Question: . Required Question . Volvo India Pvt. Ltd.: Navigating through the Roads Ahead Sapna Rakesh Kiran S Nair* The Indian bus industry grew at the

. Required Question .

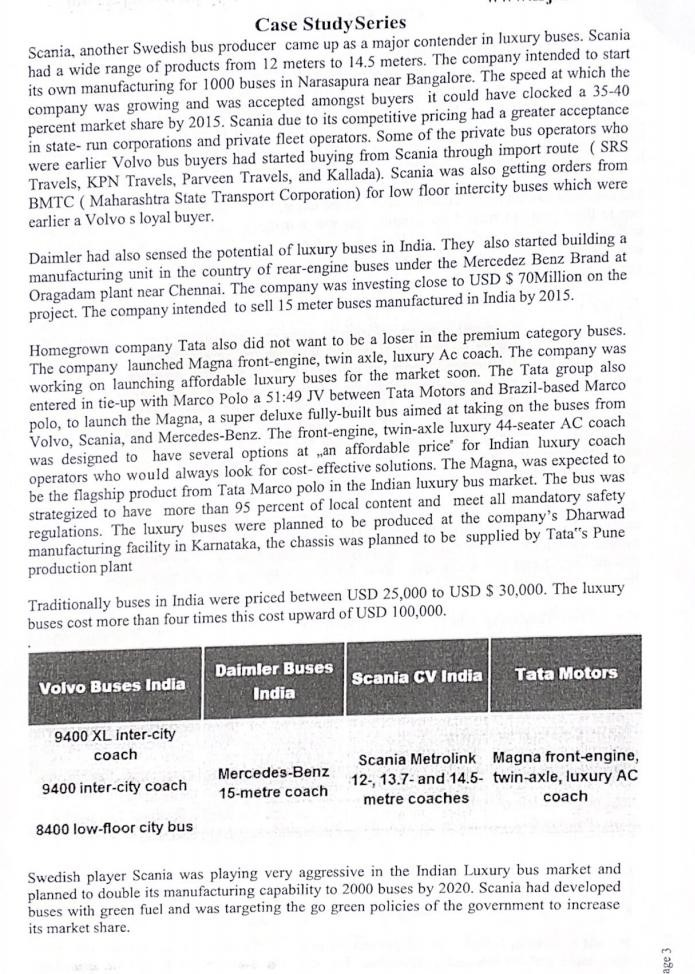

Volvo India Pvt. Ltd.: Navigating through the Roads Ahead Sapna Rakesh Kiran S Nair* The Indian bus industry grew at the rate of 3% in 2012 whereas Volvo India Pvt Ltd. grew at 10 percent, to a volume of more than 700 buses. In 2012 it also doubled its manufacturing capacity to 1800 buses. The company planned to increase bus manufacturing capacity to 2500 buses by the year 2014. The company targeted to reach $ 5400 revenue from India by FY 2015, which appeared difficult at this stage. December 2013, while looking at the goal sheet for the Volvo bus India, Volvo management wondered if the targets set were correct for the company? Has the company failed in understanding and planning for the Indian market? Volvo India Pvt Ltd The Volvo Group is one of the world's leading manufacturers of trucks, buses, construction equipment, and marine and industrial engines. The group also provides complete solutions for financing and service. Volvo buses are a key product of the firm sold internationally. Volvo entered in India in the year 2000. In the beginning, when Volvo entered India things were very different. India was not introduced to luxury buses which were 10 times costlier than the domestic buses which ruled the roads. The company bid for buses to Delhi Transport Corporation (DTC), India's capital in 1998. The buyers, as well as the users, were not exposed to the idea of expensive low floor buses. There were concerns about buses' ability to survive Indian roads and the need for Air Conditioning in the buses. Consequently, the DTC tender was shelved. Two Volvo B7R intercity buses were imported from Hong Kong and Singapore and these buses were sent on demonstration drives for six months to showcase utility in 2000. The company was able to entice private bus operators to opt-in for Volvo owing to its superior quality and comfort offered. The company drew up its marketing plan on the life cycle profitability owing to the use of products. The bus could run continuously for 22 hours offering long routes covered in lesser time. In lifecycle cost comparison Volvo proved to be much superior to other players. Volvo departed from the industry norm by offering service support for the entire bus, and not just parts and also by creating a service center at a distance of 400 KMs. The long-run capability of the buses helped chart long routes at higher prices. Mumbai to Bangalore route became popular as a consequence. A bus could do a trip from Mumbai to Puna and then Puna to Ahmedabad and then back to Mumbai from Puna. The bus operators could also increase the bus fare on Volvo buses. Volvo sold 20 buses in 2000; they could do about 1100 in 2006 and 5000 by Dec 2011. Till 2011 it grew at the rate of 10% per annum and carved a market share of 76% in the luxury buses. To reach this figure Volvo worked consistently towards creating a market for itself. The marketing program for Volvo ranged from feedback from passengers and customers to service centers and drivers. The company focused on service led sales rather than the other way assuring customers of the world-class service connectivity with the organization. The company focused on the concept of luxury travel and reached out to different stakeholders for branding Volvo experience. Eventually, private fleet operators and state transport companies created brand and Market around the Volvo brand. Page 1 Case Study Series To compete effectively Volvo also started to manufacture buses with a capacity to produce 1100 buses in a year in 2008 with the expandable capacity to 2500 buses by 2014. This gave Volvo an advantage over other premium bus sellers as they were still importing and were dependent on Indian players. Volvo supplied its first intercity bus to Bangalore Metropolitan Transport Corporation in 2006. Gradually the market increased and in 2014 Volvo supplied to close to 15 intercity bus players. Volvo had seen success as it patiently waited to develop the market and redesigned its strategy to align with industry development and circumstances. In order to provide a taste of world-class Volvo service, Volvo also opened five Volvo bus service centers that could handle comprehensive services at best standards to up to 20 buses in a day. The fifth center of the Mumbai center was opened in 2014. After-market support from Volvo was established even before the first Volvo bus was sold in India. Since then the company continued to build capabilities and networks that set standards in the market. With the Volvo Bus Center concept, the company provided customers a far more wholesome experience. As per the long term strategic plan, Volvo's made-in-India coaches were exported to Europe which made it the first company to do it. As it happens, export from India was part of Volvo Buses" global game-plan. One of the key executives of Volvo Mr. Agnevall in an interview said that, "With our Asia Leverage' strategy which we have in place since 2011, we have had this ambition to export from India. Now we are mature enough and have a production system with which we feel it's feasible to use India as an export hub for Europe. I think we have the right competence in India. These are not just products that have been developed solely in India, these are global products with substantial engineering in Europe and India and the project has been driven from India. It's a global design but manufactured in India. Leveraging our Indian footprint brings us a very competitive solution." Industry Luxury buses was a new industry in India, after the launch of Volvo in 2001 which completed its 12 years. The main players in the Luxury buses were Scania India with a Market share of 15 percent, Tata Motors which planned to launch their luxury brand DIVO, The market was further heated by Bharat Benz, which sold, the leading luxury buses of the world market. Indian roads were dominated by Tata and Ashok Leyland with front-engine vehicles and about 43 % market share each. The smaller segment that is the premium segment was dominated by Volvo with a declining market share which was about 80% in the FY 2012 Courtesy to the rising per capita income and the influx of population from tier 2 to tier 1 luxury bus market was seeing an upswing consistently. The government was also very positive and adopted luxury buses for intercity travel and long-distance travel. This market was primarily catered to, by multinational players like Volvo, Scania, and Mercedes-Benz, Although Volvo had first-mover advantage in this category, the rising market was becoming more unpredictable. Scania and Daimler Buses through their Indian manufacturing arms were looking to make their presence felt through localized manufacturing and cost efficiencies. Since 2013 Case Study Series Scania, another Swedish bus producer came up as a major contender in luxury buses. Scania had a wide range of products from 12 meters to 14.5 meters. The company intended to start its own manufacturing for 1000 buses in Narasapura near Bangalore. The speed at which the company was growing and was accepted amongst buyers it could have clocked a 35-40 percent market share by 2015. Scania due to its competitive pricing had a greater acceptance in state-run corporations and private fleet operators. Some of the private bus operators who were earlier Volvo bus buyers had started buying from Scania through import route (SRS Travels, KPN Travels, Parveen Travels, and Kallada). Scania was also getting orders from BMTC ( Maharashtra State Transport Corporation) for low floor intercity buses which were earlier a Volvo s loyal buyer. Daimler had also sensed the potential of luxury buses in India. They also started building a manufacturing unit in the country of rear-engine buses under the Mercedez Benz Brand at Oragadam plant near Chennai. The company was investing close to USD $ 70Million on the project. The company intended to sell 15 meter buses manufactured in India by 2015. Homegrown company Tata also did not want to be a loser in the premium category buses. The company launched Magna front-engine, twin axle, luxury Ac coach. The company was working on launching affordable luxury buses for the market soon. The Tata group also entered in tie-up with Marco Polo a 51:49 JV between Tata Motors and Brazil-based Marco polo, to launch the Magna, a super deluxe fully-built bus aimed at taking on the buses from Volvo, Scania, and Mercedes-Benz. The front-engine, twin-axle luxury 44-seater AC coach was designed to have several options at an affordable price for Indian luxury coach operators who would always look for cost-effective solutions. The Magna, was expected to be the flagship product from Tata Marco polo in the Indian luxury bus market. The bus was strategized to have more than 95 percent of local content and meet all mandatory safety regulations. The luxury buses were planned to be produced at the company's Dharwad manufacturing facility in Karnataka, the chassis was planned to be supplied by Tata's Pune production plant Traditionally buses in India were priced between USD 25,000 to USD $ 30,000. The luxury buses cost more than four times this cost upward of USD 100,000. Volvo Buses India Daimler Buses India Scania CV India Tata Motors 9400 XL inter-city coach 9400 inter-city coach Mercedes-Benz 15-metre coach Scania Metrolink Magna front-engine, 12., 13.7- and 14.5- twin-axle, luxury AC metre coaches coach 8400 low-floor city bus Swedish player Scania was playing very aggressive in the Indian Luxury bus market and planned to double its manufacturing capability to 2000 buses by 2020. Scania had developed buses with green fuel and was targeting the go green policies of the government to increase its market share. Case Study Series Company and demand related issues Volvo had already established a good brand name in the luxury segment, however looking at the market scenario it appeared difficult for Volvo to attain its targets if it remained confining to the existing luxury segment only. The company was mulling over the idea of creating a value segment in the market thereby making travel more comfortable and safe. However, Volvo worldwide had not dealt with this segment and any experimentation in the low-cost segment could actually dilute the luxury pull created by the brand in buses. The company has not been building a body for the buses, Volvo bus body developed snags in two to three years of rugged operations. This was a matter of concern for the company as such snags did not go well with the brand image the company had established. Although the snags were a consequence of rugged operations and the age of vehicle Volvo Brand communication had to tackle this as a branding issue. Training drivers and bus operators was one of the major initiative by Volvo. Any accident in a Volvo bus was considered to be an unfortunate occurrence and efforts were systematically organized to thwart these by training of people. Volvo buses were designed to handle fire and accident impact. Emergency doors and hammers to break the glass for exit were provided on the bus. However, operators generally added seats in the area of the emergency exit, which compounded casualty in an accident. After each accident, the bus brand was criticized for its inability to handle the accidents. There were issues of over-speeding and drunken driving which lead to accidents, but Volvo had to face the flak for the same. There were other instances where the buses which met an accident were believed to be Volvo as they used Volvo's name over the bus for attracting customers. Apart from these, there were several external environmental factors that could null the efforts made by Volvo in establishing the brand. The bus market was still at an emerging stage and needed a supportive policy structure to attract big corporate houses or international players in this industry. Some of the challenges faced by bus operators which directly impacted Volvo buses demand were as follows: Cost-based Tendering - In India, most government purchases were done through tenders under the Lowest Cost (LI) system. The authorities although keen to invite big international companies forced international players to compete with domestic players on a cost basis. This method of selection process even lead to situations where an international company with a net worth of more than INR 300 billion competed with domestic operator with a net worth of INR 0.2 billion. It was important that such tenders became quality cost-based system oriented to give the right bandwidth to Volvo. Revenue Risk - In India, the bus fares in government undertakings are being fixed by the government not providing flexibility to the operators to use surge pricing to match the demand. This left operators on a very low margin without any protection. The bus fare is fixed and are being regulated by the state government and the operator does not have the freedom to charge more without the preapproval of the government. Necessary Infrastructure - The parking and space for bus maintenance are to be organized by the private players themselves. A fleet operator has to organize for large spaces to operate a fleet. This is one of the major hurdles in entering the bus operations. Permit System in India. The bus permits are issued to specific individuals along with route time table and all relevant permissions. The individuals are bound to follow the permit Corresponding author: Kiran S Nair, Abu Dhabi School of Management, Abu Dhabi, Knair@adsm.ac.ae Page 4 Answer the following questions 1. Determine the key PESTEL factors affecting the growth of Volvo in Indian market scenario. 2. Analyze new strategic marketing plan in alignment with usage of Ansoff Matrix and synthesis if Volvos current strategy is good or else formulate an alternative marketing strategy

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock