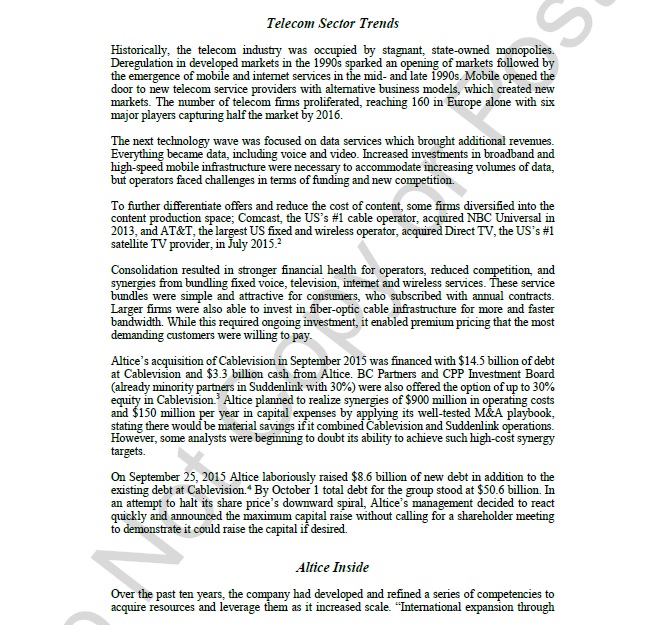

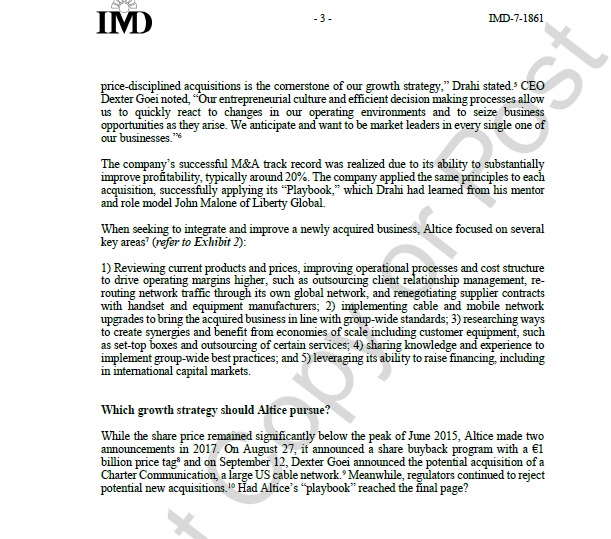

Telecom Sector Trends Historically, the telecom industry was occupied by stagnant, state-owned monopolies. Deregulation in developed markets in the 1990s sparked an opening of markets followed by the emergence of mobile and internet services in the mid- and late 1990s. Mobile opened the door to new telecom service providers with alternative business models, which created new markets. The number of telecom firms proliferated, reaching 160 in Europe alone with six major players capturing half the market by 2016. The next technology wave was focused on data services which brought additional revenues. Everything became data, including voice and video. Increased investments in broadband and high-speed mobile infrastructure were necessary to accommodate increasing volumes of data, but operators faced challenges in terms of funding and new competition. To further differentiate offers and reduce the cost of content, some firms diversified into the content production space; Comcast, the US's #1 cable operator, acquired NBC Universal in 2013, and AT&T, the largest US fixed and wireless operator, acquired Direct TV, the US's #1 satellite TV provider, in July 2015.3 Consolidation resulted in stronger financial health for operators, reduced competition, and synergies from bundling fixed voice, television, internet and wireless services. These service bundles were simple and attractive for consumers, who subscribed with annual contracts. Larger firms were also able to invest in fiber-optic cable infrastructure for more and faster bandwidth. While this required ongoing investment, it enabled premium pricing that the most demanding customers were willing to pay. Altice's acquisition of Cablevision in September 2015 was financed with $14.5 billion of debt at Cablevision and $3.3 billion cash from Altice. BC Partners and CPP Investment Board (already minority partners in Suddenlink with 30%) were also offered the option of up to 30% equity in Cablevision Altice planned to realize synergies of $900 million in operating costs and $150 million per year in capital expenses by applying its well-tested M&A playbook, stating there would be material savings if it combined Cablevision and Suddenlink operations. However, some analysts were beginning to doubt its ability to achieve such high-cost synergy targets. On September 25, 2015 Altice laboriously raised $8.6 billion of new debt in addition to the existing debt at Cablevision.* By October 1 total debt for the group stood at $50.6 billion. In an attempt to halt its share price's downward spiral, Altice's management decided to react quickly and announced the maximum capital raise without calling for a shareholder meeting to demonstrate it could raise the capital if desired. Altice Inside Over the past ten years, the company had developed and refined a series of competencies to acquire resources and leverage them as it increased scale. "International expansion throughIND - 3 - IMD-7-1861 price-disciplined acquisitions is the cornerstone of our growth strategy," Drahi stated." CEO Dexter Goei noted, "Our entrepreneurial culture and efficient decision making processes allow us to quickly react to changes in our operating environments and to seize business opportunities as they arise. We anticipate and want to be market leaders in every single one of our businesses."'6 The company's successful M&A track record was realized due to its ability to substantially improve profitability, typically around 20%. The company applied the same principles to each acquisition, successfully applying its "Playbook," which Drahi had learned from his mentor and role model John Malone of Liberty Global. When seeking to integrate and improve a newly acquired business, Altice focused on several key areas' (refer to Exhibit ?): 1) Reviewing current products and prices, improving operational processes and cost structure to drive operating margins higher, such as outsourcing client relationship management, re- routing network traffic through its own global network, and renegotiating supplier contracts with handset and equipment manufacturers; 2) implementing cable and mobile network upgrades to bring the acquired business in line with group-wide standards; 3) researching ways to create synergies and benefit from economies of scale including customer equipment, such as set-top boxes and outsourcing of certain services; 4) sharing knowledge and experience to implement group-wide best practices; and 5) leveraging its ability to raise financing, including in international capital markets. Which growth strategy should Altice pursue? While the share price remained significantly below the peak of June 2015, Altice made two announcements in 2017. On August 27, it announced a share buyback program with a el billion price tag and on September 12, Dexter Goei announced the potential acquisition of a Charter Communication, a large US cable network. " Meanwhile, regulators continued to reject potential new acquisitions. " Had Altice's "playbook" reached the final page?Historical Competitive Share Prices Share price development Altice vs S& P500 2014-2017 +400% #400% +200% Altice #100% S& PSOO 2014 1015 2016 2017 Source: Data finance. yahoo.com, accessed 5.10.2017, adapted by authors Exhibit 2 Cablevision Sources of Synergies Description Customer Further improvements of customer experience Ca. operations Reduction of operational complexity 15% Upgrade of legacy systems Network & Implementation of best-practices Ca. operations Modernization of network reduces operating expenses 35% Simplification of processes with IT improvement Sales & marketing Channel mix optimization with enhanced use of Ca. 5% 5900m technology Back-office systems upgrading G&A Elimination of duplication in functions Ca. Elimination of "public company" type costs 15% Other Business optimization across other business and Ca. Suddenlink 15% CAPEX Procurement improvements Ca. IT systems upgrades and streamlining 15% $150m Engineering best practice transfers (no volume cuts)DIALING FOR DOLLARS: O THE ALTICE ACQUISITION GROWTH STRATEGY EMBA graduates Joana Mihut, Founded by French billionaire Patrick Drahi, Altice had come a long Jon Bechert and Pavel Sanin way from its beginnings as a private telecommunications and cable prepared this case under the company. Since its first purchase in 2002 of Est Video in north-eastern supervision of Professor Stefan France, it had made more than 20 acquisitions in France, Portugal, Michel as a basis for class Belgium, Luxembourg, Israel, overseas French territories and the discussion rather than to Dominican Republic, offering cable television, internet, voice, mobile illustrate either effective or services and content. ineffective handling of a business situation. After its initial public offering (IPO) in 2014 with a valuation of $2 billion, Altice acquired media companies such as France's NextRadio TV, its influential BFM TV business channel and RMC radio station Saltice Following its success in Europe, Altice was determined to enter the US market with a bang. An attractive acquisition target was Time Warner Communications [TWC], the #2 player in the US behind Comcast. In May 2015, Altice stunned markets with a controversial $9.1 billion takeover of the seventh largest US cable operator Suddenlink. Altice's insatiable appetite for telecom dominance continued with Cablevision System Corp. just four months later, which brought 4.6 million customers across 20 states into the group and included a news channel and newspapers. Altice had become a formidable player in Europe and had succeeded in breaking into the US market. By June 2015, its share price had risen 369% since the IPO. Altice's momentum appeared to be unstoppable. In a dramatic turn of fortunes, however, the company's stock dropped by more than 70% from July to mid- December 2015 as investor confidence was shaken (refer to Exhibit I)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts