Question: 1. What would be your recommendation based on the payback period? Calculate the payback period in years (round to 2 decimal places). 2. What would

1.What would be your recommendation based on the payback period? Calculate the payback period in years (round to 2 decimal places).

2.What would be your recommendation based on the net present value method (NPV)?

3.What is your final recommendation to the manager of the company? Why?

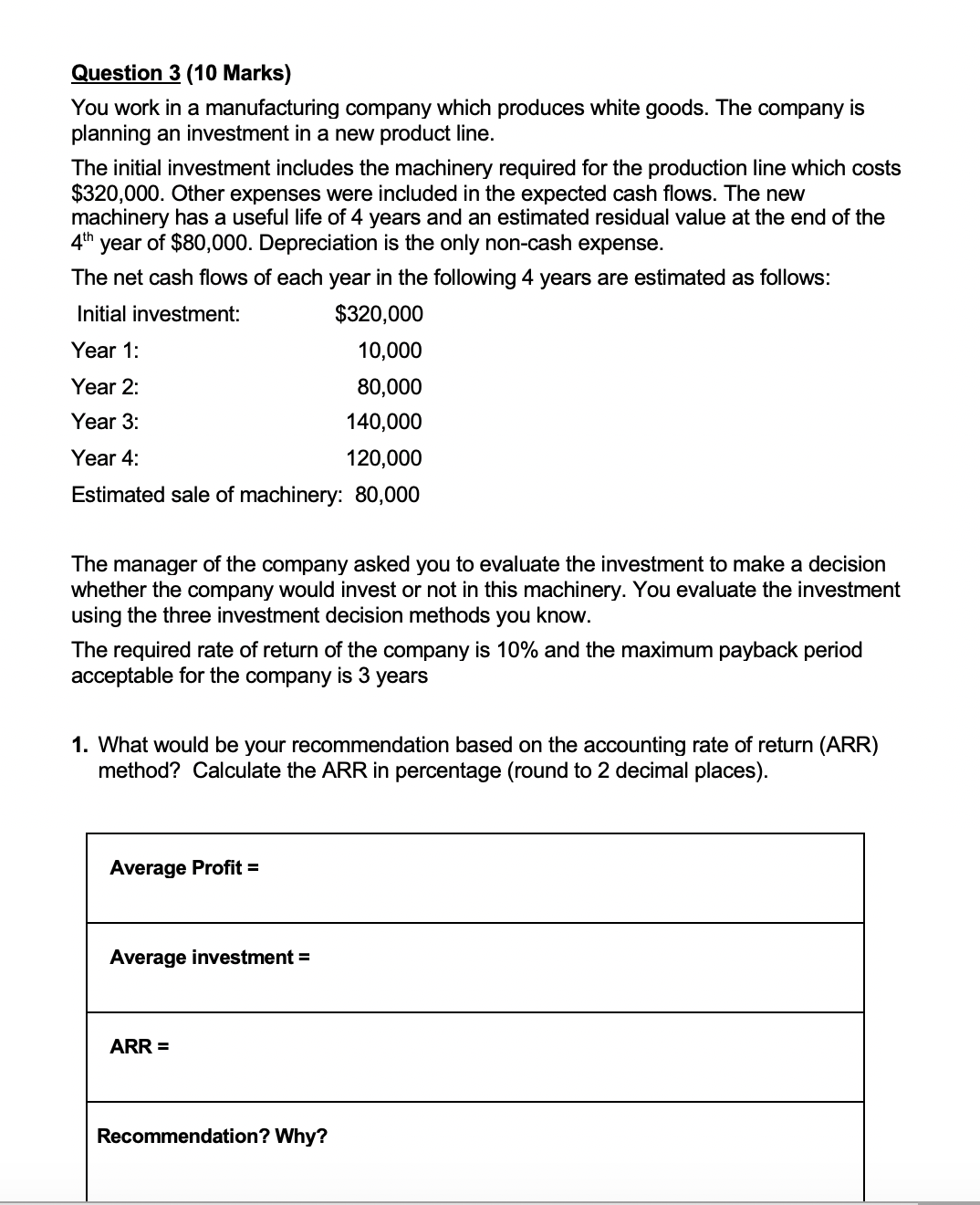

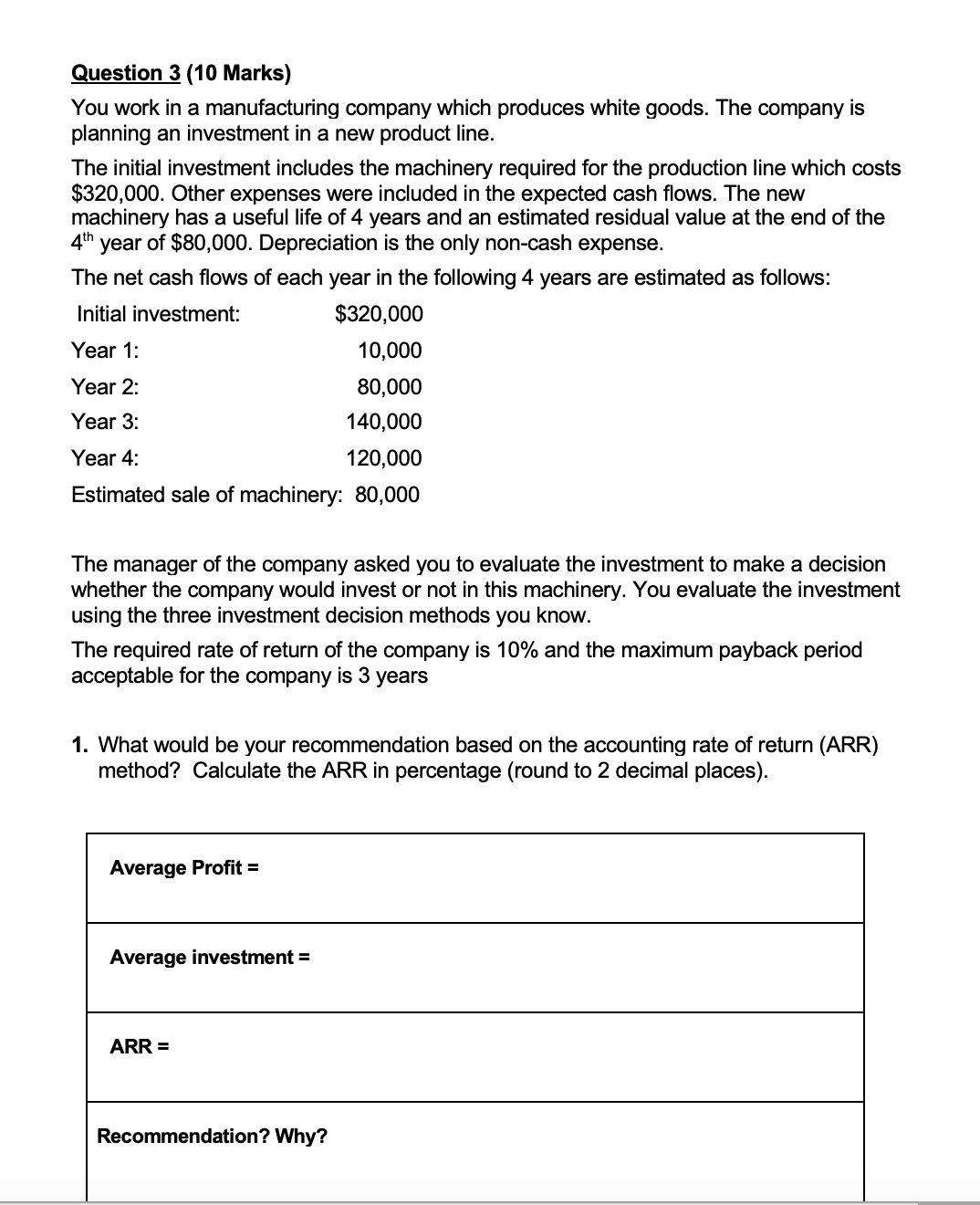

Question 3 (10 Marks) You work in a manufacturing company which produces white goods. The company is planning an investment in a new product line. The initial investment includes the machinery required for the production line which costs $320,000. Other expenses were included in the expected cash ows. The new machinery has a useful life of 4 years and an estimated residual value at the end of the 4th year of $80,000. Depreciation is the only non-cash expense. The net cash ows of each year in the following 4 years are estimated as follows: Initial investment: $320,000 Year 1: 10.000 Year 2: 80,000 Year 3: 140,000 Year 4: 120,000 Estimated sale of machinery: 80,000 The manager of the company asked you to evaluate the investment to make a decision whether the company would invest or not in this machinery. You evaluate the investment using the three investment decision methods you know. The required rate of return of the company is 10% and the maximum payback period acceptable for the company is 3 years 1. What would be your recommendation based on the accounting rate of return (ARR) method? Calculate the ARR in percentage (round to 2 decimal places). Average Prot = Average investment = Recommendation? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts