Question: 1. What was Yahoos original corporate-level strategy? 2. How has this strategy changed under Semel, and then under Bartz? What has Bartz done to reconfigure

1. What was Yahoos original corporate-level strategy? 2. How has this strategy changed under Semel, and then under Bartz? What has Bartz done to reconfigure Yahoo, and what challenges remain? Do you think she was successful? 3. How did things change under the new CEO Marissa Mayer? 4. How sustainable was Yahoos competitive advantage? What would you do to attain sustainable competitive advantage?

Just choose one question to answer in about 300 words.

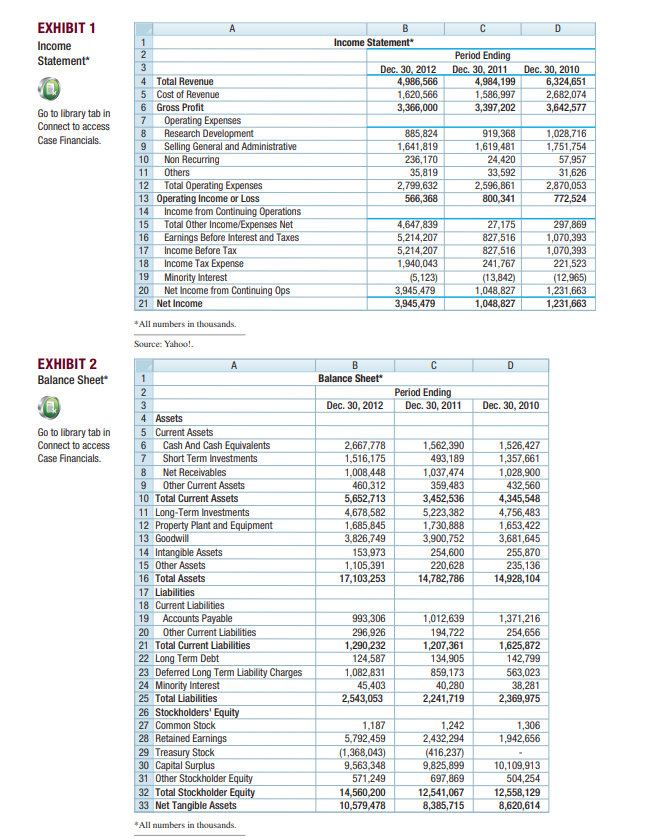

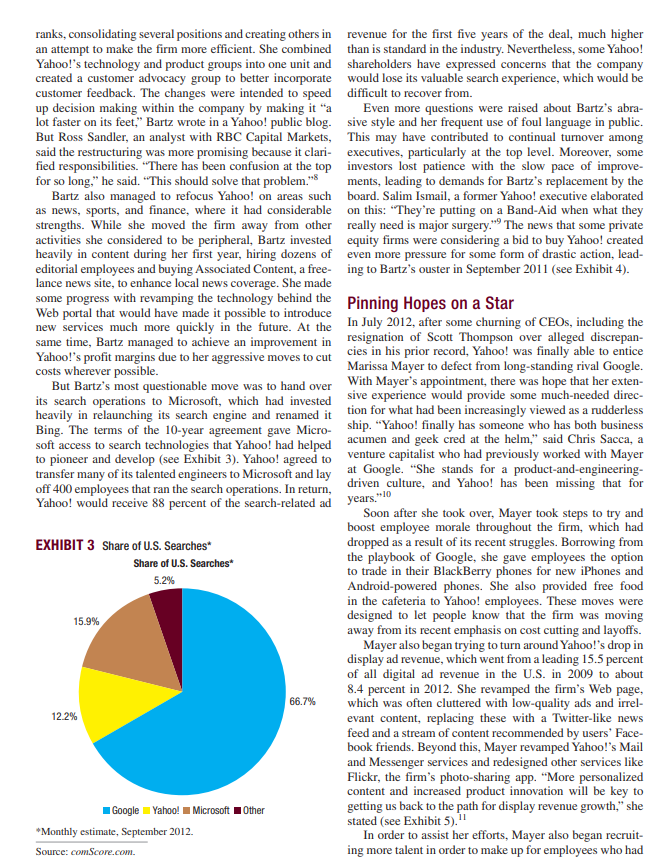

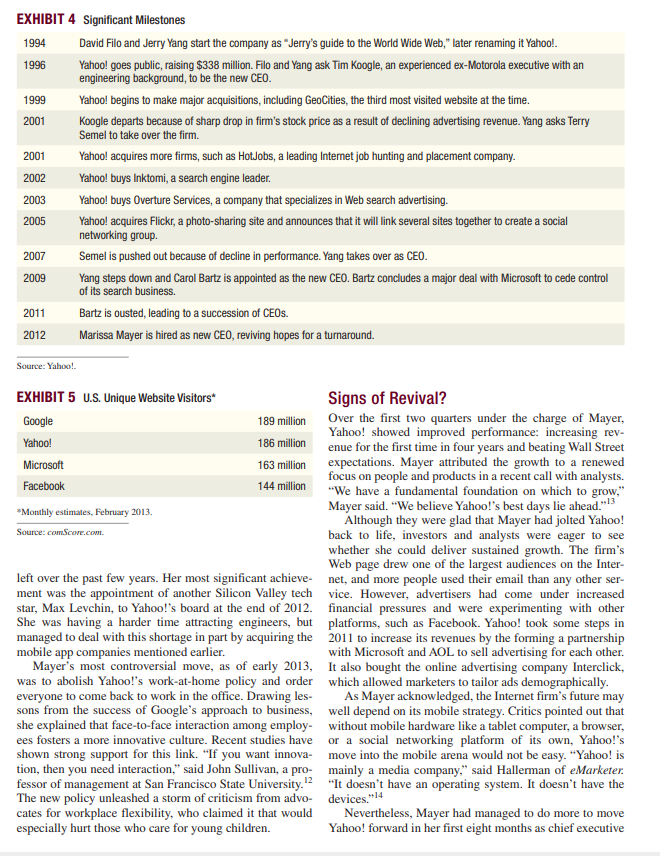

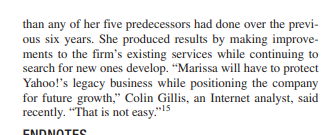

CASE 35 YAHOO!* Hallerman, an analyst at eMarketer. "But it will only carry them so far" (see Exhibits 1 and 2). Mayer recognized the challenges that she faced, but believed that she could build on Yahoo!'s strong franchises, including email, news, finances, and sports. Because of these, she asserted that the firm can capitalize on the shift of consumers to mobile devices. Noting that the most fre- quent use of smartphones was checking news, obtaining sports scores, getting financial information, and sharing photos, she asked: "Does that sound like any particular company that you know?" On March 25, 2013, Yahoo! announced the acquisition for almost $30 million of Summly, an app that condenses full-length stories into bite-sized nuggets that fit on a smartphone's screen. The British start-up was headed by 17-year-old Nick D'Aloisio, a high school student who created the new language processing technology that drives the app. "My manifesto with Summly was to get our technology into as many user's hands as possible," said D'Alosio, pointing to Yahoo!'s hundreds of millions of users. "With Yahoo!'s reputation as a content portal, we have an opportunity to fundamentally change the way con- tent is consumed."*| Summly was just the latest of half a dozen start-ups snapped up by Yahoo! in as many months to help it reboot for a smartphone-obsessed world. The Internet firm had already bought Stamped, Alike, and Jybe, which built apps for personalized recommendations of, among other things, books, food, and music. Marissa Mayer, Yahoo!'s CEO since July 2012. said she was determined to make the company a stronger force on smartphones and tablets. She believed that such personalized content would help her struggling company to make the transition from the desk top to mobile devices. The appointment of Mayer, who left a senior post at Google, represented a major coup for Yahoo!, which had gone through four chief executives in less than a year, two of which were only intended to be interim appointments. Having spent 13 years at Google, Mayer was responsible for the look and feel of some of Google's most popu- lar products and was behind the search firm's famously unadorned white home page. Consequently, her selection for the top job at Yahoo! kindled a fresh interest in the prospects for the Web-based firm's future. Despite its pioneering efforts that helped to shape the direction of the Internet during the 1990s, the momentum had shifted away from Yahoo! to newer start-ups such as Google and Facebook, which have created new users. With the appointment of Mayer as CEO, analysts were eager to see whether she could lure back advertisers, reinvigorate a muddled brand, and improve morale at a company that has been marred by executive churn, constant cost-cutting, and mass layoffs. "The sheer attention that they are getting from hiring her will be helpful for a while," said David Creating a Theme Park After a period of strong growth in the late 1990s, Yahoo! saw a steep fall in revenues and profits as advertisers cut back on their spending after the dot-com bust. Under Tim Koogle, Yahoo! had developed as a Web portal that relied heavily on advertising revenues for profits. He had been confident that advertisers would continue to pay in order to reach the younger and technologically savvy surfers who were the main users of his portal. As advertising revenues dropped off sharply, leading to a steep decline in the firm's stock price, Koogle was replaced in April 2001 by Terry Semel. an experienced Hollywood media executive who had once controlled Warner Brothers. Semel worked hard to entice traditional advertisers back to his site. But he also began to push for other sources of revenue by making acquisitions that would allow his site to offer more premium services that consumers would be willing to pay for. One of the first of these was the buyout of HotJobs.com in 2002, which moved the firm into the online job-hunting business. Semel followed up with the acquisition of online music service Musicmatch Inc., hoping to bring more subscribers into the Yahoo! fold. Over the next few years, the firm continued to add to its growing range of services by acquiring firms such as Flickr. a photo-sharing site, and Del.icio.us, a bookmark- sharing site. By making such smart deals, Semel was able to build Yahoo! into a site that could offer surfers many different services, with several of them requiring the customer to pay a small fee. He wanted to coax Web surfers to spend hard cash on everything from digital music and online games to job listings and premium email accounts with loads of extra storage. With the expansion of services, Semel envisioned building Yahoo! into a digital Disney- land, a souped-up theme park for the Internet Age. The idea was that Web surfers logging on to Yahoo!'s site, like *Case developed by Professor Jamal Shamsie, Michigan State University, with the assistance of Professor Alan B. Eisner, Pace University. Material has been drawn from published sources to be used for purposes of class discussion. Copyright 2013 Jamal Shamsie and Alan B. Eisner. A C D EXHIBIT 1 Income Statement B Income Statement Dec. 30, 2012 4,986,566 1,620,566 3,366,000 Period Ending Dec. 30, 2011 4,984,199 1 ,586,997 3,397,202 Dec. 30, 2010 6,324,651 2,682,074 3,642,577 Go to library tab in Connect to access Case Financials. 4 Total Revenue 5 Cost of Revenue 6 Gross Profit 7 Operating Expenses 8 Research Development 9 Selling General and Administrative 10 Non Recurring 11 Others 12 Total Operating Expenses 13 Operating Income or Loss 14 Income from Continuing Operations 15 Total Other Income/Expenses Net 16 Earnings Before Interest and Taxes 17 Income Before Tax 18 Income Tax Expense 19 Minority Interest 20 Net Income from Continuing Ops 21 Net Income 885.824 1,641,819 236,170 35,819 2.799,632 566,368 919,368 1,619,481 24,420 3 3,592 2,596,861 800,341 1,028,716 1,751,754 57,957 31,626 2,870,053 772,524 4,647,839 5,214,207 5,214,207 1,940,043 5,123) 3,945,479 3,945,479 27,175 827,516 827,516 241,767 (13,842) 1,048,827 ,048,827 297,869 1,070,393 1,070,393 221,523 (12,965) 1,231,663 1,231,663 1 *All numbers in thousands. Source: Yahoo! A C D EXHIBIT 2 Balance Sheet B Balance Sheet 1 Dec. 30, 2012 Period Ending Dec. 30, 2011 Dec. 30, 2010 Go to library tab in Connect to access Case Financials. 2,667,778 1,516,175 1,008,448 460,312 5,652,713 4,678,582 1,685,845 3,826,749 153,973 1,105,391 17,103,253 1,562,390 493,189 1,037,474 359,483 3,452,536 5,223,382 1,730,888 3,900,752 254,600 220,628 14,782,786 1,526,427 1,357,661 1,028,900 432,560 4,345,548 4,756,483 1,653,422 3,681,645 255,870 235,136 14,928,104 4 Assets 5 Current Assets 6 Cash And Cash Equivalents 7 Short Term Investments 8 Net Receivables 9 Other Current Assets 10 Total Current Assets 11 Long-Term Investments 12 Property Plant and Equipment 13 Goodwill 14 Intangible Assets 15 Other Assets 16 Total Assets 17 Liabilities 18 Current Liabilities 19 Accounts Payable 20 Other Current Liabilities 21 Total Current Liabilities 22 Long Term Debt 23 Deferred Long Term Liability Charges 24 Minority Interest 25 Total Liabilities 26 Stockholders' Equity 27 Common Stock 28 Retained Earnings 29 Treasury Stock 30 Capital Surplus 31 Other Stockholder Equity 32 Total Stockholder Equity 33 Net Tangible Assets 1 993,306 296,926 1,290,232 124,587 ,082,831 45,403 2,543,053 1,012,639 194,722 1,207,361 134,905 859,173 40,280 2,241,719 1,371,216 254,656 ,625,872 142,799 563,023 38.281 2,369,975 1 1,187 5,792,459 (1,368,043) 9,563,348 571,249 14,560,200 10,579,4788 1,242 1,306 2,432,294 1,942,656 (416.237) 9,825,899 1 0,109,913 697,869 504,254 12,541,067 12,558, 129 ,385,7158 ,620,614 *All numbers in thousands customers squeezing through the turnstiles in Anaheim, making key partnerships and acquisitions to keep up with should find themselves in a self-contained world full of the changing competitive landscape. The once high-flying irresistible offerings. Instead of Yahoo! being an impartial Internet pioneer was losing online advertising revenues to tour guide to the Web, it should be able to entice surfers to search engines such as Google and social networking sites stay inside its walls as long as possible. such as Facebook der to make such a concept work, Semel believed More significantly, there was some confusion among that the firm should establish strong links between its vari- Yahoo! employees about the role of content. Semel had ous sites that would allow its consumers to move effort- brought in several individuals from the entertainment sec- lessly from one of them to another. He demanded that tor to create unique content for the firm. This led to some Yahoo!'s myriad of offerings, from email accounts to stock conflicts with those people in the firm who had been work. quotes to job listings, interact with each other. Semel called ing to develop Yahoo! as a site where other people could this concept "network optimization and regarded this as place their content. "The age-old question with Yahoo! has a key goal for his firm. In order to ensure that the vari- been: Is it technology first or is it media and content first?" ous efforts that were being made by managers were tied to said David Cohen, a media executive. each other more closely, he moved swiftly to replace the Shareholder dissatisfaction with Yahoo!'s financial per- company's freewheeling culture with a more deliberate formance finally led to the resignation of Semel in July sense of order. All ideas had to be formally presented to a 2007. The firm turned to Jerry Yang, one of its cofound called the Product Council, which consisted of nineers, to improve earnings and profits. He began a 100-day managers from different parts of the firm. review of every aspect of the firm's operations but could Semel's biggest moves, however, were tied to his efforts not find ways to define the specific strengths that could to strengthen Yahoo!'s position in the search area. Yahoo! be used to narrow its focus. Rob Sanderson, a technology had been using Google to provide these services, but with analyst pointed out that Yahoo! had to make some critical Google's growing strengths in this area, Semel decided choices. "They're relevant, and hold their audience pretty Yahoo! should further develop its own search engine. In well, but the investor and media perception is that Yahoo! 2002, he purchased Inktomi, a strong contender in search is another AOL-a once-great company in decline," he engines with whom Yahoo! had also worked in the past. A explained. year later, Yahoo! also bought Overture Services, a com- One of the biggest challenges faced by Yang was the pany that specialized in identifying and ranking the popu- offer made by Microsoft in early 2008 to buy Yahoo! for larity of websites and in helping advertisers find the best $33 a share, or approximately $47.5 billion. Yang refused sites to advertise on. Finally, Semel spent millions of dol- to sell his company for less than $37 a share, although lars on further improving its search advertising system in these shares had been trading for around $20. Shareholders order to stem the continual loss of search related advertis were upset, because they stood to lose about $20 billion by ing revenues to Google. the rejection of Microsoft's offer. "I don't think anything Yahoo! puts out there is going to be comparable with what Facing an Identity Crisis Microsoft was offering said Darren Chervitz, comanager of the Jacob Internet Fund, which owned about 150,000 In spite of Semel's efforts to direct the growth of Yahoo! shares of Yahoo! into new areas, the push to develop a digital theme park led some analysts to question whether the firm had spread itself too thin. Even some people inside Yahoo! began to Scrambling for a Focus question its goal of providing a broad range of services that Less than a year and a half after he had assumed control. could attract an audience that could be sold to advertisers. Yang decided to give up his role as CEO and once again In a scathing internal memo written in the fall of 2006, took up the post of "chief Yahoo!," the strategy posi- Brad Garlinghouse, a senior Yahoo! vice president, com- tion that he had held before. After an extensive search, pared Yahoo!'s strategy to indiscriminately spreading pea- the board appointed Carol Bartz as the new head of the nut butter across the Internet. "We lack a focused, cohesive firm. Bartz had been in charge of Autodesk (a computer- vision for our company," he stated in the memo. "We want aided software design firm) for 14 years before getti to do everything and be everything-to everyone. We've the call from Yahoo!. She was expected to develop a known this for years, talked about it incessantly, but done stronger focus for a firm that was perceived to have been nothing to fundamentally address it.*** drifting, especially during Yang's turbulent leadership. Garlinghouse's memo was intended to push Yahoo! Analysts were generally positive about her appointment, into establishing a clearer vision for the firm to pursue. He although many suggested that she lacked online media had realized that Yahoo!'s attempts to offer a wide vari experience. ety of services had led to a proliferation of new executive Bartz was expected to move quickly to reassure inves- hires, which eventually contributed to a growth of con- tors who were angry with Yahoo!'s board for refusing to flict between various business units. This had made it dif- accept Microsoft's bid for the firm. Shortly after she took ficult to move swiftly to make critical decisions, such as over, Bartz moved to overhaul the company's top executive ranks, consolidating several positions and creating others in an attempt to make the firm more efficient. She combined Yahoo!'s technology and product groups into one unit and created a customer advocacy group to better incorporate customer feedback. The changes were intended to speed up decision making within the company by making it a lot faster on its feet," Bartz wrote in a Yahoo! public blog. But Ross Sandler, an analyst with RBC Capital Markets. said the restructuring was more promising because it clari- fied responsibilities. "There has been confusion at the top for so long," he said. This should solve that problem." managed to refocus Yahoo! on areas such as news, sports, and finance, where it had considerable strengths. While she moved the firm away from other activities she considered to be peripheral, Bartz invested heavily in content during her first year, hiring dozens of editorial employees and buying Associated Content, a free- lance news site, to enhance local news coverage. She made some progress with revamping the technology behind the Web portal that would have made it possible to introduce new services much more quickly in the future. At the same time, Bartz managed to achieve an improvement in Yahoo!'s profit margins due to her aggressive moves to cut costs wherever possible. But Bartz's most questionable move was to hand over its search operations to Microsoft, which had invested heavily in relaunching its search engine and renamed it Bing. The terms of the 10-year agreement gave Micro- soft access to search technologies that Yahoo! had helped ccess to search technologies that Yahool had helped to pioneer and develop (see Exhibit 3). Yahoo! agreed to transfer many of its talented engineers to Microsoft and lay off 400 employees that ran the search operations. In return, Yahoo! would receive 88 percent of the search-related ad revenue for the first five years of the deal, much higher than is standard in the industry. Nevertheless, some Yahoo! shareholders have expressed concerns that the company would lose its valuable search experience, which would be difficult to recover from. Even more questions were raised about sive style and her frequent use of foul language in public. This may have contributed to continual turnover among executives, particularly at the top level. Moreover, some investors lost patience with the slow pace of improve- ments, leading to demands for Bartz's replacement by the board. Salim Ismail, a former Yahoo! executive elaborated on this: "They're putting on a Band-Aid when what they really need is major surgery."" The news that some private equity firms were considering a bid to buy Yahoo! created even more pressure for some form of drastic action, lead- ing to Bartz's ouster in September 2011 (see Exhibit 4). Pinning Hopes on a Star In July 2012, after some churning of CEOs, including the resignation of Scott Thompson over alleged discrepan- cies in his prior record, Yahoo! was finally able to entice Marissa Mayer to defect from long-standing rival Google. With Mayer's appointment, there was hope that her exten- sive experience would provide some much-needed direc- tion for what had been increasingly viewed as a rudderless ship. "Yahoo! finally has someone who has both business acumen and geek cred at the helm, said Chris Sacca, a venture capitalist who had previously worked with Mayer at Google, "She stands for a product-and-engineering- driven culture, and Yahoo! has been missing that for years, 10 EXHIBIT 3 Share of U.S. Searches Share of U.S. Searches 5.2% 15.9% Soon after she took over, Mayer took steps to try and boost employee morale throughout the firm, which had dropped as a result of its recent struggles. Borrowing from the playbook of Google, she gave employees the option to trade in their BlackBerry phones for new iPhones and Android-powered phones. She also provided free food in the cafeteria to Yahoo! employees. These moves were designed to let people know that the firm was moving away from its recent emphasis on cost cutting and layoffs. Mayer also began trying to turn around Yahoo!'s drop in display ad revenue, which went from a leading 15.5 percent of all digital ad revenue in the U.S. in 2009 to about 8.4 percent in 2012. She revamped the firm's Web page, which was often cluttered with low-quality ads and irrel- evant content, replacing these with a Twitter-like news feed and a stream of content recommended by users' Face- book friends. Beyond this, Mayer revamped Yahoo!'s Mail and Messenger services and redesigned other services like Flickr, the firm's photo-sharing app. "More personalized content and increased product innovation will be key to getting us back to the path for display revenue growth," she stated (see Exhibit 5)." In order to assist her efforts, Mayer also began recruit- ing more talent in order to make up for employees who had 66.7% 12.2% Other Google Yahoo! Microsoft *Monthly estimate, September 2012 Source: comScore.com. EXHIBIT 4 Significant Milestones 1994 David Filo and Jerry Yang start the company as "Jerry's guide to the World Wide Web," later renaming it Yahoo! 1996 Yahoo! goes public, raising $338 million. Filo and Yang ask Tim Koogle, an experienced ex-Motorola executive with an engineering background, to be the new CEO. 1999 Yahoo! begins to make major acquisitions, including GeoCities, the third most visited website at the time 2001 Koogle departs because of sharp drop in firm's stock price as a result of declining advertising revenue. Yang asks Terry Semel to take over the firm. 2001 Yahoo! acquires more firms, such as HotJobs, a leading Internet job hunting and placement company. 2002 Yahoo! buys Inktomi, a search engine leader. 2003 Yahoo! buys Overture Services, a company that specializes in Web search advertising. 2005 Yahoo! acquires Flickr, a photo-sharing site and announces that it will link several sites together to create a social networking group. 2007 Semel is pushed out because of decline in performance. Yang takes over as CEO. 2009 Yang steps down and Carol Bartz is appointed as the new CEO. Bartz concludes a major deal with Microsoft to cede control of its search business. 2011 Bartz is ousted, leading to a succession of CEOS. 2012 Marissa Mayer is hired as new CEO, reviving hopes for a turnaround. Source: Yahoo! EXHIBIT 5 U.S. Unique Website visitors Signs of Revival? Google 189 million Over the first two quarters under the charge of Mayer, Yahoo! showed improved performance: increasing rev- Yahoo! 186 million enue for the first time in four years and beating Wall Street Microsoft 163 million expectations. Mayer attributed the growth to a renewed focus on people and products in a recent call with analysts. Facebook 144 million "We have a fundamental foundation on which to grow, *Monthly estimates, February 2013 Mayer said. "We believe Yahoo!'s best days lie ahead."*. Although they were glad that Mayer had jolted Yahoo! Source:comScore.com back to life, investors and analysts were eager to see whether she could deliver sustained growth. The firm's Web page drew one of the largest audiences on the Inter- left over the past few years. Her most significant achieve- net, and more people used their email than any other ser- ment was the appointment of another Silicon Valley tech vice. However, advertisers had come under increased star, Max Levchin, to Yahoo!'s board at the end of 2012. financial pressures and were experimenting with other She was having a harder time attracting engineers, but platforms, such as Facebook. Yahoo! took some steps in managed to deal with this shortage in part by acquiring the 2011 to increase its revenues by the forming a partnership mobile app companies mentioned earlier. with Microsoft and AOL to sell advertising for each other. Mayer's most controversial move, as of early 2013, It also bought the online advertising company Interclick, was to abolish Yahoo!'s work-at-home policy and order which allowed marketers to tailor ads demographically. everyone to come back to work in the office. Drawing les- As Mayer acknowledged, the Internet firm's future may sons from the success of Google's approach to business, well depend on its mobile strategy. Critics pointed out that she explained that face-to-face interaction among employ- without mobile hardware like a tablet computer, a brow ees fosters a more innovative culture. Recent studies have or a social networking platform of its own, Yahoo!'s shown strong support for this link. "If you want innova- move into the mobile arena would not be easy. "Yahoo! is tion, then you need interaction," said John Sullivan, a pro- mainly a media company," said Hallerman of eMarketer. fessor of management at San Francisco State University. "It doesn't have an operating system. It doesn't have the The new policy unleashed a storm of criticism from advo- devices."*14 cates for workplace flexibility, who claimed it that would Nevertheless, Mayer had managed to do more to move especially hurt those who care for young children. Yahoo! forward in her first eight months as chief executive than any of her five predecessors had done over the previ- ous six years. She produced results by making improve- ments to the firm's existing services while continuing to search for new ones develop. "Marissa will have to protect Yahoo!'s legacy business while positioning the company for future growth," Colin Gillis, an Internet analyst, said recently. "That is not easy."15 ENDNOTECStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock