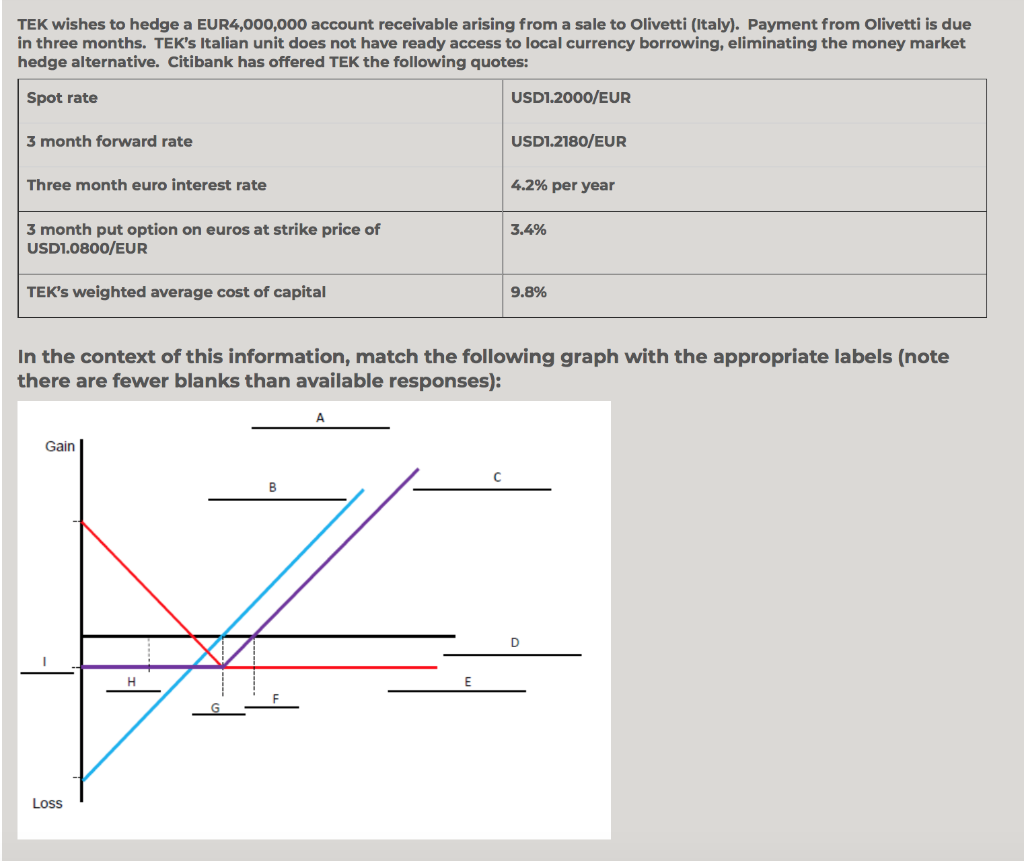

Question: 1. What is the label for line A, B, C, D, E, F, G, H, I? Options below (Pick one for each label). TEK wishes

1. What is the label for line A, B, C, D, E, F, G, H, I? Options below (Pick one for each label).

TEK wishes to hedge a EUR4,000,000 account receivable arising from a sale to Olivetti (Italy). Payment from Olivetti is due in three months. TEK's Italian unit does not have ready access to local currency borrowing, eliminating the money market hedge alternative. Citibank has offered TEK the following quotes: Spot rate USD1.2000/EUR 3 month forward rate USD1.2180/EUR Three month euro interest rate 4.2% per year 3.4% 3 month put option on euros at strike price of USD1.0800/EUR TEK's weighted average cost of capital 9.8% In the context of this information, match the following graph with the appropriate labels (note there are fewer blanks than available responses): A Gain Loss USD1.0800/EUR1 Premium of USD146,880 USD1.0400/EUR1 USD1.2180/EUR1 S(USD/EUR)90 days Put Option Hedge Hedged Receivable USD1.1140/EUR1 Forward Maket Hedge Long Receivable Long Put Premium of USD136,000 TEK wishes to hedge a EUR4,000,000 account receivable arising from a sale to Olivetti (Italy). Payment from Olivetti is due in three months. TEK's Italian unit does not have ready access to local currency borrowing, eliminating the money market hedge alternative. Citibank has offered TEK the following quotes: Spot rate USD1.2000/EUR 3 month forward rate USD1.2180/EUR Three month euro interest rate 4.2% per year 3.4% 3 month put option on euros at strike price of USD1.0800/EUR TEK's weighted average cost of capital 9.8% In the context of this information, match the following graph with the appropriate labels (note there are fewer blanks than available responses): A Gain Loss USD1.0800/EUR1 Premium of USD146,880 USD1.0400/EUR1 USD1.2180/EUR1 S(USD/EUR)90 days Put Option Hedge Hedged Receivable USD1.1140/EUR1 Forward Maket Hedge Long Receivable Long Put Premium of USD136,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts