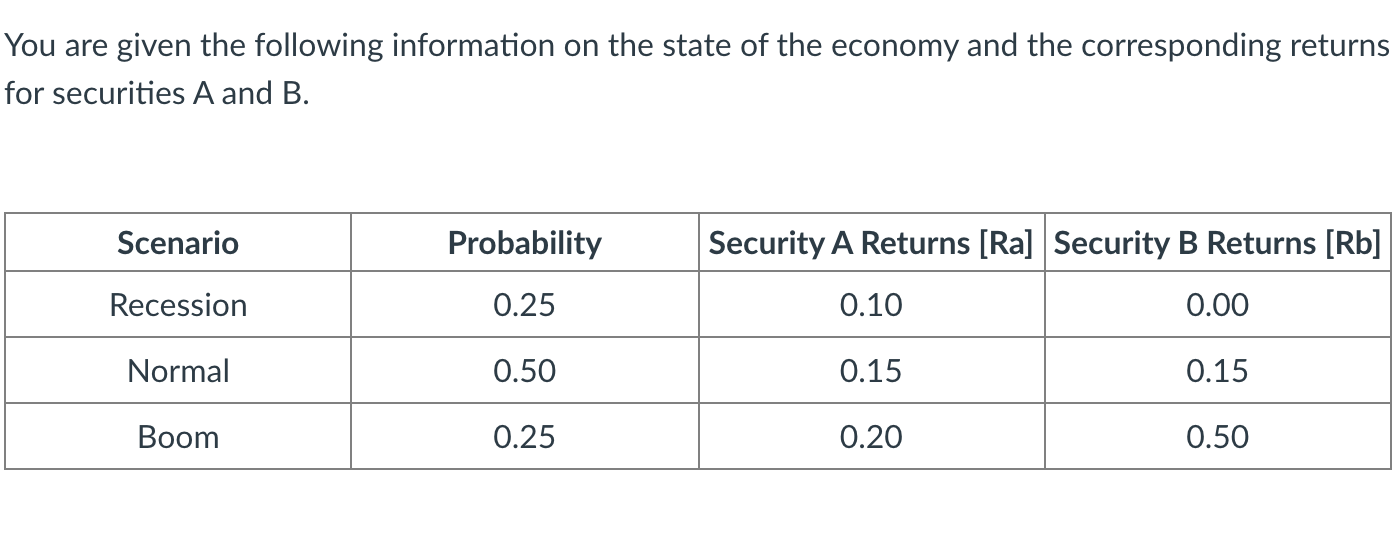

Question: 1. What is the Expected Return on Security A? (2 DP) 2. What is the Expected return of Security B? (2 DP) 3. What is

1.

1.

What is the Expected Return on Security A? (2 DP)

2.

What is the Expected return of Security B? (2 DP)

3.

What is the Standard Deviation of Security A's Returns? (4 DP)

4.

What is the Standard Deviation of Security B's Returns? (4 DP)

5.

What is the Expected Return on an Equally Weighted Portfolio of Security A and Security B? (3 DP)

6.

What is the Standard Deviation of the an Equally Weighted Portfolio with Securities A and B (above)? (4 DP)

You are given the following information on the state of the economy and the corresponding returns for securities A and B. Scenario Probability Security A Returns [Ra] Security B Returns (Rb] Recession 0.25 0.10 0.00 Normal 0.50 0.15 0.15 Boom 0.25 0.20 0.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts