Question: PART D PLEASE!! ** given equation to solving part D b. The modified B/C ratio of Design Y is 2.06 (Round to two decimal places)

PART D PLEASE!!

PART D PLEASE!!

** given equation to solving part D

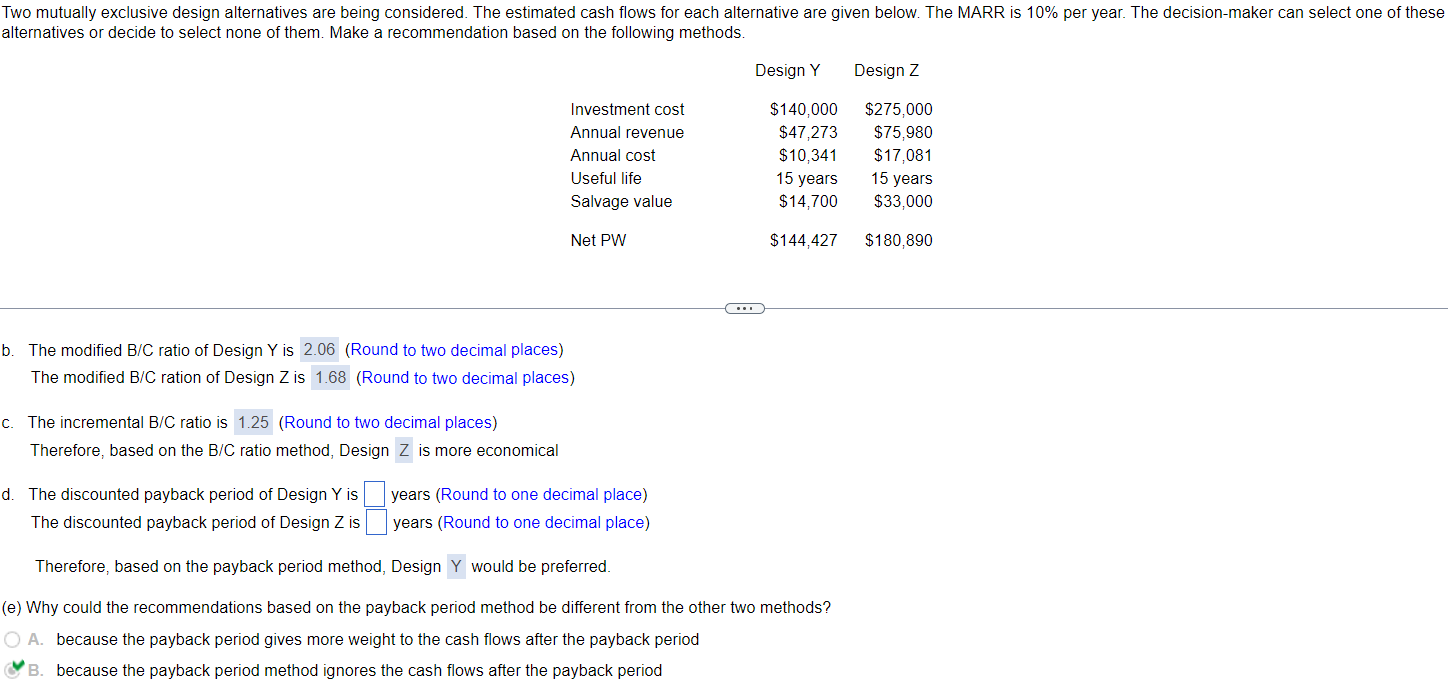

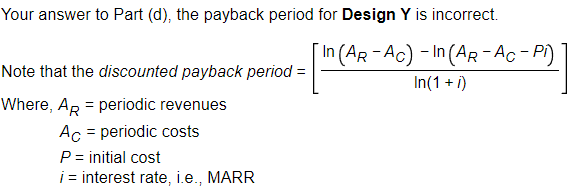

b. The modified B/C ratio of Design Y is 2.06 (Round to two decimal places) The modified B/C ration of Design Z is (Round to two decimal places) c. The incremental B/C ratio is (Round to two decimal places) Therefore, based on the B/C ratio method, Design is more economical d. The discounted payback period of Design Y is years (Round to one decimal place) The discounted payback period of Design Z is years (Round to one decimal place) Therefore, based on the payback period method, Design would be preferred. (e) Why could the recommendations based on the payback period method be different from the other two methods? A. because the payback period gives more weight to the cash flows after the payback period B. because the payback period method ignores the cash flows after the payback period Your answer to Part (d), the payback period for Design Y is incorrect. Note that the discounted payback period =[ln(1+i)ln(ARAC)ln(ARACPI)] Where, AR= periodic revenues AC= periodic costs P= initial cost i= interest rate, i.e., MARR b. The modified B/C ratio of Design Y is 2.06 (Round to two decimal places) The modified B/C ration of Design Z is (Round to two decimal places) c. The incremental B/C ratio is (Round to two decimal places) Therefore, based on the B/C ratio method, Design is more economical d. The discounted payback period of Design Y is years (Round to one decimal place) The discounted payback period of Design Z is years (Round to one decimal place) Therefore, based on the payback period method, Design would be preferred. (e) Why could the recommendations based on the payback period method be different from the other two methods? A. because the payback period gives more weight to the cash flows after the payback period B. because the payback period method ignores the cash flows after the payback period Your answer to Part (d), the payback period for Design Y is incorrect. Note that the discounted payback period =[ln(1+i)ln(ARAC)ln(ARACPI)] Where, AR= periodic revenues AC= periodic costs P= initial cost i= interest rate, i.e., MARR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts