Question: 1. When should you select settings and customizations for your company file? A. At the time you create the company file B. As work related

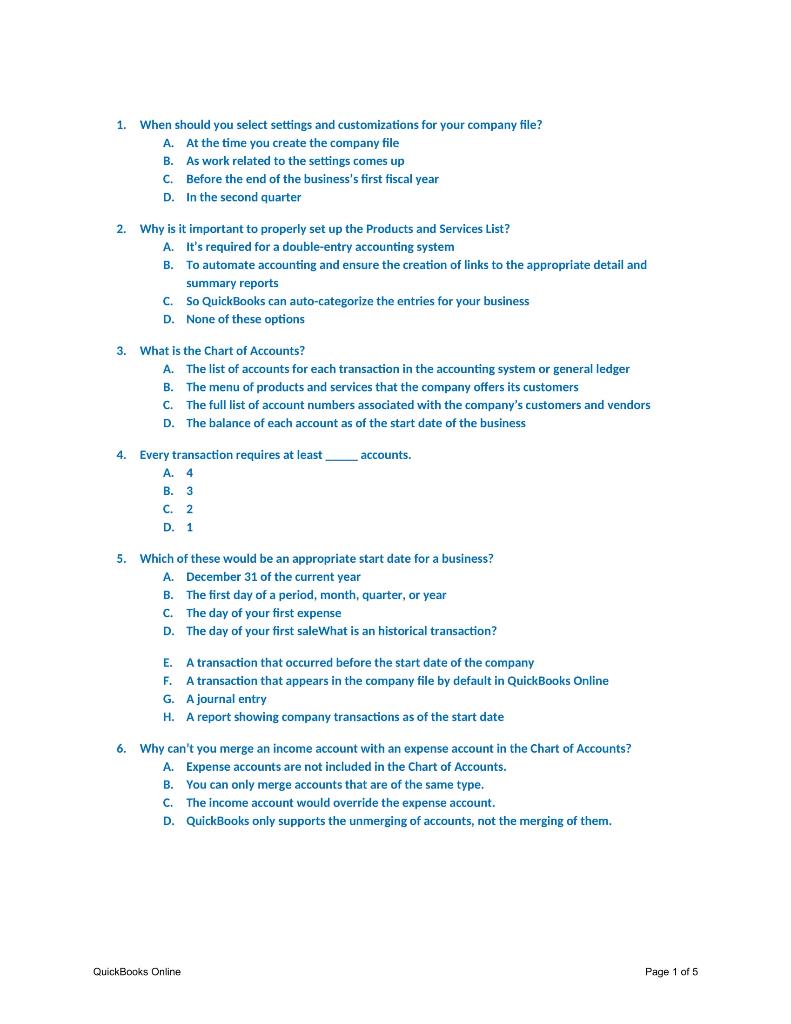

1. When should you select settings and customizations for your company file? A. At the time you create the company file B. As work related to the settings comes up C. Before the end of the business's first fiscal year D. In the second quarter 2. Why is it important to properly set up the Products and Services List? A. It's required for a double-entry accounting system B. To automate accounting and ensure the creation of links to the appropriate detail and summary reports C. So QuickBooks can auto-categorize the entries for your business D. None of these options 3. What is the Chart of Accounts? A. The list of accounts for each transaction in the accounting system or general ledger B. The menu of products and services that the company offers its customers C. The full list of account numbers associated with the company's customers and vendors D. The balance of each account as of the start date of the business 4. Every transaction requires at least accounts. A. 4 B. 3 C. 2 D. 1 5. Which of these would be an appropriate start date for a business? A. December 31 of the current year B. The first day of a period, month, quarter, or year C. The day of your first expense D. The day of your first saleWhat is an historical transaction? E. A transaction that occurred before the start date of the company F. A transaction that appears in the company file by default in QuickBooks Online G. A journal entry H. A report showing company transactions as of the start date 6. Why can't you merge an income account with an expense account in the Chart of Accounts? A. Expense accounts are not included in the Chart of Accounts. B. You can only merge accounts that are of the same type. C. The income account would override the expense account. D. QuickBooks only supports the unmerging of accounts, not the merging of them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts