Question: 1. What is the net benefit for every child below seventeen. 2. How many children under the age of 17 will create breakeven tax responsibility?

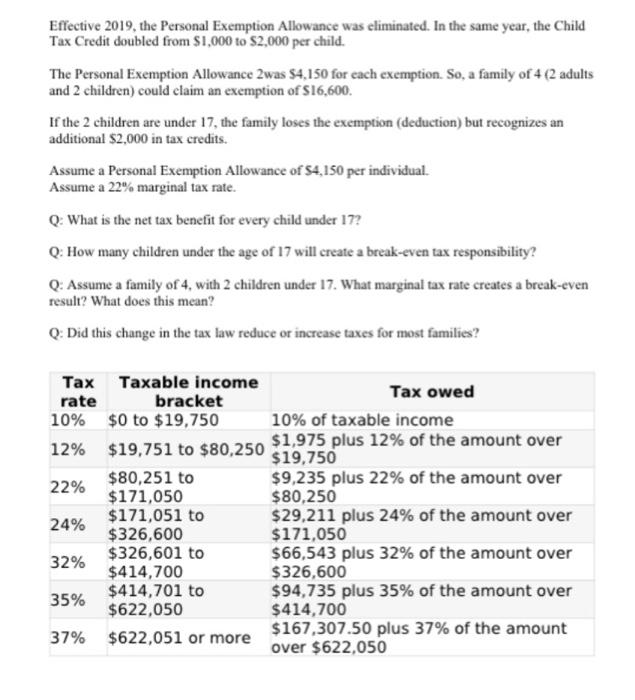

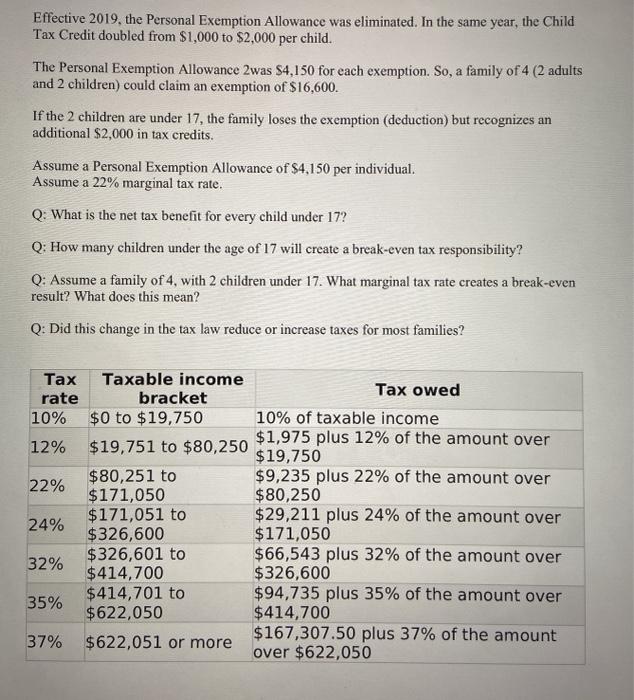

Effective 2019, the Personal Exemption Allowance was eliminated. In the same year, the Child Tax Credit doubled from $1,000 to $2,000 per child. The Personal Exemption Allowance Zwas $4.150 for each exemption. So, a family of 4 (2 adults and 2 children) could claim an exemption of $16,600. If the 2 children are under 17, the family loses the exemption (deduction) but recognizes an additional $2,000 in tax credits. Assume a Personal Exemption Allowance of 54,150 per individual. Assume a 22% marginal tax rate. Q: What is the net tax benefit for every child under 17? Q: How many children under the age of 17 will create a break-even tax responsibility? Q: Assume a family of 4, with 2 children under 17. What marginal tax rate creates a break-even result? What does this mean? Q: Did this change in the tax law reduce or increase taxes for most families? Tax Taxable income Tax owed rate bracket 10% $0 to $19.750 10% of taxable income 12% $19,751 to $80,250 $1,975 plus 12% of the amount over $19,750 $80,251 to 22% $9,235 plus 22% of the amount over $171,050 $80,250 24% $171,051 to $29,211 plus 24% of the amount over $326,600 $171,050 $326,601 to $66,543 plus 32% of the amount over 32% $414,700 $326,600 35% $414,701 to $94,735 plus 35% of the amount over $622,050 $414,700 37% $622,051 or more $167,307.50 plus 37% of the amount over $622,050 Effective 2019, the Personal Exemption Allowance was eliminated. In the same year, the Child Tax Credit doubled from $1,000 to $2,000 per child. The Personal Exemption Allowance 2was $4.150 for each exemption. So, a family of 4 (2 adults and 2 children) could claim an exemption of $16,600. If the 2 children are under 17, the family loses the exemption (deduction) but recognizes an additional $2,000 in tax credits. Assume a Personal Exemption Allowance of $4,150 per individual. Assume a 22% marginal tax rate. Q: What is the net tax benefit for every child under 17? Q: How many children under the age of 17 will create a break-even tax responsibility? Q: Assume a family of 4, with 2 children under 17. What marginal tax rate creates a break-even result? What does this mean? Q: Did this change in the tax law reduce or increase taxes for most families? Tax Taxable income rate bracket Tax owed 10% $0 to $19,750 10% of taxable income $1,975 plus 12% of the amount over 12% $19,751 to $80,250 $19,750 $80,251 to $9,235 plus 22% of the amount over 22% $171,050 $80,250 $171,051 to $29,211 plus 24% of the amount over 24% $326,600 $171,050 $326,601 to $66,543 plus 32% of the amount over 32% $414,700 $326,600 $414,701 to $94,735 plus 35% of the amount over 35% $622,050 $414,700 $167,307.50 plus 37% of the amount 37% $622,051 or more over $622,050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts